Question: 3. Risk Premium and Foreign Borrowing: Consider a small open endowment economy without a government that is inhabited by a representative consumer who lives two

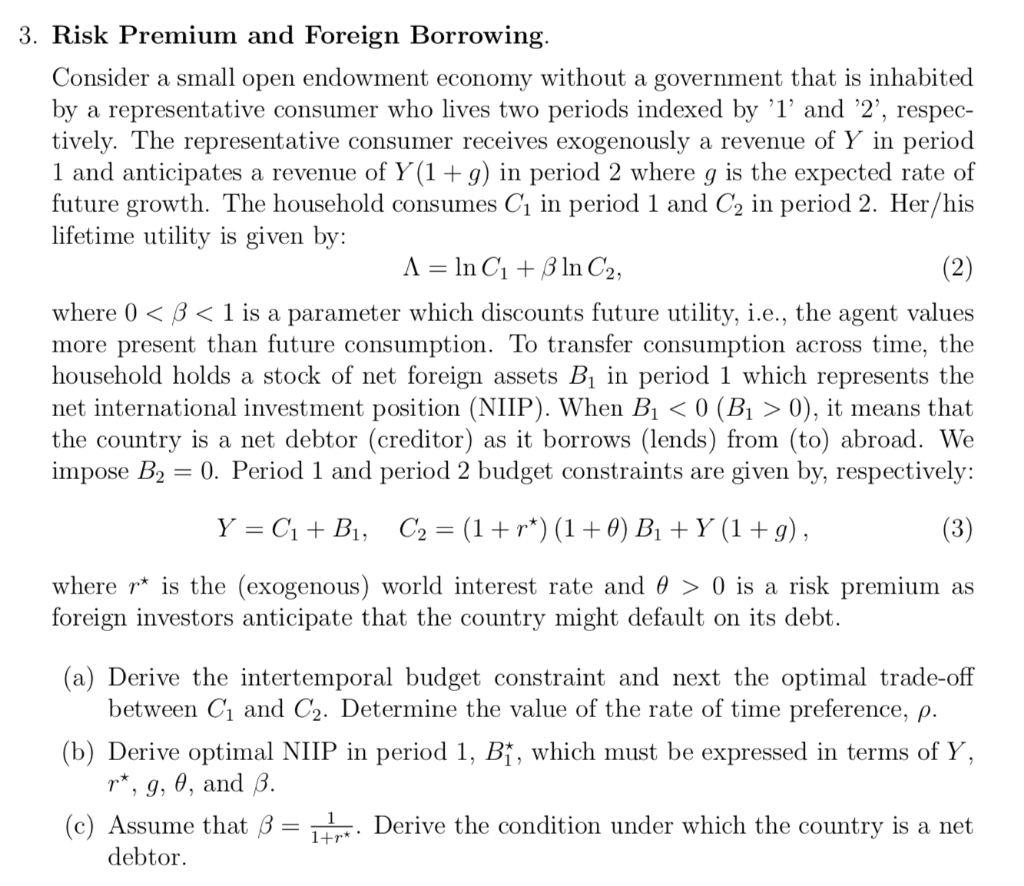

3. Risk Premium and Foreign Borrowing: Consider a small open endowment economy without a government that is inhabited by a representative consumer who lives two periods indexed by 'l' and '2', respec- tively. The representative consumer receives exogenously a revenue of Y in period 1 and anticipates a revenue of Y(1+g) in period 2 where g is the expected rate of future growth. The household consumes C in period 1 and C2 in period 2. Her/his lifetime utility is given by: A = In C1 + In C2, (2) where 0 0), it means that the country is a net debtor (creditor) as it borrows (lends) from (to) abroad. We impose B2 = 0. Period 1 and period 2 budget constraints are given by, respectively: Y = C1 + B1, C2 = (1+r*)(1+0) B1 +Y (1 +g), (3) where pt is the (exogenous) world interest rate and 0 > 0 is a risk premium as foreign investors anticipate that the country might default on its debt. (a) Derive the intertemporal budget constraint and next the optimal trade-off between C and C2. Determine the value of the rate of time preference, p. (b) Derive optimal NIIP in period 1, B1, which must be expressed in terms of Y, r*, g, 0, and B. (c) Assume that B= Derive the condition under which the country is a net debtor. 1+r* 3. Risk Premium and Foreign Borrowing: Consider a small open endowment economy without a government that is inhabited by a representative consumer who lives two periods indexed by 'l' and '2', respec- tively. The representative consumer receives exogenously a revenue of Y in period 1 and anticipates a revenue of Y(1+g) in period 2 where g is the expected rate of future growth. The household consumes C in period 1 and C2 in period 2. Her/his lifetime utility is given by: A = In C1 + In C2, (2) where 0 0), it means that the country is a net debtor (creditor) as it borrows (lends) from (to) abroad. We impose B2 = 0. Period 1 and period 2 budget constraints are given by, respectively: Y = C1 + B1, C2 = (1+r*)(1+0) B1 +Y (1 +g), (3) where pt is the (exogenous) world interest rate and 0 > 0 is a risk premium as foreign investors anticipate that the country might default on its debt. (a) Derive the intertemporal budget constraint and next the optimal trade-off between C and C2. Determine the value of the rate of time preference, p. (b) Derive optimal NIIP in period 1, B1, which must be expressed in terms of Y, r*, g, 0, and B. (c) Assume that B= Derive the condition under which the country is a net debtor. 1+r*

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts