Question: 3. Problem 17-03 (Compressed APV Model with Constant Growth) eBook Problem Walk-Through Compressed APV Model with Constant Growth An unlevered firm has a value of

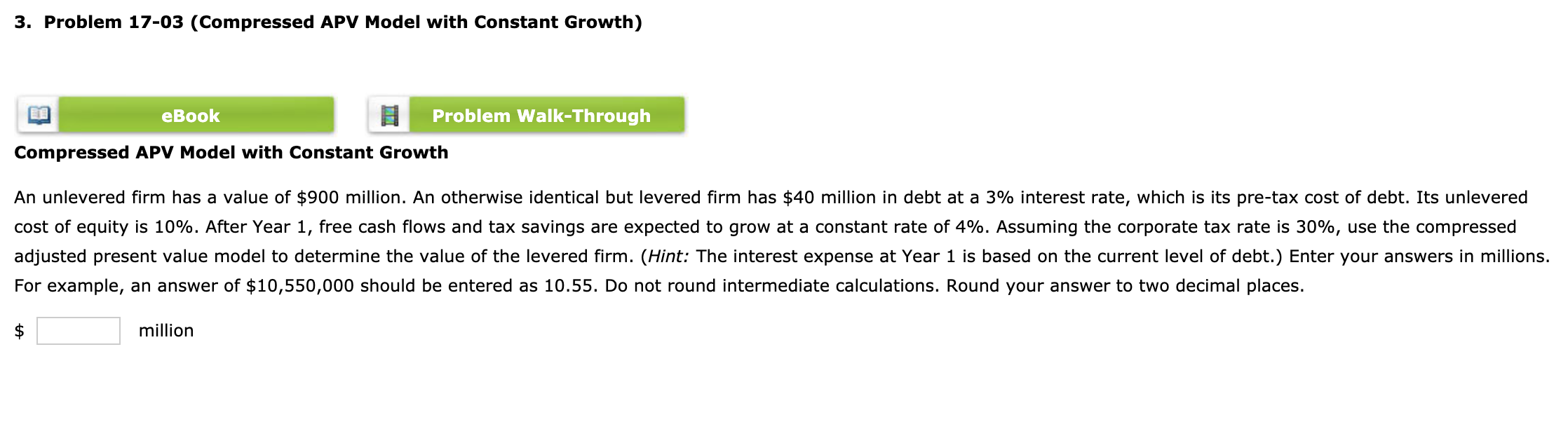

3. Problem 17-03 (Compressed APV Model with Constant Growth) eBook Problem Walk-Through Compressed APV Model with Constant Growth An unlevered firm has a value of $900 million. An otherwise identical but levered firm has $40 million in debt at a 3% interest rate, which is its pre-tax cost of debt. Its unlevered cost of equity is 10%. After Year 1, free cash flows and tax savings are expected to grow at a constant rate of 4%. Assuming the corporate tax rate is 30%, use the compressed adjusted present value model to determine the value of the levered firm. (Hint: The interest expense at Year 1 is based on the current level of debt.) Enter your answers in millions. For example, an answer of $10,550,000 should be entered as 10.55. Do not round intermediate calculations. Round your answer to two decimal places. $ million

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts