Question: help solving those. thank you 3. Present value Finding a present value is the reverse of finding a future value. Discounting is the process of

help solving those. thank you

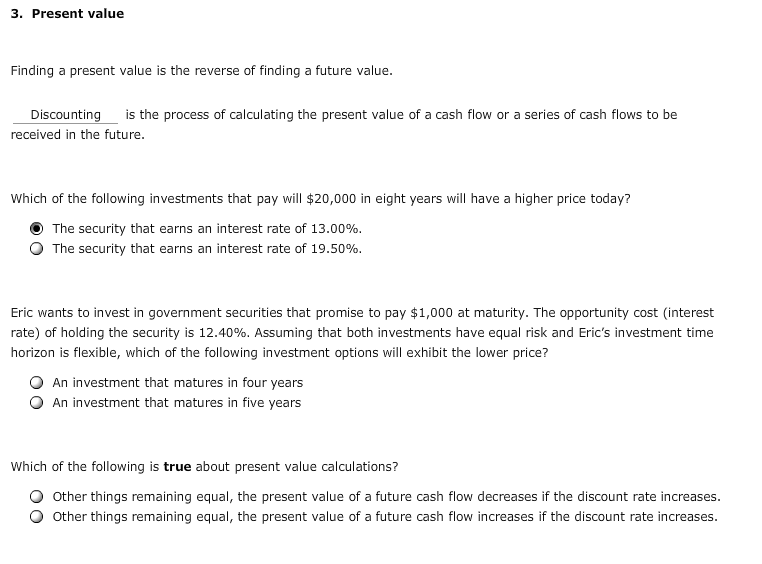

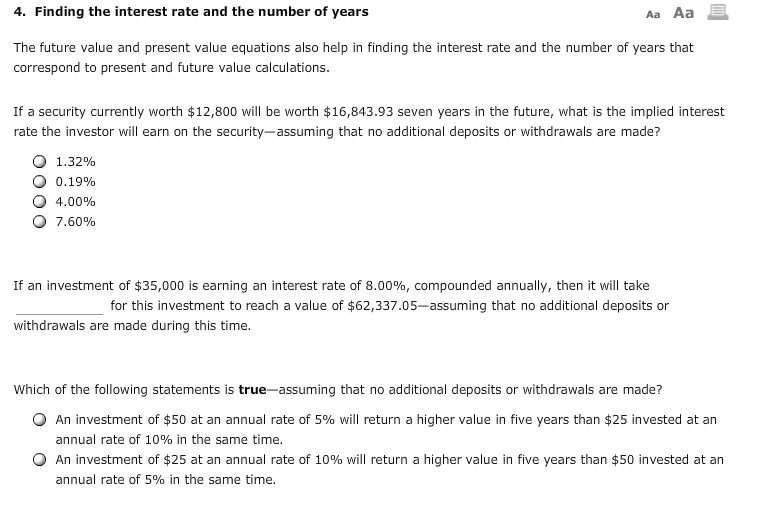

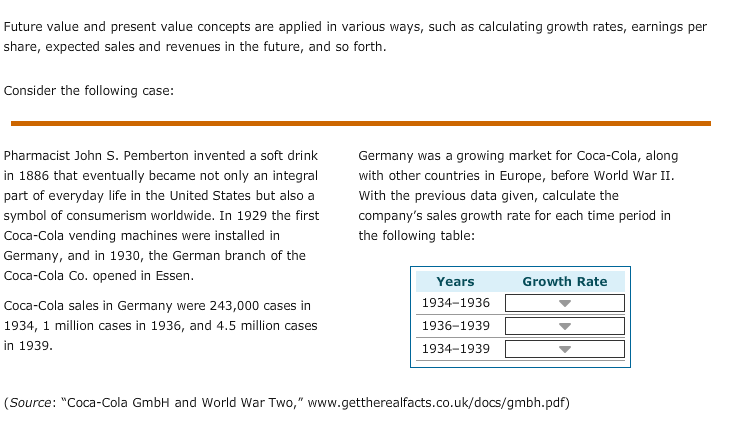

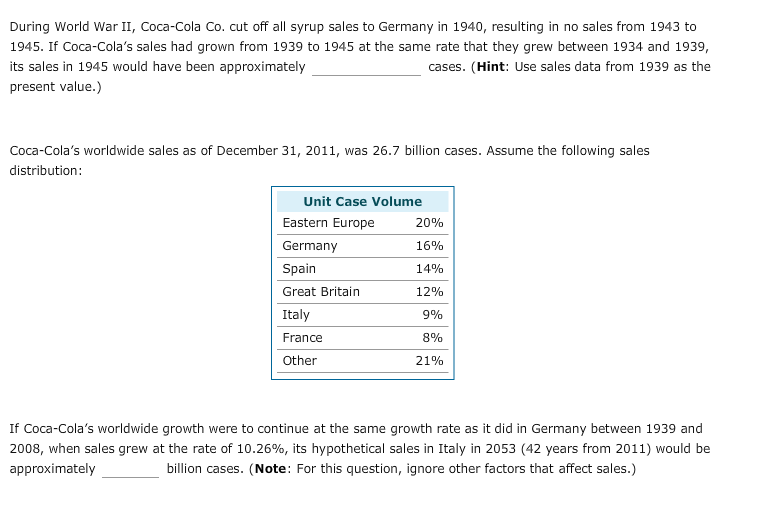

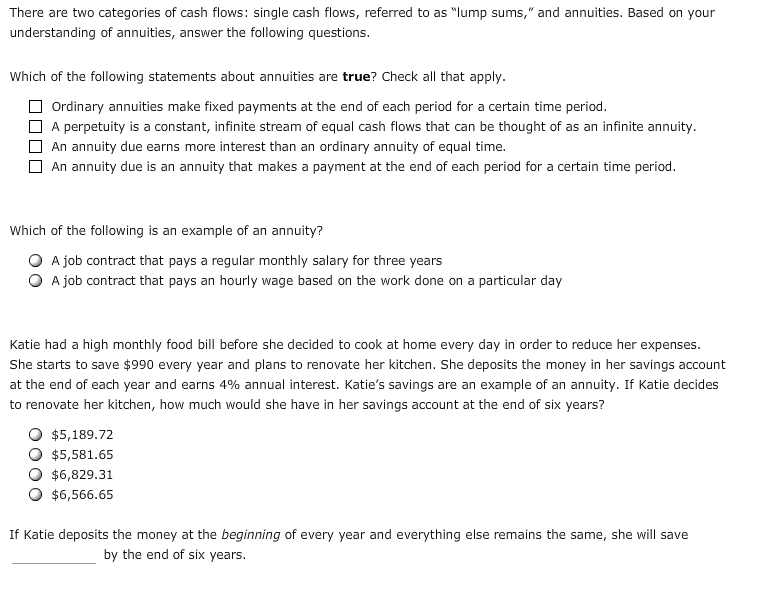

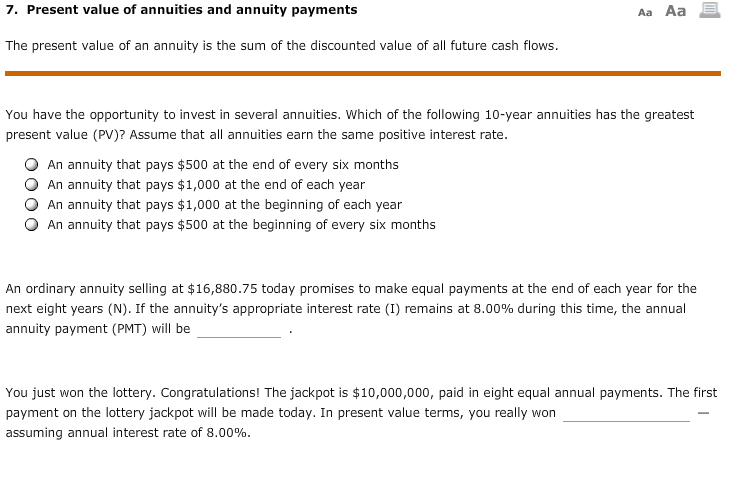

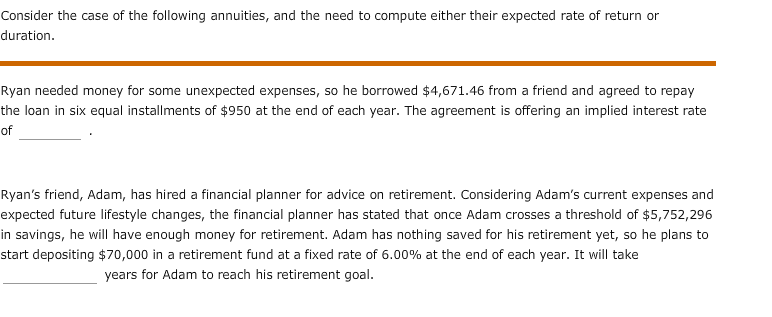

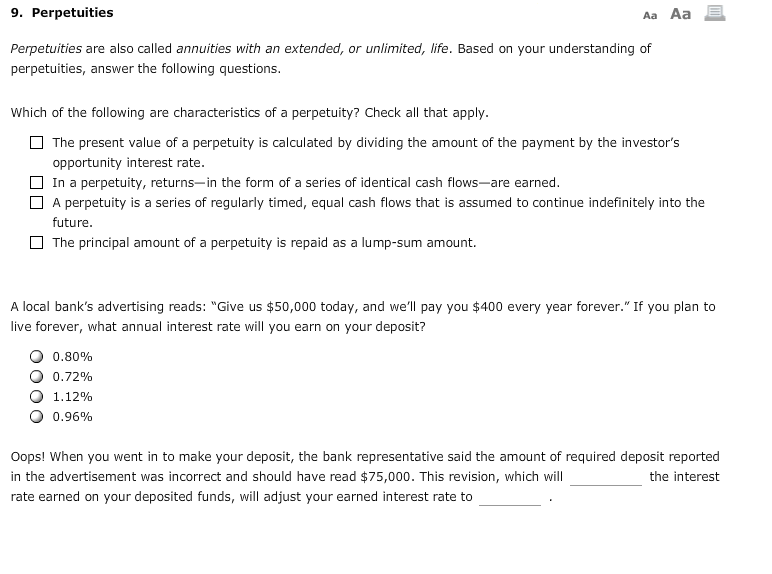

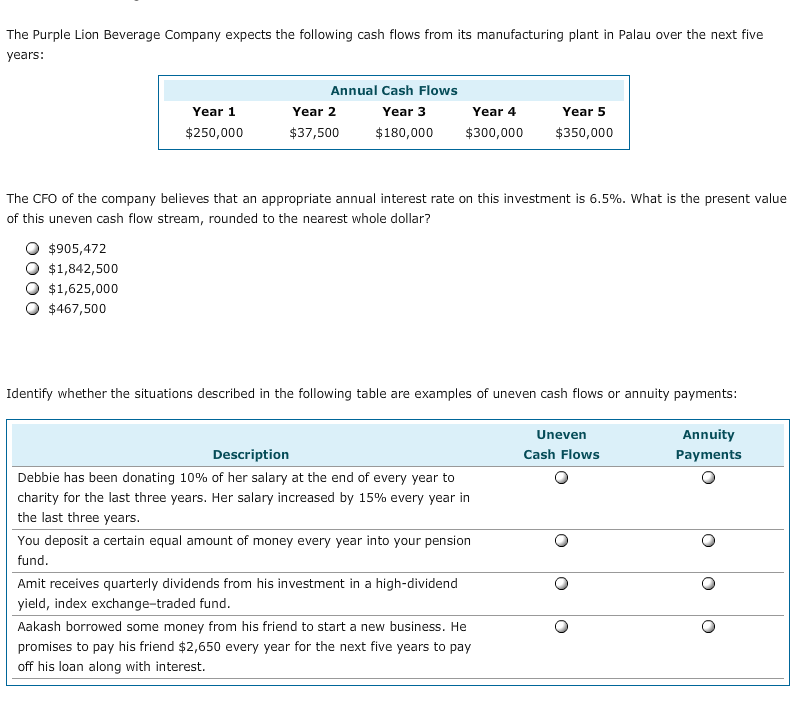

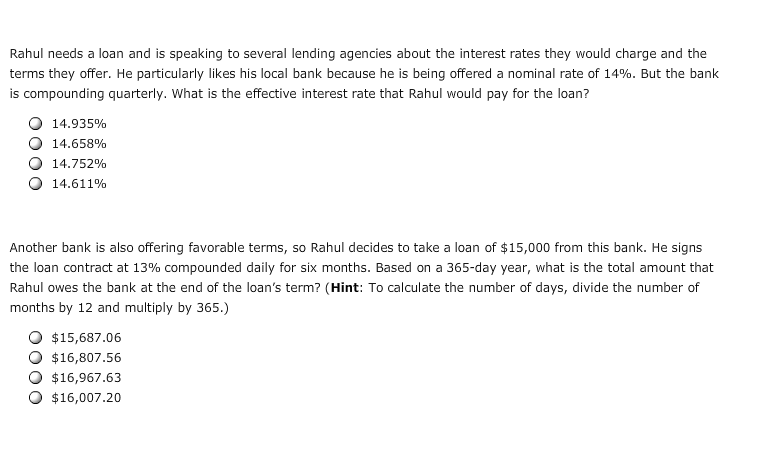

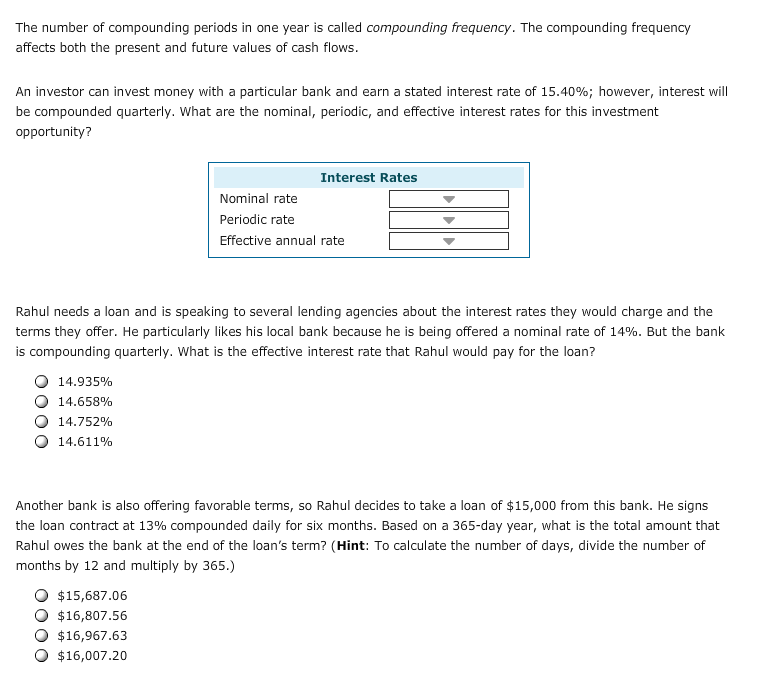

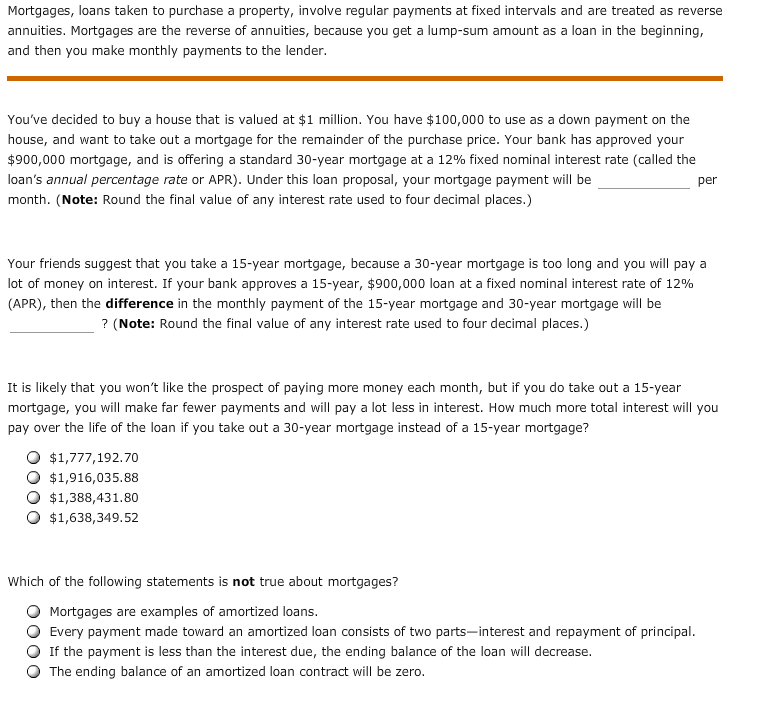

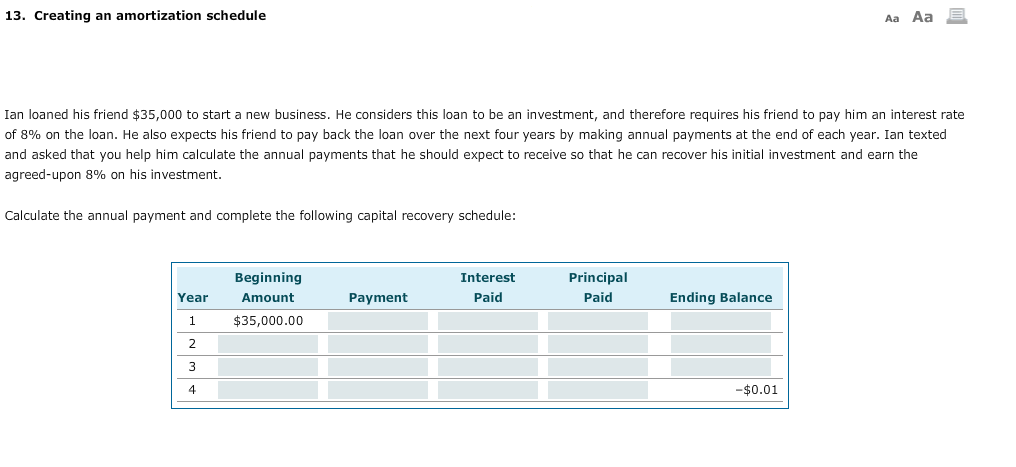

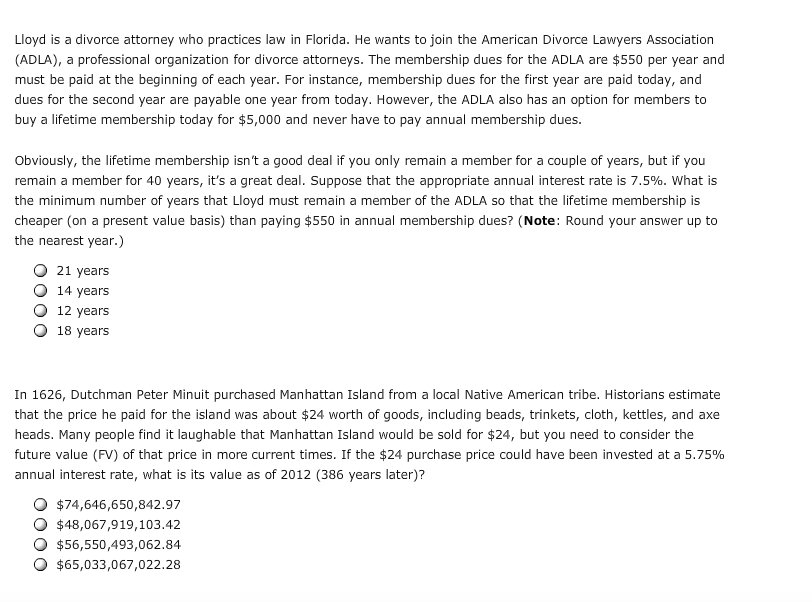

3. Present value Finding a present value is the reverse of finding a future value. Discounting is the process of calculating the present value of a cash flow or a series of cash flows to be received in the future. Which of the following investments that pay will $20,000 in eight years will have a higher price today? The security that earns an interest rate of 13.00%. The security that earns an interest rate of 19.50%. Eric wants to invest in government securities that promise to pay $1,000 at maturity. The opportunity cost interest rate) of holding the security is 12.40%. Assuming that both investments have equal risk and Eric's investment time horizon is flexible, which of the following investment options will exhibit the lower price? An investment that matures in four years An investment that matures in five years Which of the following is true about present value calculations? Other things remaining equal, the present value of a future cash flow decreases if the discount rate increases. Other things remaining equal, the present value of a future cash flow increases if the discount rate increases. 4. Finding the interest rate and the number of years Aa Aa E The future value and present value equations also help in finding the interest rate and the number of years that correspond to present and future value calculations. If a security currently worth $12,800 will be worth $16,843.93 seven years in the future, what is the implied interest rate the investor will earn on the security-assuming that no additional deposits or withdrawals are made? O O 1.32% 0.19% 4.00% 7.60% 0 If an investment of $35,000 is earning an interest rate of 8.00%, compounded annually, then it will take for this investment to reach a value of $62,337.05-assuming that no additional deposits or withdrawals are made during this time. Which of the following statements is true-assuming that no additional deposits or withdrawals are made? An investment of $50 at an annual rate of 5% will return a higher value in five years than $25 invested at an annual rate of 10% in the same time. An investment of $25 at an annual rate of 10% will return a higher value in five years than $50 invested at an annual rate of 5% in the same time. Future value and present value concepts are applied in various ways, such as calculating growth rates, earnings per share, expected sales and revenues in the future, and so forth. Consider the following case: Pharmacist John S. Pemberton invented a soft drink in 1886 that eventually became not only an integral part of everyday life in the United States but also a symbol of consumerism worldwide. In 1929 the first Coca-Cola vending machines were installed in Germany, and in 1930, the German branch of the Coca-Cola Co. opened in Essen. Germany was a growing market for Coca-Cola, along with other countries in Europe, before World War II. With the previous data given, calculate the company's sales growth rate for each time period in the following table: Growth Rate | Coca-Cola sales in Germany were 243,000 cases in 1934, 1 million cases in 1936, and 4.5 million cases in 1939. Years 1934-1936 1936-1939 1934-1939 (Source: "Coca-Cola GmbH and World War Two," www.gettherealfacts.co.uk/docs/gmbh.pdf) During World War II, Coca-Cola Co. cut off all syrup sales to Germany in 1940, resulting in no sales from 1943 to 1945. If Coca-Cola's sales had grown from 1939 to 1945 at the same rate that they grew between 1934 and 1939, its sales in 1945 would have been approximately cases. (Hint: Use sales data from 1939 as the present value.) Coca-Cola's worldwide sales as of December 31, 2011, was 26.7 billion cases. Assume the following sales distribution: Unit Case Volume Eastern Europe 20% Germany 16% Spain 14% Great Britain 12% Italy 9% France 8% Other 21% If Coca-Cola's worldwide growth were to continue at the same growth rate as it did in Germany between 1939 and 2008, when sales grew at the rate of 10.26%, its hypothetical sales in Italy in 2053 (42 years from 2011) would be approximately billion cases. (Note: For this question, ignore other factors that affect sales.) 7. Present value of annuities and annuity payments Aa Aa E The present value of an annuity is the sum of the discounted value of all future cash flows. You have the opportunity to invest in several annuities. Which of the following 10-year annuities has the greatest present value (PV)? Assume that all annuities earn the same positive interest rate. An annuity that pays $500 at the end of every six months An annuity that pays $1,000 at the end of each year An annuity that pays $1,000 at the beginning of each year An annuity that pays $500 at the beginning of every six months An ordinary annuity selling at $16,880.75 today promises to make equal payments at the end of each year for the next eight years (N). If the annuity's appropriate interest rate (I) remains at 8.00% during this time, the annual annuity payment (PMT) will be You just won the lottery. Congratulations! The jackpot is $10,000,000, paid in eight equal annual payments. The first payment on the lottery jackpot will be made today. In present value terms, you really won assuming annual interest rate of 8.00%. Consider the case of the following annuities, and the need to compute either their expected rate of return or duration. Ryan needed money for some unexpected expenses, so he borrowed $4,671.46 from a friend and agreed to repay the loan in six equal installments of $950 at the end of each year. The agreement is offering an implied interest rate of Ryan's friend, Adam, has hired a financial planner for advice on retirement. Considering Adam's current expenses and expected future lifestyle changes, the financial planner has stated that once Adam crosses a threshold of $5,752,296 in savings, he will have enough money for retirement. Adam has nothing saved for his retirement yet, so he plans to start depositing $70,000 in a retirement fund at a fixed rate of 6.00% at the end of each year. It will take years for Adam to reach his retirement goal. 9. Perpetuities Aa Aa E Perpetuities are also called annuities with an extended, or unlimited, life. Based on your understanding of perpetuities, answer the following questions. Which of the following are characteristics of a perpetuity? Check all that apply. The present value of a perpetuity is calculated by dividing the amount of the payment by the investor's opportunity interest rate. In a perpetuity, returns in the form of a series of identical cash flows-are earned. A perpetuity is a series of regularly timed, equal cash flows that is assumed to continue indefinitely into the future. The principal amount of a perpetuity is repaid as a lump-sum amount. A local bank's advertising reads: "Give us $50,000 today, and we'll pay you $400 every year forever." If you plan to live forever, what annual interest rate will you earn on your deposit? O O O O 0.80% 0.72% 1.12% 0.96% Oops! When you went in to make your deposit, the bank representative said the amount of required deposit reported in the advertisement was incorrect and should have read $75,000. This revision, which will the interest rate earned on your deposited funds, will adjust your earned interest rate to The Purple Lion Beverage Company expects the following cash flows from its manufacturing plant in Palau over the next five years: Year 1 $250,000 Annual Cash Flows Year 2 Year 3 Year 4 $37,500 $180,000 $300,000 Year 5 $350,000 The CFO of the company believes that an appropriate annual interest rate on this investment is 6.5%. What is the present value of this uneven cash flow stream, rounded to the nearest whole dollar? $905,472 $1,842,500 $1,625,000 $467,500 Identify whether the situations described in the following table are examples of uneven cash flows or annuity payments: Uneven Cash Flows Annuity Payments Description Debbie has been donating 10% of her salary at the end of every year to charity for the last three years. Her salary increased by 15% every year in the last three years. You deposit a certain equal amount of money every year into your pension fund. Oo oo Amit receives quarterly dividends from his investment in a high-dividend yield, index exchange-traded fund. Aakash borrowed some money from his friend to start a new business. He promises to pay his friend $2,650 every year for the next five years to pay off his loan along with interest. Rahul needs a loan and is speaking to several lending agencies about the interest rates they would charge and the terms they offer. He particularly likes his local bank because he is being offered a nominal rate of 14%. But the bank is compounding quarterly. What is the effective interest rate that Rahul would pay for the loan? O 14.935% O 14.658% 14.752% 14.611% Another bank is also offering favorable terms, so Rahul decides to take a loan of $15,000 from this bank. He signs the loan contract at 13% compounded daily for six months. Based on a 365-day year, what is the total amount that Rahul owes the bank at the end of the loan's term? (Hint: To calculate the number of days, divide the number of months by 12 and multiply by 365.) O $15,687.06 $16,807.56 $16,967.63 $16,007.20 The number of compounding periods in one year is called compounding frequency. The compounding frequency affects both the present and future values of cash flows. An investor can invest money with a particular bank and earn a stated interest rate of 15.40%; however, interest will be compounded quarterly. What are the nominal, periodic, and effective interest rates for this investment opportunity? Interest Rates Nominal rate Periodic rate Effective annual rate Rahul needs a loan and is speaking to several lending agencies about the interest rates they would charge and the terms they offer. He particularly likes his local bank because he is being offered a nominal rate of 14%. But the bank is compounding quarterly. What is the effective interest rate that Rahul would pay for the loan? 14.935% O 14.658% 0 14.752% O 14.611% Another bank is also offering favorable terms, so Rahul decides to take a loan of $15,000 from this bank. He signs the loan contract at 13% compounded daily for six months. Based on a 365-day year, what is the total amount that Rahul owes the bank at the end of the loan's term? (Hint: To calculate the number of days, divide the number of months by 12 and multiply by 365.) $15,687.06 $16,807.56 $16,967.63 $16,007.20 Mortgages, loans taken to purchase a property, involve regular payments at fixed intervals and are treated as reverse annuities. Mortgages are the reverse of annuities, because you get a lump-sum amount as a loan in the beginning, and then you make monthly payments to the lender. You've decided to buy a house that is valued at $1 million. You have $100,000 to use as a down payment on the house, and want to take out a mortgage for the remainder of the purchase price. Your bank has approved your $900,000 mortgage, and is offering a standard 30-year mortgage at a 12% fixed nominal interest rate (called the loan's annual percentage rate or APR). Under this loan proposal, your mortgage payment will be month. (Note: Round the final value of any interest rate used to four decimal places.) per Your friends suggest that you take a 15-year mortgage, because a 30-year mortgage is too long and you will pay a lot of money on interest. If your bank approves a 15-year, $900,000 loan at a fixed nominal interest rate of 12% (APR), then the difference in the monthly payment of the 15-year mortgage and 30-year mortgage will be ? (Note: Round the final value of any interest rate used to four decimal places.) It is likely that you won't like the prospect of paying more money each month, but if you do take out a 15-year mortgage, you will make far fewer payments and will pay a lot less in interest. How much more total interest will you pay over the life of the loan if you take out a 30-year mortgage instead of a 15-year mortgage? $1,777,192.70 O $1,916,035.88 $1,388,431.80 $1,638,349.52 Which of the following statements is not true about mortgages? Mortgages are examples of amortized loans. Every payment made toward an amortized loan consists of two parts-interest and repayment of principal. If the payment is less than the interest due, the ending balance of the loan will decrease. The ending balance of an amortized loan contract will be zero. 13. Creating an amortization schedule Aa Aa E Ian loaned his friend $35,000 to start a new business. He considers this loan to be an investment, and therefore requires his friend to pay him an interest rate of 8% on the loan. He also expects his friend to pay back the loan over the next four years by making annual payments at the end of each year. Ian texted and asked that you help him calculate the annual payments that he should expect to receive so that he can recover his initial investment and earn the agreed-upon 8% on his investment. Calculate the annual payment and complete the following capital recovery schedule: Beginning Amount $35,000.00 Payment Interest Paid Principal Paid Year 1 Ending Balance -$0.01 Lloyd is a divorce attorney who practices law in Florida. He wants to join the American Divorce Lawyers Association (ADLA), a professional organization for divorce attorneys. The membership dues for the ADLA are $550 per year and must be paid at the beginning of each year. For instance, membership dues for the first year are paid today, and dues for the second year are payable one year from today. However, the ADLA also has an option for members to buy a lifetime membership today for $5,000 and never have to pay annual membership dues. Obviously, the lifetime membership isn't a good deal if you only remain a member for a couple of years, but if you remain a member for 40 years, it's a great deal. Suppose that the appropriate annual interest rate is 7.5%. What is the minimum number of years that Lloyd must remain a member of the ADLA so that the lifetime membership is cheaper (on a present value basis) than paying $550 in annual membership dues? (Note: Round your answer up to the nearest year.) O 21 years O 14 years 12 years 18 years In 1626, Dutchman Peter Minuit purchased Manhattan Island from a local Native American tribe. Historians estimate that the price he paid for the island was about $24 worth of goods, including beads, trinkets, cloth, kettles, and axe heads. Many people find it laughable that Manhattan Island would be sold for $24, but you need to consider the future value (FV) of that price in more current times. If the $24 purchase price could have been invested at a 5.75% annual interest rate, what is its value as of 2012 (386 years later)? $74,646,650,842.97 $48,067,919,103.42 $56,550,493,062.84 $65,033,067,022.28

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts