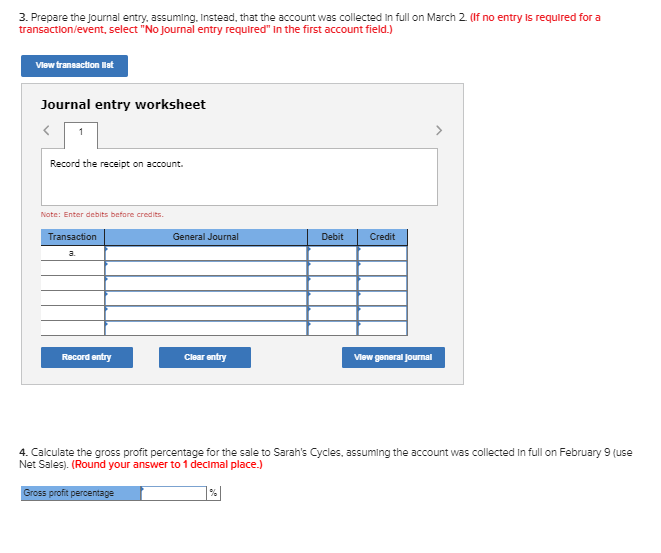

Question: 3. Prepare the journal entry, assuming. Instead, that the account was collected in full on March 2. (If no entry is required for a transaction/event,

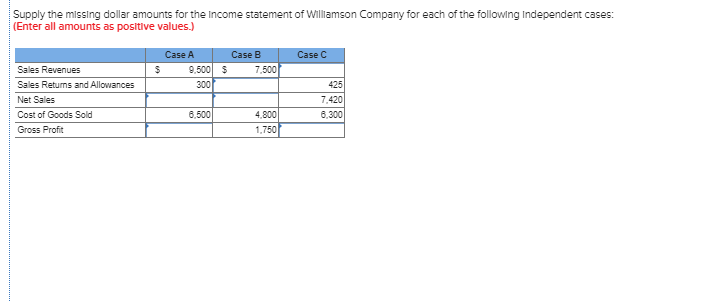

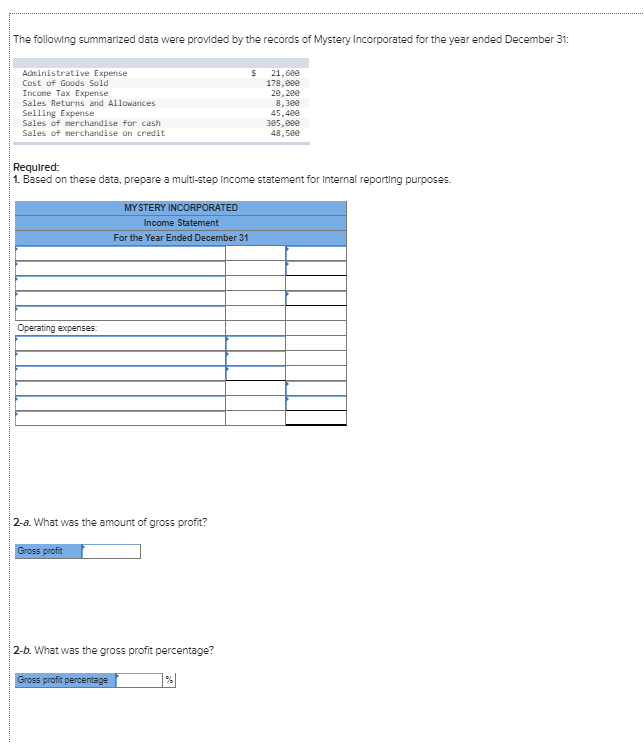

3. Prepare the journal entry, assuming. Instead, that the account was collected in full on March 2. (If no entry is required for a transaction/event, select "No Journal entry required" in the first account field.) View transaction lat Journal entry worksheet Record the receipt on account. Note: Enter debits before credits Transaction General Journal Debit Credit Record entry Clear entry View general Journal 4. Calculate the gross profit percentage for the sale to Sarah's Cycles, assuming the account was collected in full on February 9 (use Net Sales). (Round your answer to 1 decimal place.) Gross profit percentage Supply the missing dollar amounts for the income statement of Williamson Company for each of the following Independent cases: (Enter all amounts as positive values.) Case C Case A 9,500 300 Case B 7,500 $ $ Sales Revenues Sales Returns and Allowances Net Sales Cost of Goods Sold Gross Profit 425 7.420 0.300 6,500 4.000 4.800 1.7501 The following summarized data were provided by the records of Mystery Incorporated for the year ended December 31: $ Administrative Expense Cost of Goods Sold Income Tax Expense Sales Returns and Allowances Selling Expense Sales of merchandise for cash Sales of merchandise on credit 21,60e 178,888 2e, 200 8.380 45.400 305.689 48,500 Required: 1. Based on these data, prepare a multi-step Income statement for Internal reporting purposes. MYSTERY INCORPORATED Income Statement For the Year Ended December 31 Operating expenses 2-a. What was the amount of gross profit? Gross profit 2-6. What was the gross profit percentage? Gross profit percentage %

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts