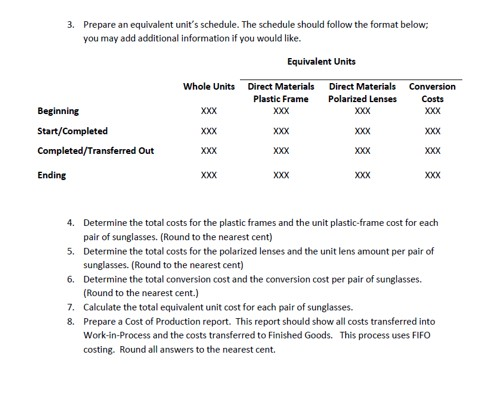

Question: 3. Prepare an equivalent unit's schedule. The schedule should follow the format below; you may add additional information if you would like. Equivalent Units Beginning

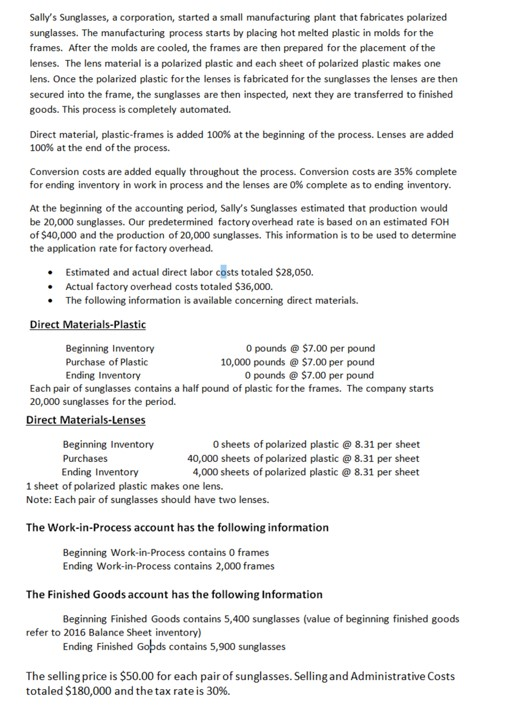

3. Prepare an equivalent unit's schedule. The schedule should follow the format below; you may add additional information if you would like. Equivalent Units Beginning Start/Completed Completed/Transferred Out Whole Units Direct Materials Direct Materials Conversion Plastic Frame Polarized Lenses Costs XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX Ending XXX XXX XXX XXX 4. Determine the total costs for the plastic frames and the unit plastic-frame cost for each pair of sunglasses. (Round to the nearest cent) 5. Determine the total costs for the polarized lenses and the unit lens amount per pair of sunglasses. (Round to the nearest cent) 6. Determine the total conversion cost and the conversion cost per pair of sunglasses. (Round to the nearest cent.) 7. Calculate the total equivalent unit cost for each pair of sunglasses. 8. Prepare a Cost of Production report. This report should show all costs transferred into Work-in-Process and the costs transferred to Finished Goods. This process uses FIFO costing. Round all answers to the nearest cent. Sally's Sunglasses, a corporation, started a small manufacturing plant that fabricates polarized sunglasses. The manufacturing process starts by placing hot melted plastic in molds for the frames. After the molds are cooled, the frames are then prepared for the placement of the lenses. The lens material is a polarized plastic and each sheet of polarized plastic makes one lens. Once the polarized plastic for the lenses is fabricated for the sunglasses the lenses are then secured into the frame, the sunglasses are then inspected, next they are transferred to finished goods. This process is completely automated. Direct material, plastic-frames is added 100% at the beginning of the process. Lenses are added 100% at the end of the process. Conversion costs are added equally throughout the process. Conversion costs are 35% complete for ending inventory in work in process and the lenses are 0% complete as to ending inventory. At the beginning of the accounting period, Sally's Sunglasses estimated that production would be 20,000 sunglasses. Our predetermined factory overhead rate is based on an estimated FOH of $40,000 and the production of 20,000 sunglasses. This information is to be used to determine the application rate for factory overhead. Estimated and actual direct labor costs totaled $28,050. Actual factory overhead costs totaled $36,000. The following information is available concerning direct materials. Direct Materials-Plastic Beginning Inventory O pounds @ $7.00 per pound Purchase of Plastic 10,000 pounds @ $7.00 per pound Ending Inventory O pounds @ $7.00 per pound Each pair of sunglasses contains a half pound of plastic for the frames. The company starts 20,000 sunglasses for the period. Direct Materials-Lenses Beginning Inventory Osheets of polarized plastic @ 8.31 per sheet Purchases 40,000 sheets of polarized plastic @ 8.31 per sheet Ending Inventory 4,000 sheets of polarized plastic @ 8.31 per sheet 1 sheet of polarized plastic makes one lens. Note: Each pair of sunglasses should have two lenses. The Work-in-process account has the following information Beginning Work-in-Process contains O frames Ending Work-in-Process contains 2,000 frames The Finished Goods account has the following Information Beginning Finished Goods contains 5,400 sunglasses (value of beginning finished goods refer to 2016 Balance Sheet inventory) Ending Finished Gods contains 5,900 sunglasses The selling price is $50.00 for each pair of sunglasses. Selling and Administrative Costs totaled $180,000 and the tax rate is 30%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts