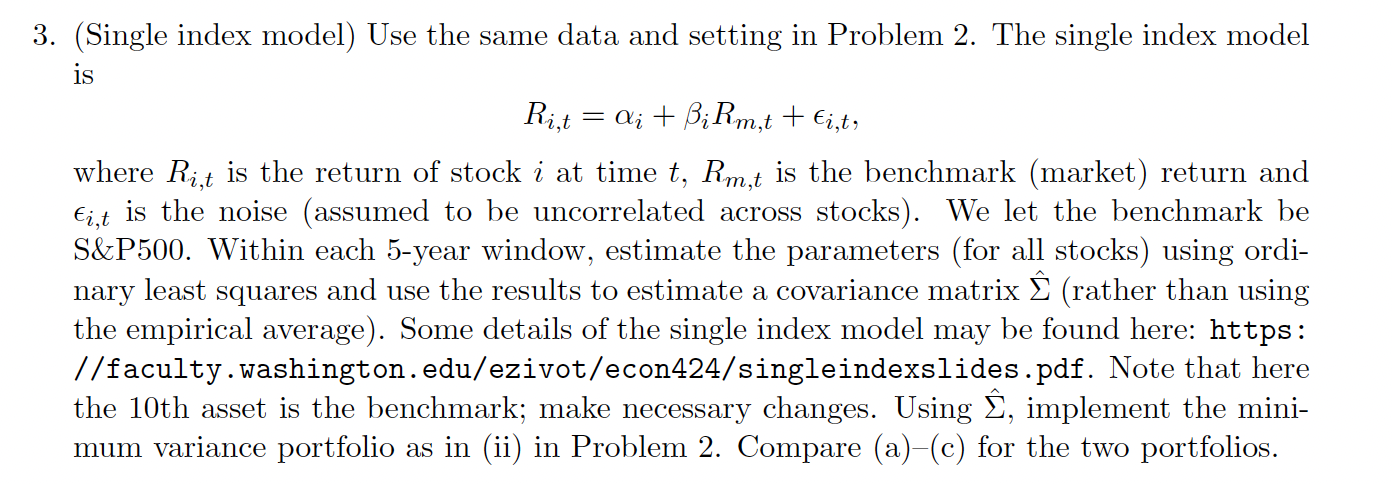

Question: 3. (Single index model) Use the same data and setting in Problem 2. The single index model is Ri,t = ai +iRm,t + Ei,t,

3. (Single index model) Use the same data and setting in Problem 2. The single index model is Ri,t = ai +iRm,t + Ei,t, where Rit is the return of stock i at time t, Rm,t is the benchmark (market) return and Eit is the noise (assumed to be uncorrelated across stocks). We let the benchmark be S&P500. Within each 5-year window, estimate the parameters (for all stocks) using ordi- nary least squares and use the results to estimate a covariance matrix (rather than using the empirical average). Some details of the single index model may be found here: https: //faculty.washington.edu/ezivot/econ424/singleindexslides.pdf. Note that here the 10th asset is the benchmark; make necessary changes. Using , implement the mini- mum variance portfolio as in (ii) in Problem 2. Compare (a)-(c) for the two portfolios.

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts