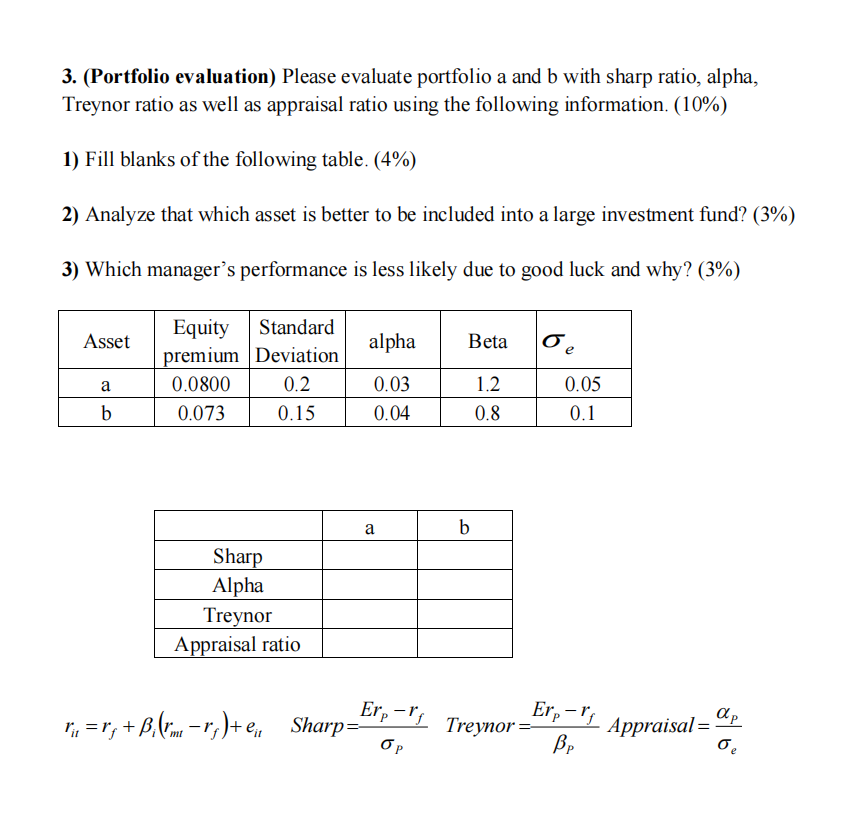

Question: 3. (Portfolio evaluation) Please evaluate portfolio a and b with sharp ratio, alpha, Treynor ratio as well as appraisal ratio using the following information. (10%)

3. (Portfolio evaluation) Please evaluate portfolio a and b with sharp ratio, alpha, Treynor ratio as well as appraisal ratio using the following information. (10\%) 1) Fill blanks of the following table. (4\%) 2) Analyze that which asset is better to be included into a large investment fund? (3\%) 3) Which manager's performance is less likely due to good luck and why? (3\%) rit=rf+i(rmtrf)+eitSharp=PErPrfTreynor=PErPrfAppraisal=eP

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts