Question: Question 9 (11 points) Premier Services utilizes an Activity Based Costing system to assign overhead costs to its work. The company has identified the following

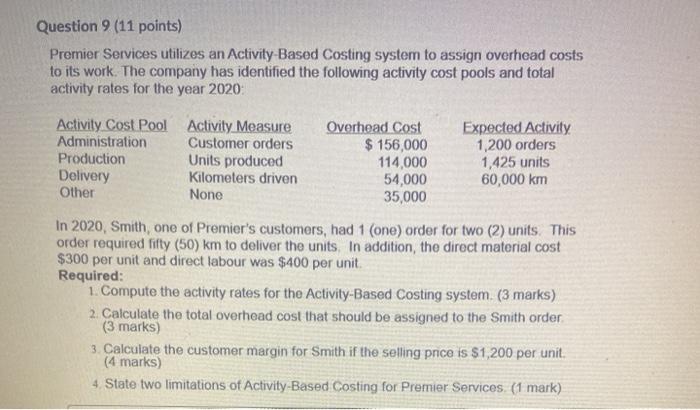

Question 9 (11 points) Premier Services utilizes an Activity Based Costing system to assign overhead costs to its work. The company has identified the following activity cost pools and total activity rates for the year 2020 Activity Cost Pool Activity Measure Administration Customer orders Production Units produced Delivery Kilometers driven Other None Overhead Cost $ 156,000 114,000 54,000 35,000 Expected Activity 1,200 orders 1,425 units 60,000 km In 2020, Smith, one of Premier's customers, had 1 (one) order for two (2) units. This order required fifty (50) km to deliver the units. In addition, the direct material cost $300 per unit and direct labour was $400 per unit. Required: 1. Compute the activity rates for the Activity-Based Costing system. (3 marks) 2. Calculate the total overhead cost that should be assigned to the Smith order (3 marks) 3. Calculate the customer margin for Smith if the selling price is $1,200 per unit (4 marks) 4 State two limitations of Activity-Based Costing for Premier Services (1 mark)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts