Question: 3 Questions - Current position analysis: Question 1) Please refer to the picture below. Determine for each year the working capital, current ratio, and the

3 Questions - Current position analysis:

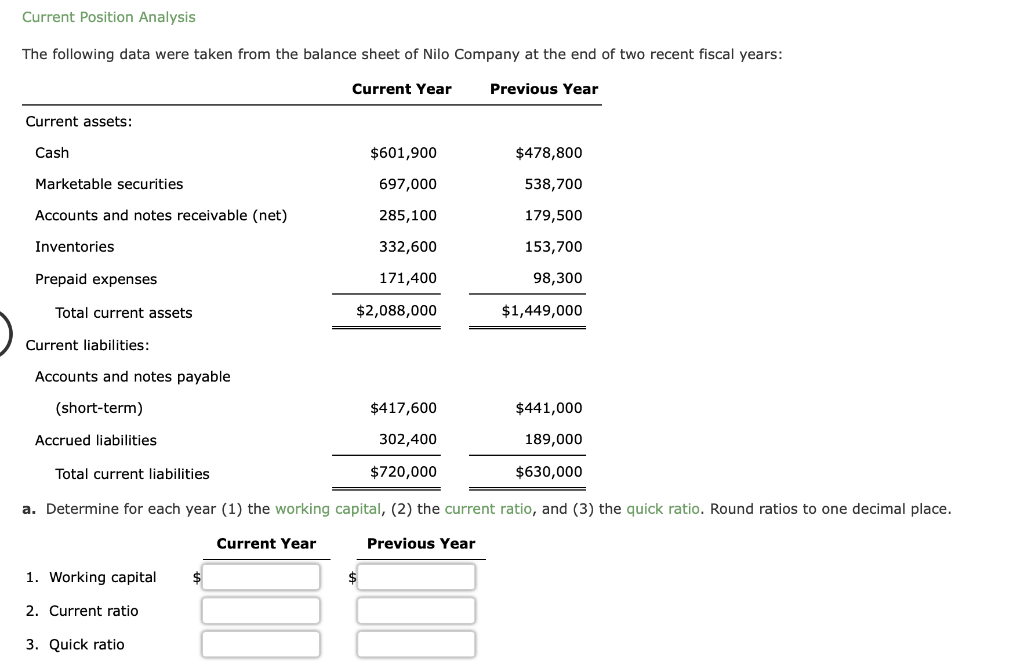

Question 1) Please refer to the picture below. Determine for each year the working capital, current ratio, and the quick ratio. Round to one decimal point.

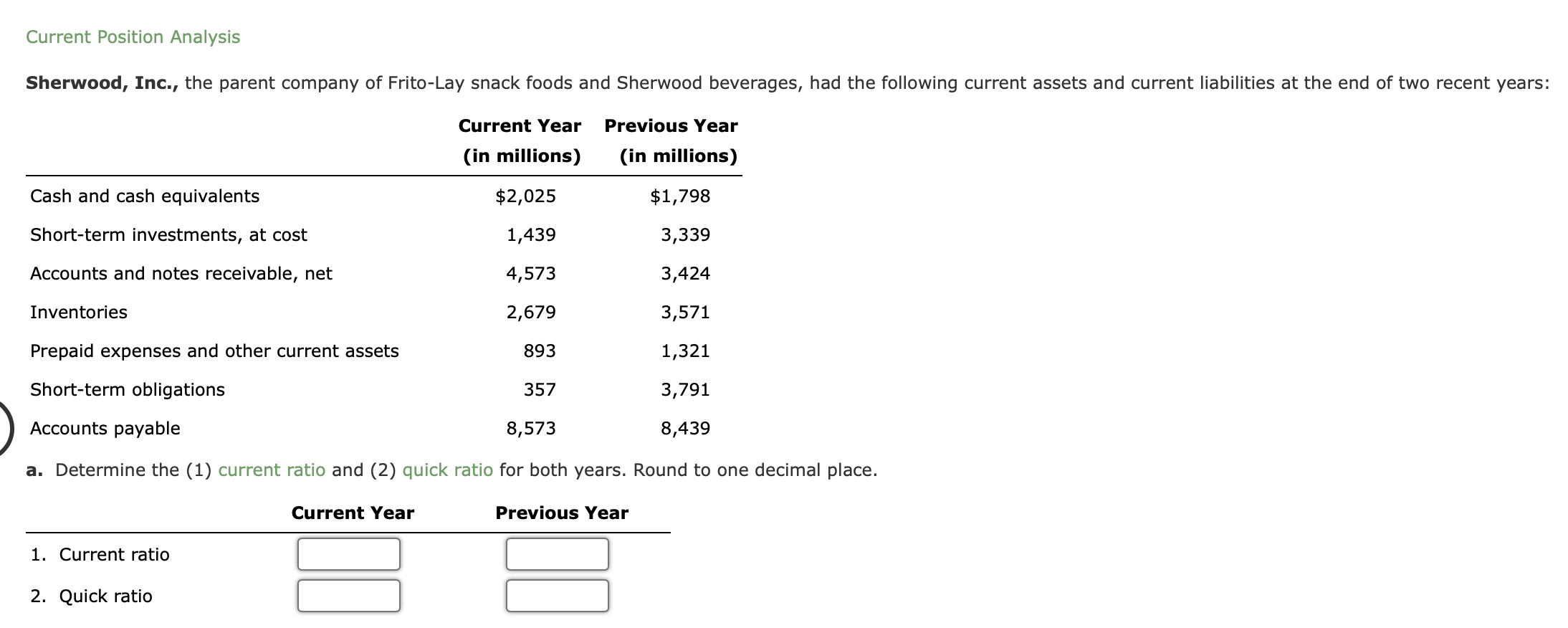

Question 2) Please refer to the picture below. Determine for each year the working capital, current ratio, and the quick ratio. Round to one decimal point.

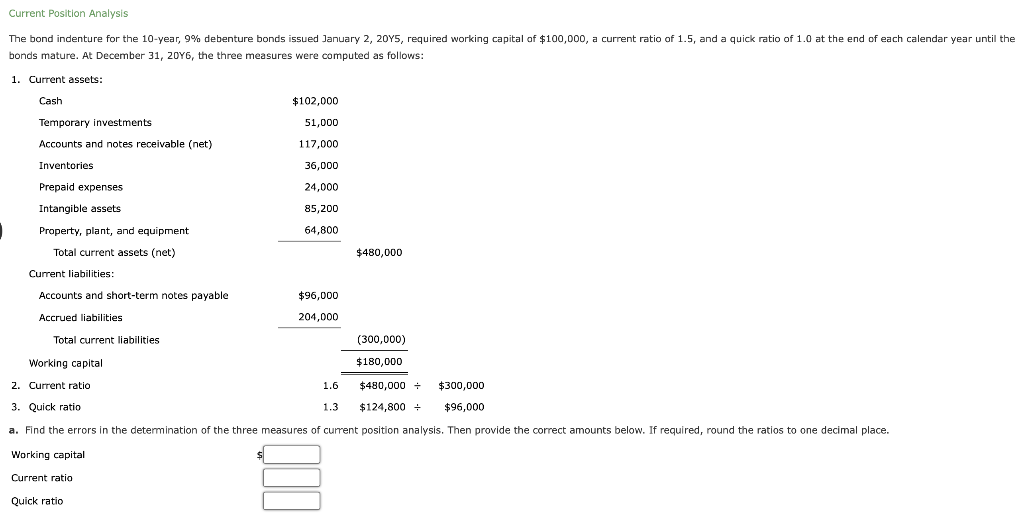

Question 3) Please refer to the picture below. Find the errors in the determination of the three measures of current position analysis. Then provide the correct amounts below. If required, round the decimals to one place.

Current Position Analysis The following data were taken from the balance sheet of Nilo Company at the end of two recent fiscal years: Current Year Previous Year Current assets: Cash $601,900 $478,800 Marketable securities 697,000 538,700 Accounts and notes receivable (net) 285,100 179,500 Inventories 332,600 153,700 Prepaid expenses 171,400 98,300 Total current assets $2,088,000 $1,449,000 Current liabilities: Accounts and notes payable (short-term) $417,600 $441,000 189,000 Accrued liabilities 302,400 Total current liabilities $720,000 $630,000 a. Determine for each year (1) the working capital, (2) the current ratio, and (3) the quick ratio. Round ratios to one decimal place. Current Year Previous Year 1. Working capital 2. Current ratio 3. Quick ratio Current Position Analysis Sherwood, Inc., the parent company of Frito-Lay snack foods and Sherwood beverages, had the following current assets and current liabilities at the end of two recent years: Current Year Previous Year (in millions) (in millions) Cash and cash equivalents $2,025 $1,798 Short-term investments, at cost 1,439 3,339 Accounts and notes receivable, net 4,573 3,424 Inventories 2,679 3,571 Prepaid expenses and other current assets 893 1,321 Short-term obligations 357 3,791 Accounts payable 8,573 8,439 a. Determine the (1) current ratio and (2) quick ratio for both years. Round to one decimal place. Current Year Previous Year 1. Current ratio 2. Quick ratio Current Position Analysis The bond indenture for the 10-year, 9% debenture bonds issued January 2, 2045, required working capital of $100,000, a current ratio of 1.5, and a quick ratio of 1.0 at the end of each calendar year until the bonds mature. At December 31, 20Y6, the three measures were computed as follows: 1. Current assets: Cash $102,000 Temporary investments 51,000 Accounts and notes receivable (net) 117,000 Inventories 36,000 Prepaid expenses 24,000 Intangible assets 85,200 64,800 Property, plant, and equipment Total current assets (net) Current liabilities: $480,000 $96,000 Accounts and short-term notes payable Accrued liabilities Total current liabilities 204,000 (300,000) Working capital $180,000 2. Current ratio 1.6 $480,000 + $300,000 3. Quick ratio 1.3 $124,800 - $96,000 a. Find the errors in the determination of the three measures of current position analysis. Then provide the correct amounts below. If required, round the ratios to one decimal place. Working capital ill Current ratio Quick ratio

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts