Question: 3. Present value Finding a present value is the reverse of finding a future value. Discounting is the process of calculating the present value of

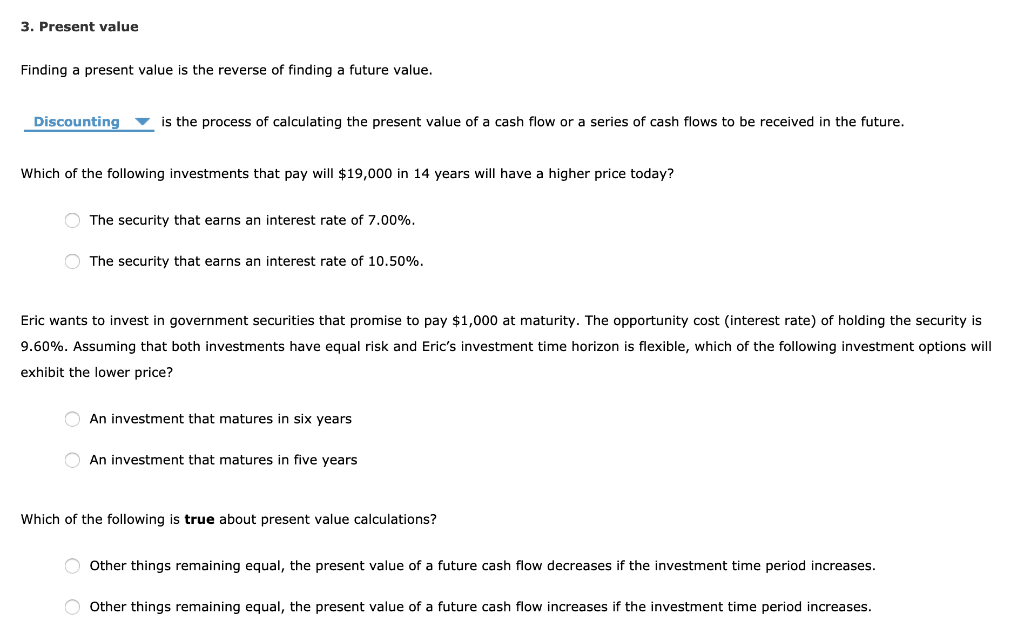

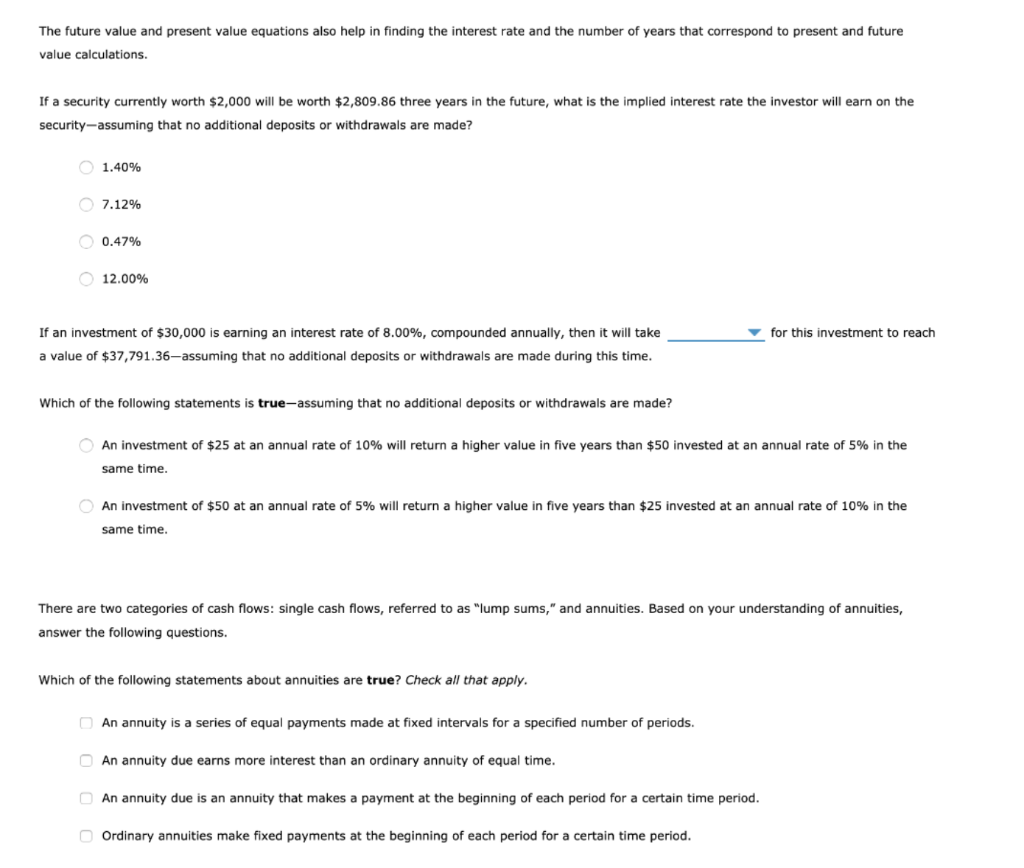

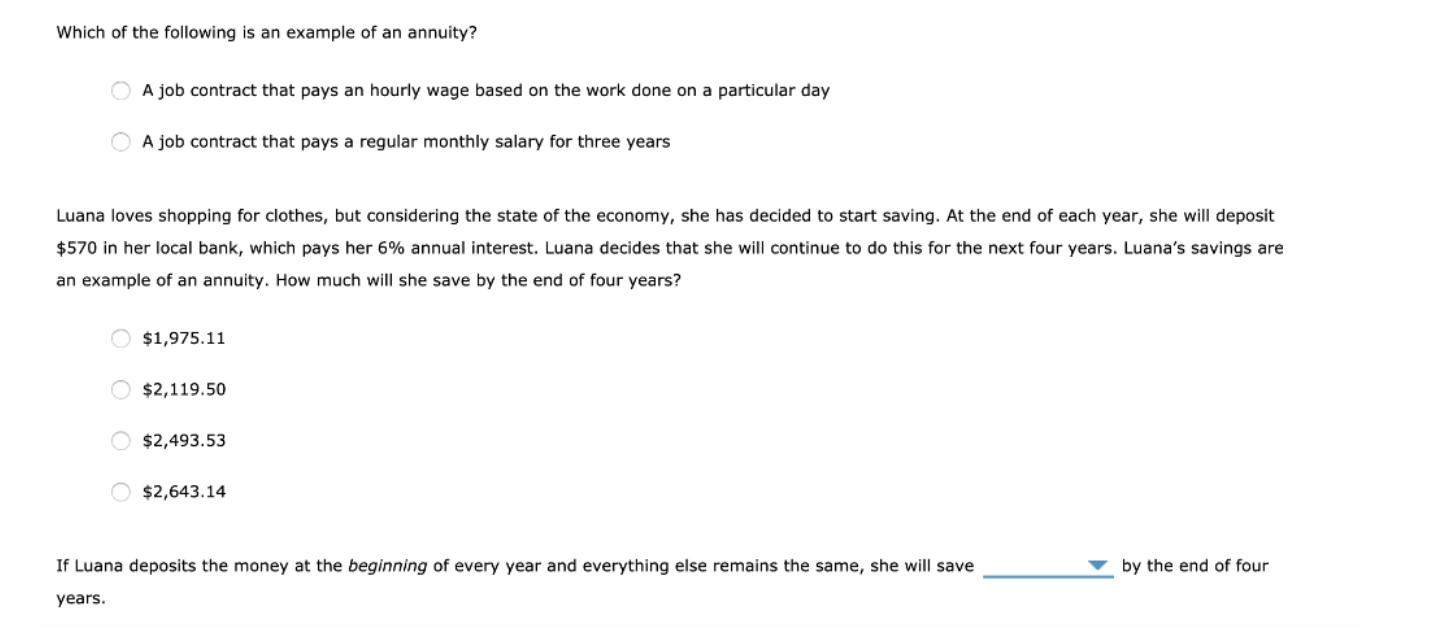

3. Present value Finding a present value is the reverse of finding a future value. Discounting is the process of calculating the present value of a cash flow or a series of cash flows to be received in the future. Which of the following investments that pay will $19,000 in 14 years will have a higher price today? O The security that earns an interest rate of 7.00%. The security that earns an interest rate of 10.50%. Eric wants to invest in government securities that promise to pay $1,000 at maturity. The opportunity cost interest rate) of holding the security is 9.60%. Assuming that both investments have equal risk and Eric's investment time horizon is flexible, which of the following investment options will exhibit the lower price? An investment that matures in six years O An investment that matures in five years Which of the following is true about present value calculations? O Other things remaining equal, the present value of a future cash flow decreases if the investment time period increases. O Other things remaining equal, the present value of a future cash flow increases if the investment time period increases. The future value and present value equations also help in finding the interest rate and the number of years that correspond to present and future value calculations. If a security currently worth $2,000 will be worth $2,809.86 three years in the future, what is the implied interest rate the investor will earn on the security-assuming that no additional deposits or withdrawals are made? 1.40% 07.12% O 0.47% 12.00% for this investment to reach If an investment of $30,000 is earning an interest rate of 8.00%, compounded annually, then it will take a value of $37,791.36-assuming that no additional deposits or withdrawals are made during this time. Which of the following statements is true-assuming that no additional deposits or withdrawals are made? An investment of $25 at an annual rate of 10% will return a higher value in five years than $50 invested at an annual rate of 5% in the same time. O An investment of $50 at an annual rate of 5% will return a higher value in five years than $25 invested at an annual rate of 10% in the same time. There are two categories of cash flows: single cash flows, referred to as "lump sums," and annuities. Based on your understanding of annuities, answer the following questions. Which of the following statements about annuities are true? Check all that apply. An annuity is a series of equal payments made at fixed intervals for a specified number of periods. An annuity due earns more interest than an ordinary annuity of equal time. An annuity due is an annuity that makes a payment at the beginning of each period for a certain time period. Ordinary annuities make fixed payments at the beginning of each period for a certain time period. Which of the following is an example of an annuity? O A job contract that pays an hourly wage based on the work done on a particular day O A job contract that pays a regular monthly salary for three years Luana loves shopping for clothes, but considering the state of the economy, she has decided to start saving. At the end of each year, she will deposit $570 in her local bank, which pays her 6% annual interest. Luana decides that she will continue to do this for the next four years. Luana's savings are an example of an annuity. How much will she save by the end of four years? O $1,975.11 $2,119.50 $2,493.53 $2,643.14 If Luana deposits the money at the beginning of every year and everything else remains the same, she will save by the end of four years

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts