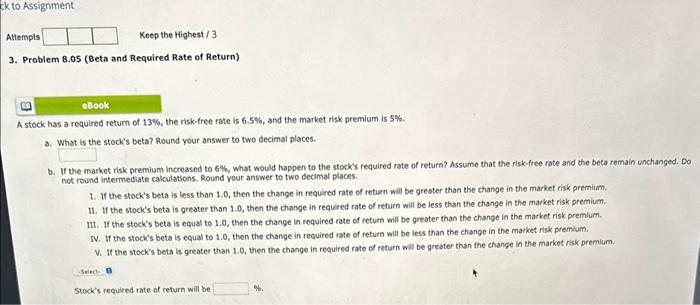

Question: 3. Problem B.05 (Beta and Required Rate of Return) A stock has a required return of 13%, the risk-free rate is 6.5%, and the market

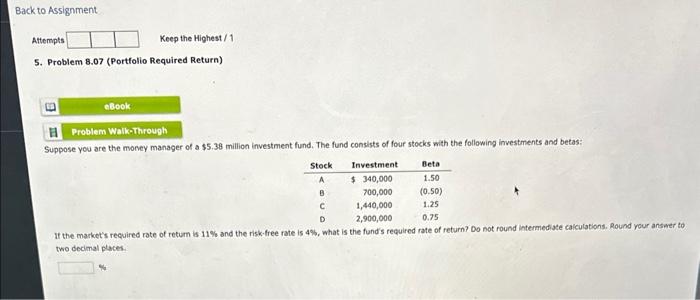

3. Problem B.05 (Beta and Required Rate of Return) A stock has a required return of 13%, the risk-free rate is 6.5%, and the market risk premium is 5%. a. What is the stock's beta? Round your answer to two decimal places. b. If the market risk premium increased to 6%, what would happen to the stock's required rate of return? Assume that the risk-free rate and the beta remain unchanged. Do not round intermediate caloulations. Round your answer to two decimal places. 1. If the stock's beta is less than 1.0, then the change in required rate of return will be greater than the change in the market risk premium. 11. If the stock's beta is greater than 1.0, then the change in required rate of retura will be less than the change in the market risk premium. III. If the stock's beta is equal to 1.0, then the change in required rate of return will be greater than the change in the market risk premlum. IV. If the stock's beta is equal to 1.0, then the change in required rate of return will be less than the change in the market risk premium. V. If the stock's beta is greater than 1.0, then the change in required rate of return will be greater than the change in the market risk premium. Stock's required rate of return will be 5. Problem 8.07 (Portfolio Required Return) Suppose you are the money manager of a $5.38 million investment fund. The fund consists of four stocks with the following investments and betas: If the market's required rate of retum is 11% and the risk-free rate is 4%, what is the fund's required rate of return? Do not round intermiediate calculations. Round your answer to two decimal places

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts