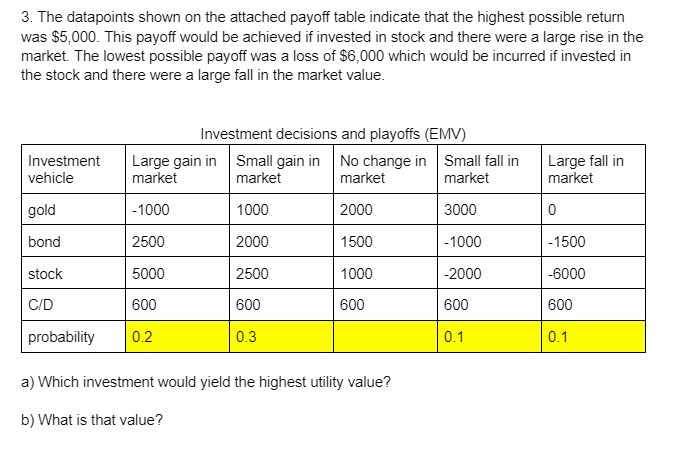

Question: 3. The datapoints shown on the attached payoff table indicate that the highest possible return was $5,000. This payoff would be achieved if invested in

3. The datapoints shown on the attached payoff table indicate that the highest possible return was $5,000. This payoff would be achieved if invested in stock and there were a large rise in the market. The lowest possible payoff was a loss of $6,000 which would be incurred if invested in the stock and there were a large fall in the market value. Investment vehicle Investment decisions and playoffs (EMV) Large gain in Small gain in No change in Small fall in market market market market Large fall in market gold -1000 1000 2000 3000 0 bond 2500 2000 1500 -1000 -1500 stock 5000 2500 1000 -2000 -6000 C/D 600 600 600 600 600 probability 0.2 0.3 0.1 0.1 a) Which investment would yield the highest utility value? b) What is that value? 3. The datapoints shown on the attached payoff table indicate that the highest possible return was $5,000. This payoff would be achieved if invested in stock and there were a large rise in the market. The lowest possible payoff was a loss of $6,000 which would be incurred if invested in the stock and there were a large fall in the market value. Investment vehicle Investment decisions and playoffs (EMV) Large gain in Small gain in No change in Small fall in market market market market Large fall in market gold -1000 1000 2000 3000 0 bond 2500 2000 1500 -1000 -1500 stock 5000 2500 1000 -2000 -6000 C/D 600 600 600 600 600 probability 0.2 0.3 0.1 0.1 a) Which investment would yield the highest utility value? b) What is that value

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts