Question: 3. Suppose that So = 4, u = 2, d = and the interest rate R = Let 5= (S0+S + S + S3)

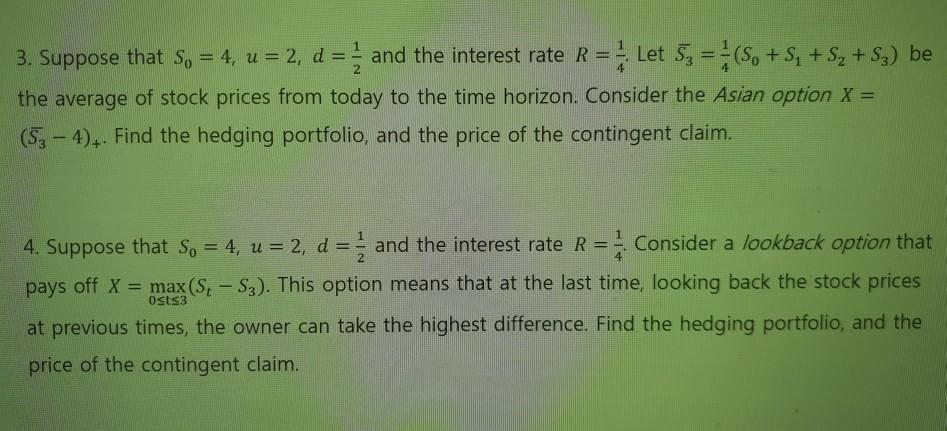

3. Suppose that So = 4, u = 2, d = and the interest rate R = Let 5= (S0+S + S + S3) be the average of stock prices from today to the time horizon. Consider the Asian option X = (S3-4). Find the hedging portfolio, and the price of the contingent claim. 4. Suppose that So = 4, u = 2, d = and the interest rate R = Consider a lookback option that pays off X= max (S, -S3). This option means that at the last time, looking back the stock prices 0sts3 at previous times, the owner can take the highest difference. Find the hedging portfolio, and the price of the contingent claim.

Step by Step Solution

3.46 Rating (149 Votes )

There are 3 Steps involved in it

ANSWER 1 The american put has price VP 25... View full answer

Get step-by-step solutions from verified subject matter experts