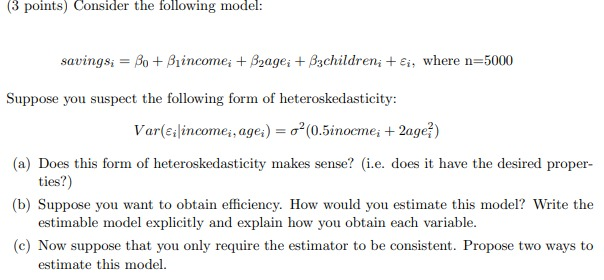

Question: (3 points) Consider the following model: savings; = Bo + B income; + Bzage; + Bzchildren; + Ei, where n=5000 Suppose you suspect the following

(3 points) Consider the following model: savings; = Bo + B income; + Bzage; + Bzchildren; + Ei, where n=5000 Suppose you suspect the following form of heteroskedasticity: Var(eilincome, agei) = 0 (0.5inocme; + 2age) (a) Does this form of heteroskedasticity makes sense? (i.e. does it have the desired proper- ties?) (b) Suppose you want to obtain efficiency. How would you estimate this model? Write the estimable model explicitly and explain how you obtain each variable. (c) Now suppose that you only require the estimator to be consistent. Propose two ways to estimate this model. (3 points) Consider the following model: savings; = Bo + B income; + Bzage; + Bzchildren; + Ei, where n=5000 Suppose you suspect the following form of heteroskedasticity: Var(eilincome, agei) = 0 (0.5inocme; + 2age) (a) Does this form of heteroskedasticity makes sense? (i.e. does it have the desired proper- ties?) (b) Suppose you want to obtain efficiency. How would you estimate this model? Write the estimable model explicitly and explain how you obtain each variable. (c) Now suppose that you only require the estimator to be consistent. Propose two ways to estimate this model

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts