Question: Homework Problem: Assignment 1, Problem 6 Open Interest vs Trade Volume You are in charge of logging trades of copper futures in an open outcry

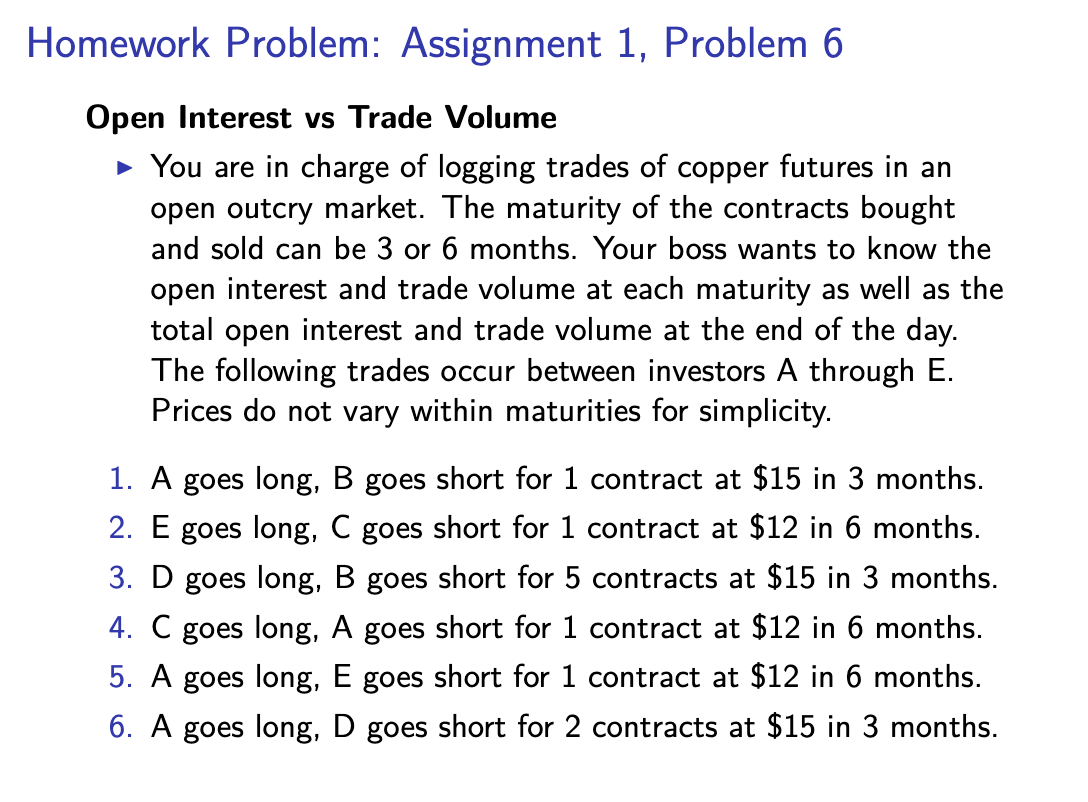

Homework Problem: Assignment 1, Problem 6 Open Interest vs Trade Volume You are in charge of logging trades of copper futures in an open outcry market. The maturity of the contracts bought and sold can be 3 or 6 months. Your boss wants to know the open interest and trade volume at each maturity as well as the total open interest and trade volume at the end of the day. The following trades occur between investors A through E. Prices do not vary within maturities for simplicity. 1. A goes long, B goes short for 1 contract at $15 in 3 months. 2. E goes long, C goes short for 1 contract at $12 in 6 months. 3. D goes long, B goes short for 5 contracts at $15 in 3 months. 4. C goes long, A goes short for 1 contract at $12 in 6 months. 5. A goes long, E goes short for 1 contract at $12 in 6 months. 6. A goes long, D goes short for 2 contracts at $15 in 3 months. Homework Problem: Assignment 1, Problem 6 Open Interest vs Trade Volume You are in charge of logging trades of copper futures in an open outcry market. The maturity of the contracts bought and sold can be 3 or 6 months. Your boss wants to know the open interest and trade volume at each maturity as well as the total open interest and trade volume at the end of the day. The following trades occur between investors A through E. Prices do not vary within maturities for simplicity. 1. A goes long, B goes short for 1 contract at $15 in 3 months. 2. E goes long, C goes short for 1 contract at $12 in 6 months. 3. D goes long, B goes short for 5 contracts at $15 in 3 months. 4. C goes long, A goes short for 1 contract at $12 in 6 months. 5. A goes long, E goes short for 1 contract at $12 in 6 months. 6. A goes long, D goes short for 2 contracts at $15 in 3 months

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts