Question: 3. Real and Nominal Interest Rates a. Explain the difference between a nominal versus a real interest rate and why this is important for a

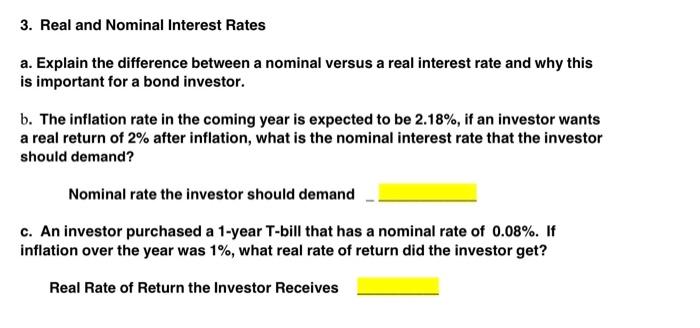

3. Real and Nominal Interest Rates a. Explain the difference between a nominal versus a real interest rate and why this is important for a bond investor. b. The inflation rate in the coming year is expected to be 2.18%, if an investor wants a real return of 2% after inflation, what is the nominal interest rate that the investor should demand? Nominal rate the investor should demand C. An investor purchased a 1-year T-bill that has a nominal rate of 0.08%. If inflation over the year was 1%, what real rate of return did the investor get? Real Rate of Return the Investor Receives

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts