Question: 3. Stock valuation methods: Adjusted dividend discount model Suppose that TurboLight Co., a renewable energy startup, currently has earnings of $5 per share and that

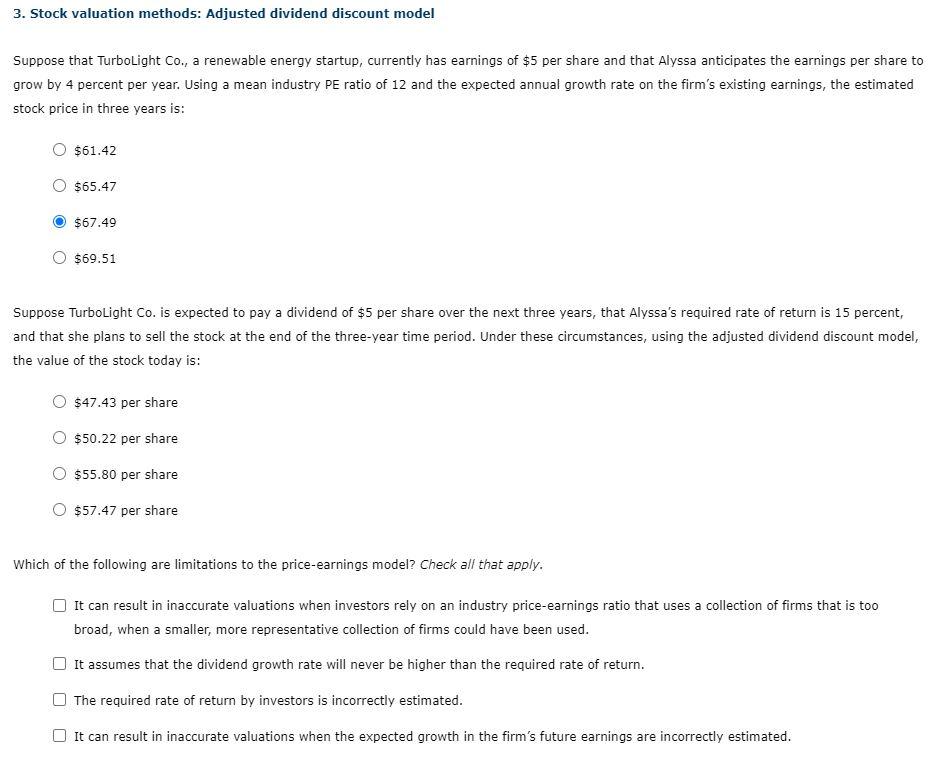

3. Stock valuation methods: Adjusted dividend discount model Suppose that TurboLight Co., a renewable energy startup, currently has earnings of $5 per share and that Alyssa anticipates the earnings per share to grow by 4 percent per year. Using a mean industry PE ratio of 12 and the expected annual growth rate on the firm's existing earnings, the estimated stock price in three years is: $61.42 $65.47 $67.49 $69.51 Suppose TurboLight Co. is expected to pay a dividend of $5 per share over the next three years, that Alyssa's required rate of return is 15 percent, and that she plans to sell the stock at the end of the three-year time period. Under these circumstances, using the adjusted dividend discount model, the value of the stock today is: $47.43 per share $50.22 per share $55.80 per share $57.47 per share Which of the following are limitations to the price-earnings model? Check all that apply. It can result in inaccurate valuations when investors rely on an industry price-earnings ratio that uses a collection of firms that is too broad, when a smaller, more representative collection of firms could have been used. It assumes that the dividend growth rate will never be higher than the required rate of return. The required rate of return by investors is incorrectly estimated. It can result in inaccurate valuations when the expected growth in the firm's future earnings are incorrectly estimated

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts