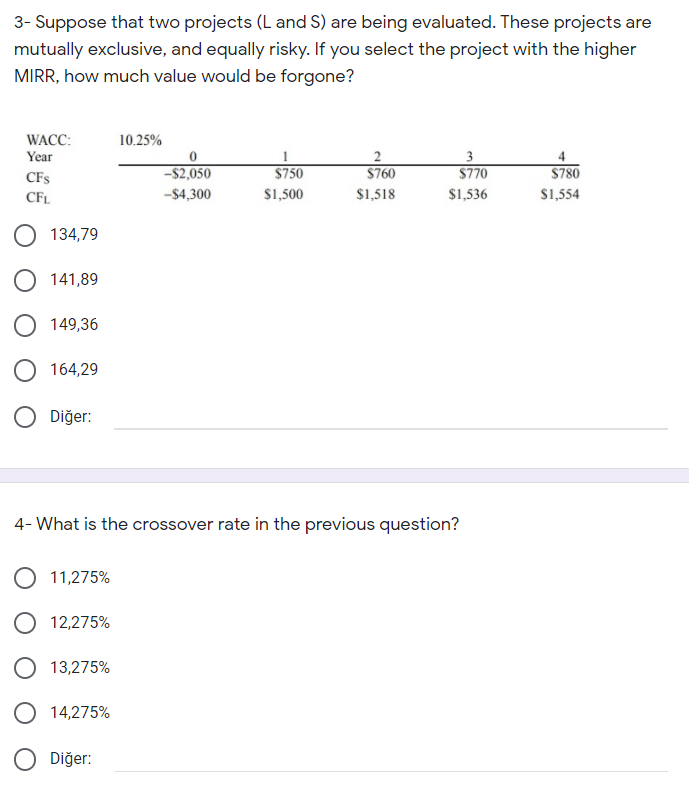

Question: 3- Suppose that two projects (L and S) are being evaluated. These projects are mutually exclusive, and equally risky. If you select the project with

3- Suppose that two projects (L and S) are being evaluated. These projects are mutually exclusive, and equally risky. If you select the project with the higher MIRR, how much value would be forgone? 10.25% WACC: Year -$2,050 $750 2 $760 $1,518 CFS CFL $770 $780 $1,554 -$4,300 $1,500 $1,536 O 134,79 0 141,89 O 149,36 164,29 O Dier 4-What is the crossover rate in the previous question? O 11,275% O 12,275% O 13,275% O 14,275% O Dier

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts