Question: 3) Two new rides are being compared by a local amusement park in terms of their annual operating costs. The two rides are assumed to

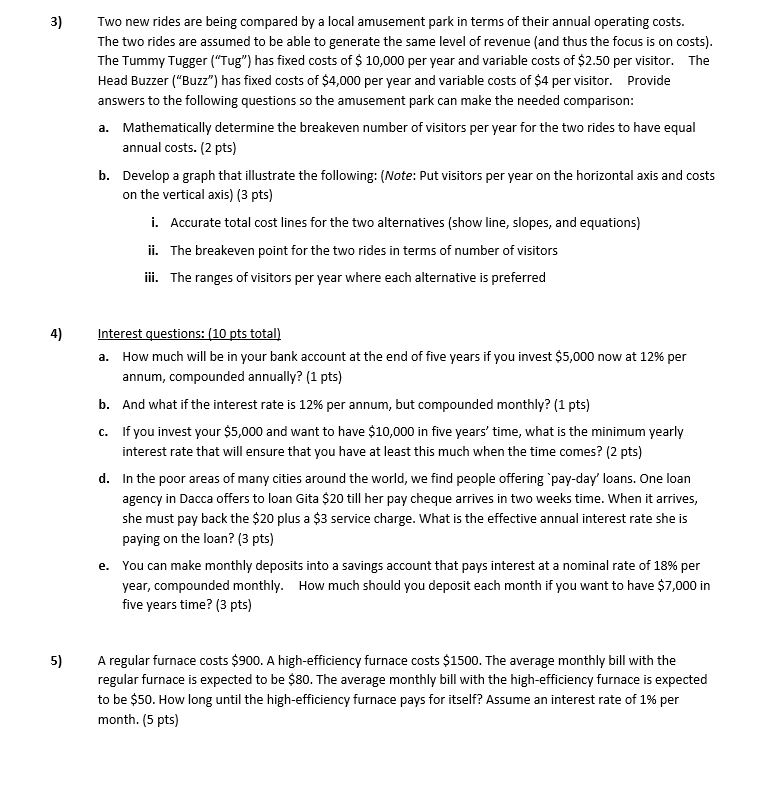

3) Two new rides are being compared by a local amusement park in terms of their annual operating costs. The two rides are assumed to be able to generate the same level of revenue (and thus the focus is on costs) The Tummy Tugger ('Tug") has fixed costs of $ 10,000 per year and variable costs of $2.50 per visitor. The Head Buzzer ("Buzz") has fixed costs of $4,000 per year and variable costs of $4 per visitor. Provide answers to the following questions so the amusement park can make the needed comparison a. Mathematically determine the breakeven number of visitors per year for the two rides to have equal annual costs. (2 pts) b. Develop a graph that illustrate the following: (Note: Put visitors per year on the horizontal axis and costs on the vertical axis) (3 pts) i. Accurate total cost lines for the two alternatives (show line, slopes, and equations) The breakeven point for the two rides in terms of number of visitors The ranges of visitors per year where each alternative is preferred ii. iii. 4) Intere How much will be in your bank account at the end of five years if you invest $5,000 now at 12% per annum, compounded annually? (1 pts) And what if the interest rate is 12% per annum, but compounded monthly? (1 pts) If you invest your $5,000 and want to have $10,000 in five years' time, what is the minimum yearly interest rate that will ensure that you have at least this much when the time comes? (2 pts) a. b. c. d. In the poor areas of many cities around the world, we find people offering pay-day' loans. One loan agency in Dacca offers to loan Gita $20 till her pay cheque arrives in two weeks time. When it arrives she must pay back the $20 plus a $3 service charge. What is the effective annual interest rate she is paying on the loan? (3 pts) You can make monthly deposits into a savings account that pays interest at a nominal rate of 18% per year, compounded monthly. five years time? (3 pts) e. How much should you deposit each month if you want to have $7,000 in A regular furnace costs $900. A high-efficiency furnace costs $1500. The average monthly bill with the regular furnace is expected to be $80. The average monthly bill with the high-efficiency furnace is expected to be $50. How long until the high-efficiency furnace pays for itself? Assume an interest rate of 1% per month. (5 pts) 5)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts