Question: 3. Stock valuation methods: Adjusted dividend discount model Suppose that TurboLight Co., a renewable energy startup, currently has earnings of $9 per share and that

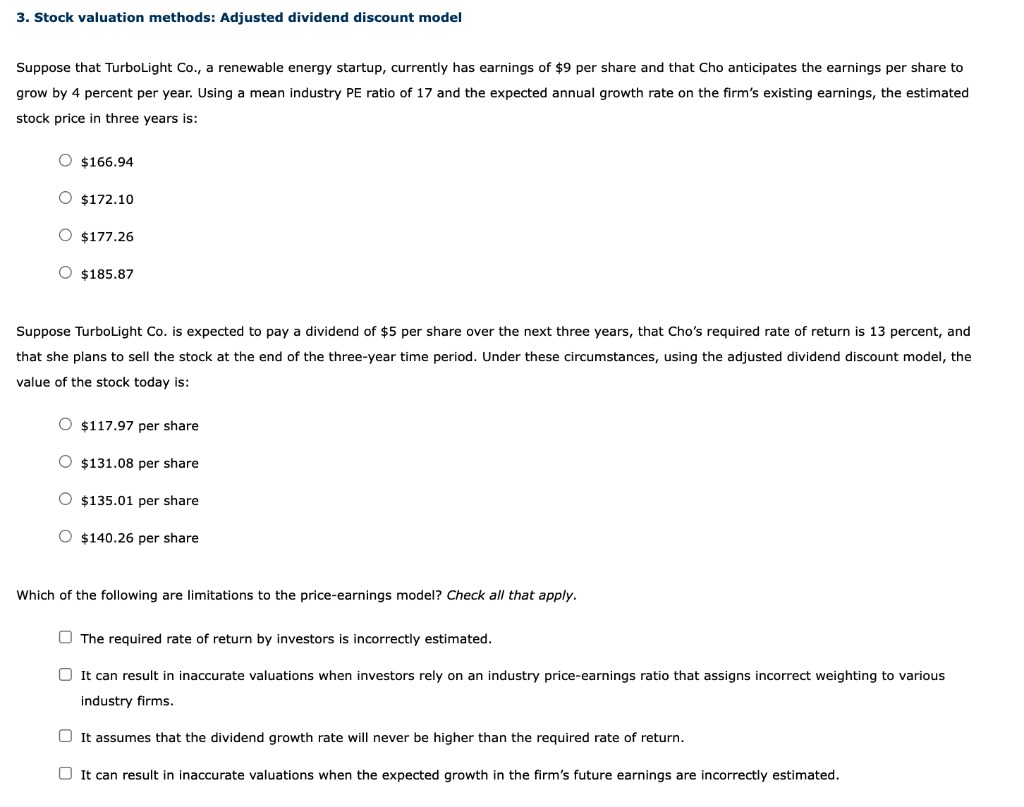

3. Stock valuation methods: Adjusted dividend discount model Suppose that TurboLight Co., a renewable energy startup, currently has earnings of $9 per share and that Cho anticipates the earnings per share to grow by 4 percent per year. Using a mean industry PE ratio of 17 and the expected annual growth rate on the firm's existing earnings, the estimated stock price in three years is: $166.94$172.10$177.26$185.87 Suppose TurboLight Co. is expected to pay a dividend of $5 per share over the next three years, that Cho's required rate of return is 13 percent, and that she plans to sell the stock at the end of the three-year time period. Under these circumstances, using the adjusted dividend discount model, the value of the stock today is: $117.97pershare$131.08pershare$135.01pershare$140.26pershare Which of the following are limitations to the price-earnings model? Check all that apply. The required rate of return by investors is incorrectly estimated. It can result in inaccurate valuations when investors rely on an industry price-earnings ratio that assigns incorrect weighting to various industry firms. It assumes that the dividend growth rate will never be higher than the required rate of return. It can result in inaccurate valuations when the expected growth in the firm's future earnings are incorrectly estimated

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts