Question: 3. This question is on option pricing using Black-Scholes The Black-Scholes pricing problem for a European binary call op- tion is given by the partial

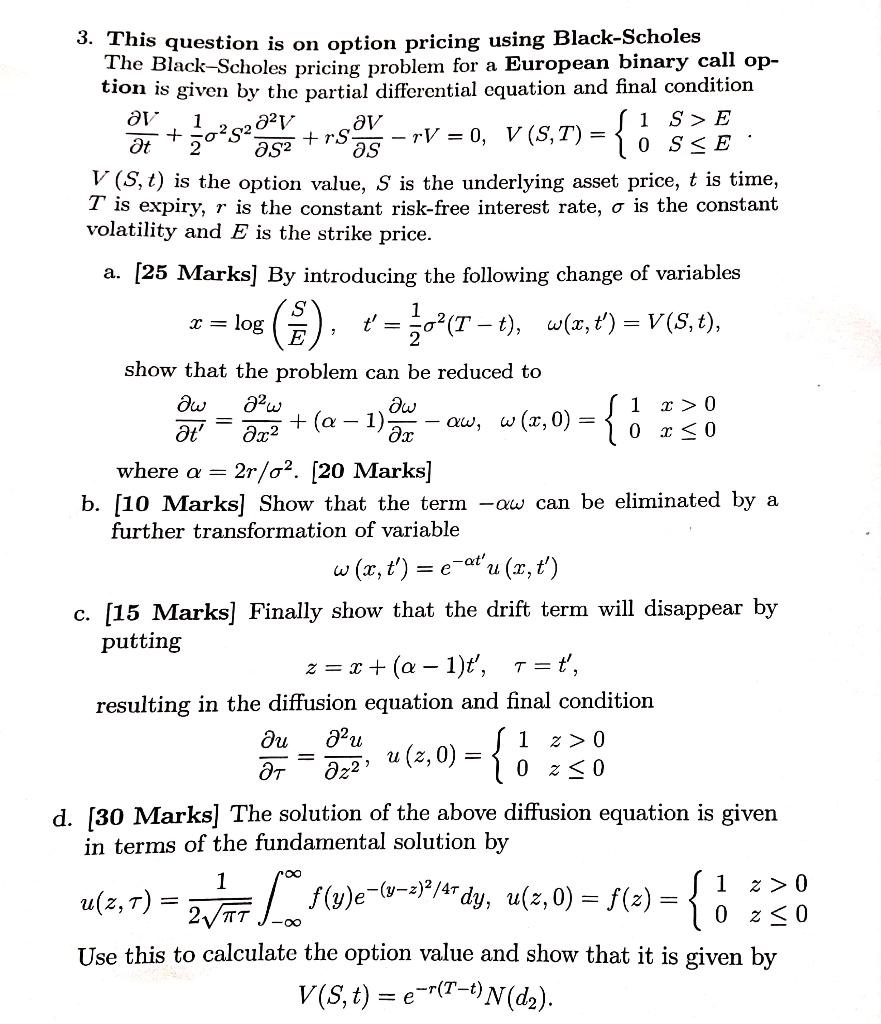

3. This question is on option pricing using Black-Scholes The Black-Scholes pricing problem for a European binary call op- tion is given by the partial differential equation and final condition ar 1 1 S > E 8 S2 + S 20 av as +rS t -rV = 0, V (S, T) = 0 SE V (S, t) is the option value, S is the underlying asset price, t is time, T is expiry, r is the constant risk-free interest rate, o is the constant volatility and E is the strike price. a. [25 Marks] By introducing the following change of variables S x = log t' = 1/1/0 (T - t), w(x, t') = V(S, t), 7 show that the problem can be reduced to 2w + (a 1 x > 0 0 x 0 It' 1) ! - aw, w (10,0) = { x x where a = 2r/o. [20 Marks] b. [10 Marks] Show that the term -aw can be eliminated by a further transformation of variable. w (x, t') = e-at t'u (x, t') c. [15 Marks] Finally show that the drift term will disappear by putting z = x + (a1)t', T = =t', resulting in the diffusion equation and final condition Ju Ju 1 z > 0 u (2,0) = { T z 0 z 0 d. [30 Marks] The solution of the above diffusion equation is given in terms of the fundamental solution by 1 J1 z>0 2TT f(y)e-(y-2)/47 dy, u(z,0) = f(z) = u(27) = = 10 z0 Use this to calculate the option value and show that it is given by V(S,t) = e-r(T-t) N (d). 3. This question is on option pricing using Black-Scholes The Black-Scholes pricing problem for a European binary call op- tion is given by the partial differential equation and final condition ar 1 1 S > E 8 S2 + S 20 av as +rS t -rV = 0, V (S, T) = 0 SE V (S, t) is the option value, S is the underlying asset price, t is time, T is expiry, r is the constant risk-free interest rate, o is the constant volatility and E is the strike price. a. [25 Marks] By introducing the following change of variables S x = log t' = 1/1/0 (T - t), w(x, t') = V(S, t), 7 show that the problem can be reduced to 2w + (a 1 x > 0 0 x 0 It' 1) ! - aw, w (10,0) = { x x where a = 2r/o. [20 Marks] b. [10 Marks] Show that the term -aw can be eliminated by a further transformation of variable. w (x, t') = e-at t'u (x, t') c. [15 Marks] Finally show that the drift term will disappear by putting z = x + (a1)t', T = =t', resulting in the diffusion equation and final condition Ju Ju 1 z > 0 u (2,0) = { T z 0 z 0 d. [30 Marks] The solution of the above diffusion equation is given in terms of the fundamental solution by 1 J1 z>0 2TT f(y)e-(y-2)/47 dy, u(z,0) = f(z) = u(27) = = 10 z0 Use this to calculate the option value and show that it is given by V(S,t) = e-r(T-t) N (d)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts