Question: 3. Suppose we are considering a project that will generate sales of $100,000 per year for 3 years. It has costs of $80,000 per year.

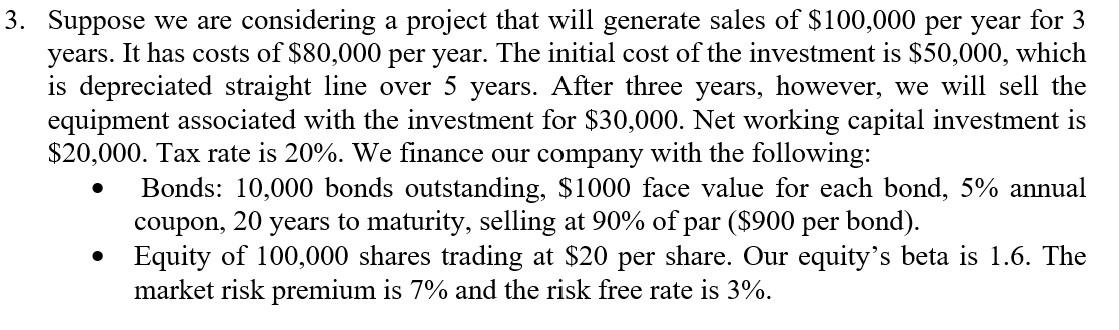

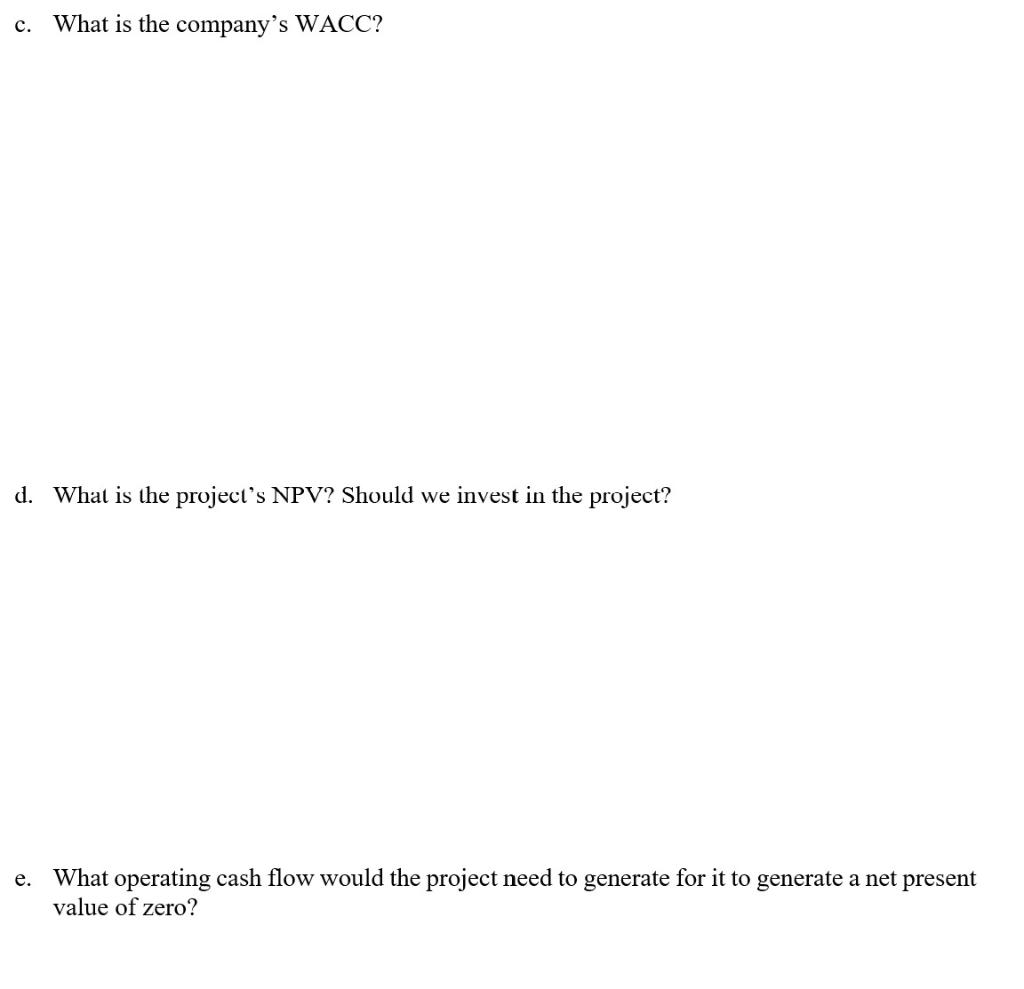

3. Suppose we are considering a project that will generate sales of $100,000 per year for 3 years. It has costs of $80,000 per year. The initial cost of the investment is $50,000, which is depreciated straight line over 5 years. After three years, however, we will sell the equipment associated with the investment for $30,000. Net working capital investment is $20,000. Tax rate is 20%. We finance our company with the following: Bonds: 10,000 bonds outstanding, $1000 face value for each bond, 5% annual coupon, 20 years to maturity, selling at 90% of par ($900 per bond). Equity of 100,000 shares trading at $20 per share. Our equity's beta is 1.6. The market risk premium is 7% and the risk free rate is 3%. . . c. What is the company's WACC? d. What is the project's NPV? Should we invest in the project? e. What operating cash flow would the project need to generate for it to generate a net present value of zero

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts