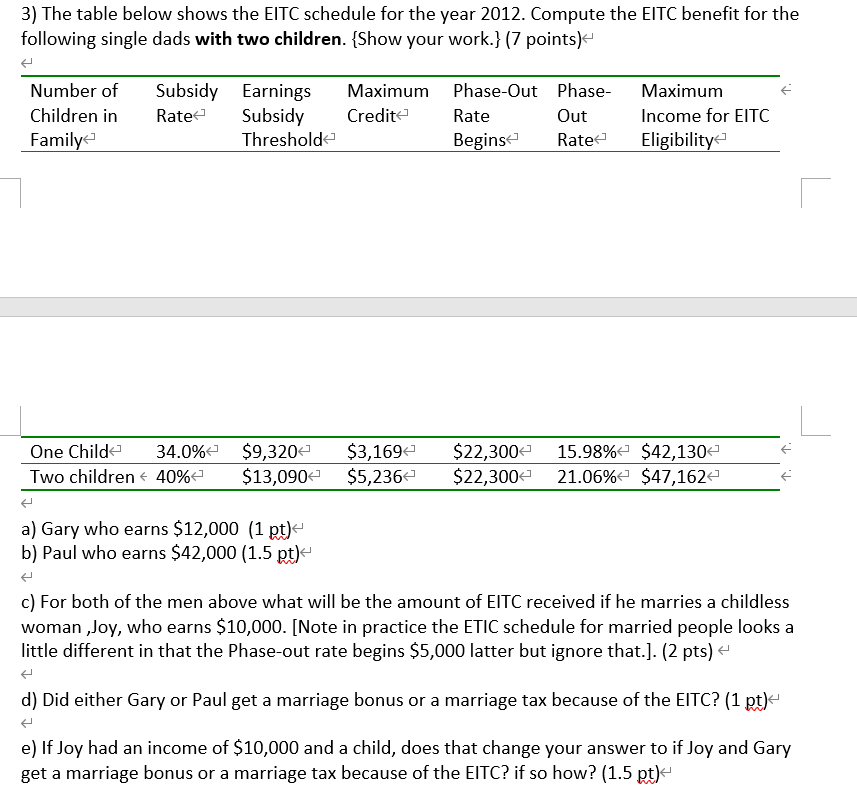

Question: 3) The table below shows the EITC schedule for the year 2012. Compute the EITC benefit for the following single dads with two children. {Show

3) The table below shows the EITC schedule for the year 2012. Compute the EITC benefit for the following single dads with two children. {Show your work.} (7 points) Number of Children in Family Subsidy Rate Earnings Subsidy Threshold Maximum Credit Phase-Out Phase- Rate Out Begins Rate Maximum Income for EITC Eligibility One Child 34.0% Two children + 40% $9,3204 $3,1694 $13,090 $5,2364 $22,300 15.98% $42,1304 $22,3004 21.06%- $47,1624 a) Gary who earns $12,000 (1 pt) b) Paul who earns $42,000 (1.5 pt) c) For both of the men above what will be the amount of EITC received if he marries a childless woman ,Joy, who earns $10,000. [Note in practice the ETIC schedule for married people looks a little different in that the Phase-out rate begins $5,000 latter but ignore that.). (2 pts) + d) Did either Gary or Paul get a marriage bonus or a marriage tax because of the EITC? (1 pt) e) If Joy had an income of $10,000 and a child, does that change your answer to if Joy and Gary get a marriage bonus or a marriage tax because of the EITC? if so how? (1.5 pt) 3) The table below shows the EITC schedule for the year 2012. Compute the EITC benefit for the following single dads with two children. {Show your work.} (7 points) Number of Children in Family Subsidy Rate Earnings Subsidy Threshold Maximum Credit Phase-Out Phase- Rate Out Begins Rate Maximum Income for EITC Eligibility One Child 34.0% Two children + 40% $9,3204 $3,1694 $13,090 $5,2364 $22,300 15.98% $42,1304 $22,3004 21.06%- $47,1624 a) Gary who earns $12,000 (1 pt) b) Paul who earns $42,000 (1.5 pt) c) For both of the men above what will be the amount of EITC received if he marries a childless woman ,Joy, who earns $10,000. [Note in practice the ETIC schedule for married people looks a little different in that the Phase-out rate begins $5,000 latter but ignore that.). (2 pts) + d) Did either Gary or Paul get a marriage bonus or a marriage tax because of the EITC? (1 pt) e) If Joy had an income of $10,000 and a child, does that change your answer to if Joy and Gary get a marriage bonus or a marriage tax because of the EITC? if so how? (1.5 pt)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts