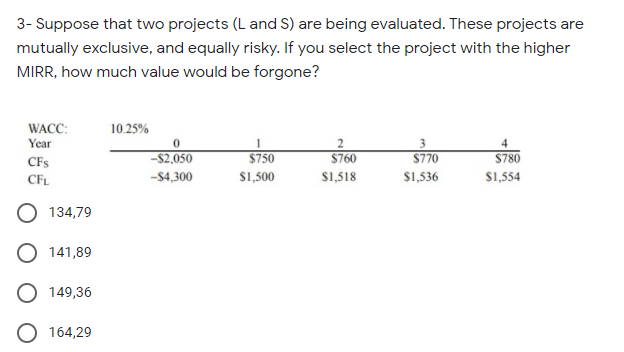

Question: 3- Suppose that two projects (L and S) are being evaluated. These projects are mutually exclusive, and equally risky. If you select the project with

3- Suppose that two projects (L and S) are being evaluated. These projects are mutually exclusive, and equally risky. If you select the project with the higher MIRR, how much value would be forgone? 10.25% WACC: Year -$2,050 $750 2 $760 $1,518 CFS $770 4 $780 CFL -$4,300 $1,500 $1,536 $1,554 O 134,79 O 141,89 149,36 O 164,29

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock