Question: Question 1 ( 3 0 points ) Discuss whether each of following statements is true or false and WHY. a . Suppose all the assumptions

Question points

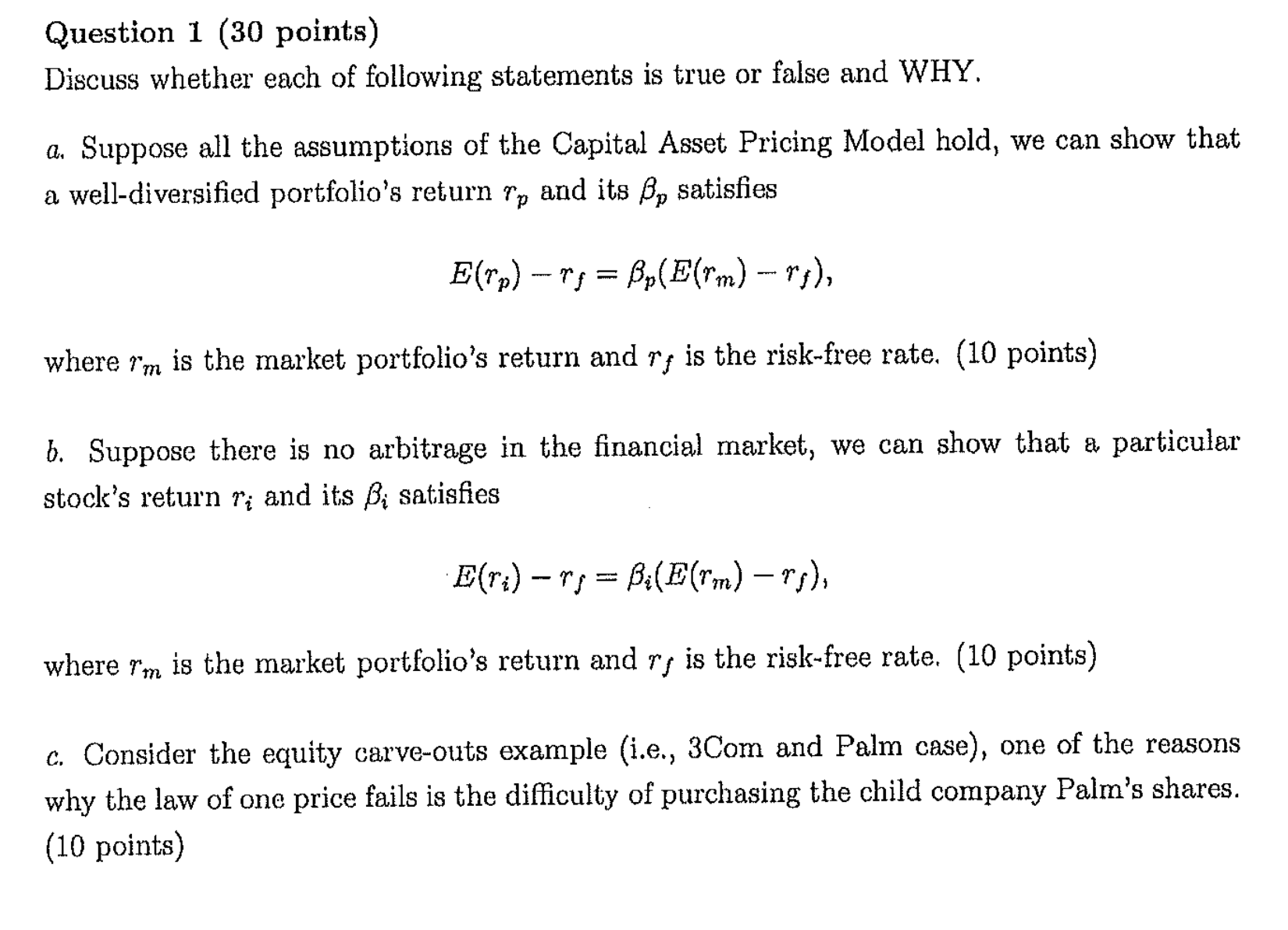

Discuss whether each of following statements is true or false and WHY.

a Suppose all the assumptions of the Capital Asset Pricing Model hold, we can show that

a welldiversified portfolio's return and its satisfies

where is the market portfolio's return and is the riskfree rate. points

b Suppose there is no arbitrage in the financial market, we can show that a particular

stock's return and its satisfies

where is the market portfolio's return and is the riskfree rate. points

c Consider the equity carveouts example ie Com and Palm case one of the reasons

why the law of one price fails is the difficulty of purchasing the child company Palm's shares.

points

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock