Question: 3 Skipped May 9 Malance. May 1 6 Offical instruments were purchased for $ 1 5 6 , 0 0 0 cash. pay the entires

Skipped

May Malance.

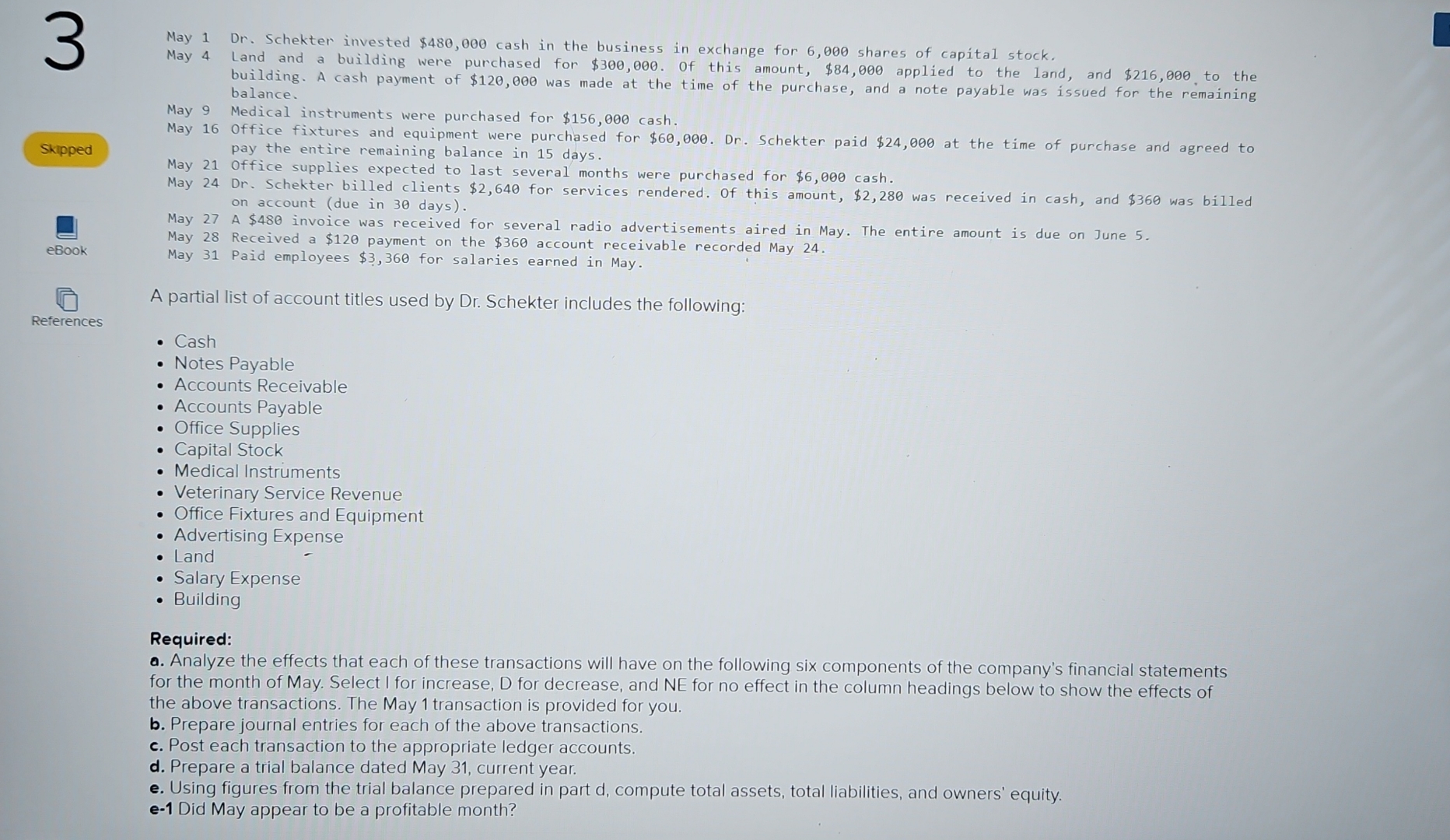

May Offical instruments were purchased for $ cash.

pay the entires and equipment were purchased for $

May Office supplies expected last several months were

May Office fixtures and equipment were purchased for $ Dr Schekter paid $ at the time of purchase and agreed to

May Dr Schekter invested $ cash in the business in exchange for shares of capital stock.

May Land and a building were purchased for $ Of this amount, $ applied to the land, and $ to the building. A cash payment of $ was made at the time of the purchase, and a note payable was issued for the remaining

balance.

May Dr Schekter billed clients $ for for months were purchased for $ cash.

ebook

May Account due in days

May A $ invoice was received for several radio advertisements aired in May. The entire amount is due on June

May Paid emped a $ payment on the $ account receivable recorded May

References

A partial list of account titles used by Dr Schekter includes the following:

Cash

Notes Payable

Accounts Receivable

Accounts Payable

Office Supplies

Capital Stock

Medical Instruments

Veterinary Service Revenue

Office Fixtures and Equipment

Advertising Expense

Land

Salary Expense

Building

Required:

a Analyze the effects that each of these transactions will have on the following six components of the company's financial statements for the month of May. Select I for increase, D for decrease, and NE for no effect in the column headings below to show the effects of the above transactions. The May transaction is provided for you.

b Prepare journal entries for each of the above transactions.

c Post each transaction to the appropriate ledger accounts.

d Prepare a trial balance dated May current year.

e Using figures from the trial balance prepared in part d compute total assets, total liabilities, and owners' equity.

e Did May appear to be a profitable month?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock