Question: 3. Real and Nominal Interest Rates a. Explain the difference between a nominal versus a real interest rate. b. If a bond gives you a

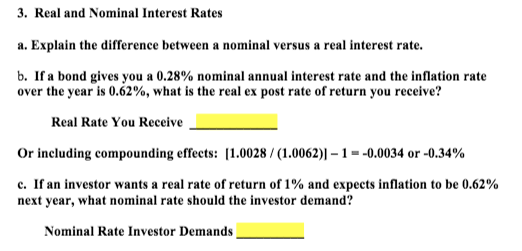

3. Real and Nominal Interest Rates a. Explain the difference between a nominal versus a real interest rate. b. If a bond gives you a 0.28% nominal annual interest rate and the inflation rate over the year is 0.62%, what is the real ex post rate of return you receive? Real Rate You Receive Or including compounding effects: [1.0028 / (1.0062)) 1 = -0.0034 or -0.34% c. If an investor wants a real rate of return of 1% and expects inflation to be 0.62% next year, what nominal rate should the investor demand? Nominal Rate Investor Demands

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts