Question: 3. Sensitivity analysis a. Change the variables price, variable cost, and fixed cost (+20% and -20%) and recalculate the NPV of your project. Complete the

3. Sensitivity analysis

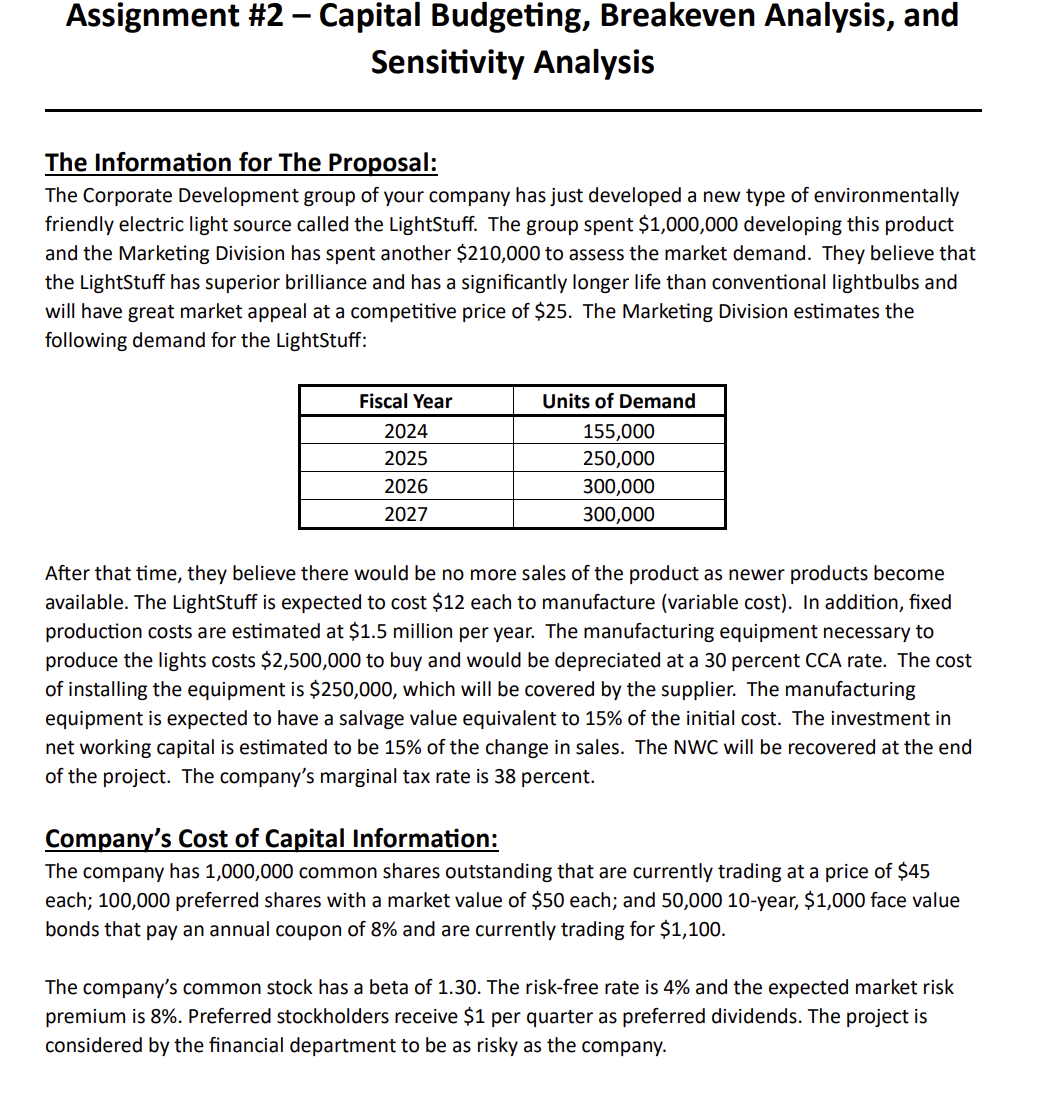

a. Change the variables price, variable cost, and fixed cost (+20% and -20%) and recalculate the NPV of your project.

Complete the following table with your results:

Table 1. NPV at different deviations from the Base Case:

Deviation from Base CaseSales PriceVariable Cost/UnitFixed CostLow Case (-20%) Base Case (0%) High Case (20%) Assignment \\#2 - Capital Budgeting, Breakeven Analysis, and Sensitivity Analysis The Information for The Proposal: The Corporate Development group of your company has just developed a new type of environmentally friendly electric light source called the LightStuff. The group spent \\( \\$ 1,000,000 \\) developing this product and the Marketing Division has spent another \\( \\$ 210,000 \\) to assess the market demand. They believe that the LightStuff has superior brilliance and has a significantly longer life than conventional lightbulbs and will have great market appeal at a competitive price of \\( \\$ 25 \\). The Marketing Division estimates the following demand for the LightStuff: After that time, they believe there would be no more sales of the product as newer products become available. The LightStuff is expected to cost \\( \\$ 12 \\) each to manufacture (variable cost). In addition, fixed production costs are estimated at \\( \\$ 1.5 \\) million per year. The manufacturing equipment necessary to produce the lights costs \\( \\$ 2,500,000 \\) to buy and would be depreciated at a 30 percent CCA rate. The cost of installing the equipment is \\( \\$ 250,000 \\), which will be covered by the supplier. The manufacturing equipment is expected to have a salvage value equivalent to \15 of the initial cost. The investment in net working capital is estimated to be \15 of the change in sales. The NWC will be recovered at the end of the project. The company's marginal tax rate is 38 percent. Company's Cost of Capital Information: The company has \\( 1,000,000 \\) common shares outstanding that are currently trading at a price of \\( \\$ 45 \\) each; 100,000 preferred shares with a market value of \\( \\$ 50 \\) each; and 50,000 10-year, \\( \\$ 1,000 \\) face value bonds that pay an annual coupon of \8 and are currently trading for \\( \\$ 1,100 \\). The company's common stock has a beta of 1.30 . The risk-free rate is \4 and the expected market risk premium is \8. Preferred stockholders receive \\( \\$ 1 \\) per quarter as preferred dividends. The project is considered by the financial department to be as risky as the company. Assignment \\#2 - Capital Budgeting, Breakeven Analysis, and Sensitivity Analysis The Information for The Proposal: The Corporate Development group of your company has just developed a new type of environmentally friendly electric light source called the LightStuff. The group spent \\( \\$ 1,000,000 \\) developing this product and the Marketing Division has spent another \\( \\$ 210,000 \\) to assess the market demand. They believe that the LightStuff has superior brilliance and has a significantly longer life than conventional lightbulbs and will have great market appeal at a competitive price of \\( \\$ 25 \\). The Marketing Division estimates the following demand for the LightStuff: After that time, they believe there would be no more sales of the product as newer products become available. The LightStuff is expected to cost \\( \\$ 12 \\) each to manufacture (variable cost). In addition, fixed production costs are estimated at \\( \\$ 1.5 \\) million per year. The manufacturing equipment necessary to produce the lights costs \\( \\$ 2,500,000 \\) to buy and would be depreciated at a 30 percent CCA rate. The cost of installing the equipment is \\( \\$ 250,000 \\), which will be covered by the supplier. The manufacturing equipment is expected to have a salvage value equivalent to \15 of the initial cost. The investment in net working capital is estimated to be \15 of the change in sales. The NWC will be recovered at the end of the project. The company's marginal tax rate is 38 percent. Company's Cost of Capital Information: The company has \\( 1,000,000 \\) common shares outstanding that are currently trading at a price of \\( \\$ 45 \\) each; 100,000 preferred shares with a market value of \\( \\$ 50 \\) each; and 50,000 10-year, \\( \\$ 1,000 \\) face value bonds that pay an annual coupon of \8 and are currently trading for \\( \\$ 1,100 \\). The company's common stock has a beta of 1.30 . The risk-free rate is \4 and the expected market risk premium is \8. Preferred stockholders receive \\( \\$ 1 \\) per quarter as preferred dividends. The project is considered by the financial department to be as risky as the company

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts