Question: 3. (Two period binomial model; 15 points) Consider a two period binomial model where So = $50, and in each time period, the stock can

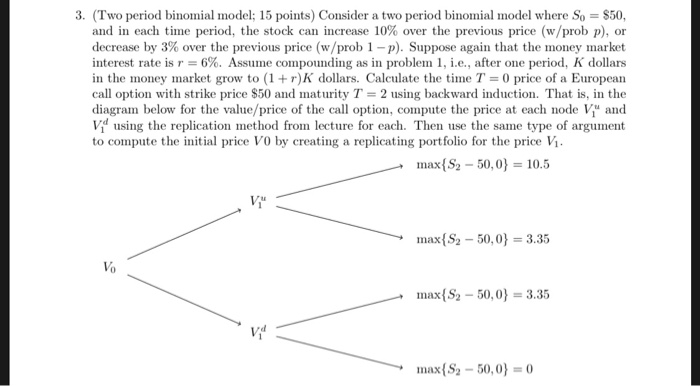

3. (Two period binomial model; 15 points) Consider a two period binomial model where So = $50, and in each time period, the stock can increase 10% over the previous price (w/prob p), or decrease by 3% over the previous price (w/prob 1-p). Suppose again that the money market interest rate is r = 6%. Assume compounding as in problem 1, i.e., after one period, K dollars in the money market grow to (1+r)K dollars. Calculate the time T = 0 price of a European call option with strike price $50 and maturity T = 2 using backward induction. That is, in the diagram below for the value/price of the call option, compute the price at each node V" and V using the replication method from lecture for each. Then use the same type of argument to compute the initial price VO by creating a replicating portfolio for the price V. max{S2 - 50,0} = 10.5 max{S2 - 50,0} = 3.35 Vo max{S2 - 50,0) = 3.35 max{S, - 50,0) = 0

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts