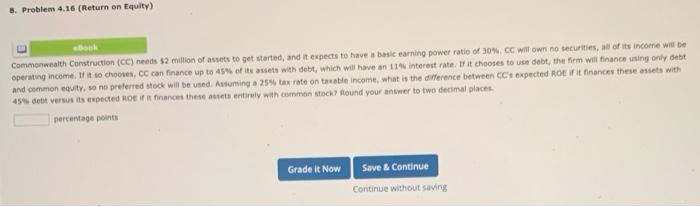

Question: 3. Problem 4.16 (Return on Equity) ebook Commonwealth Construction (CC) needs $2 million of assets to get started, and it expects to have a basic

3. Problem 4.16 (Return on Equity) ebook Commonwealth Construction (CC) needs $2 million of assets to get started, and it expects to have a basic earning power ratio of 30%. CC will own no securities, of its income will be operating income. If it to chooses, CC can finance up to 45 of its assets with debt, which will have an 11 interest rate. If it chooses to use debt, the firm will finance using only debt and common equity, so no preferred stock will be used. Assuming a 2556 tax rate on taxable income, what is the difference between CC's expected ROE finances these assets with 455 det versus is expected HOE finances these wets entirely with common stock found your answer to two decimal places percentage points Grade it Now Save & Continue Continue without saving

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts