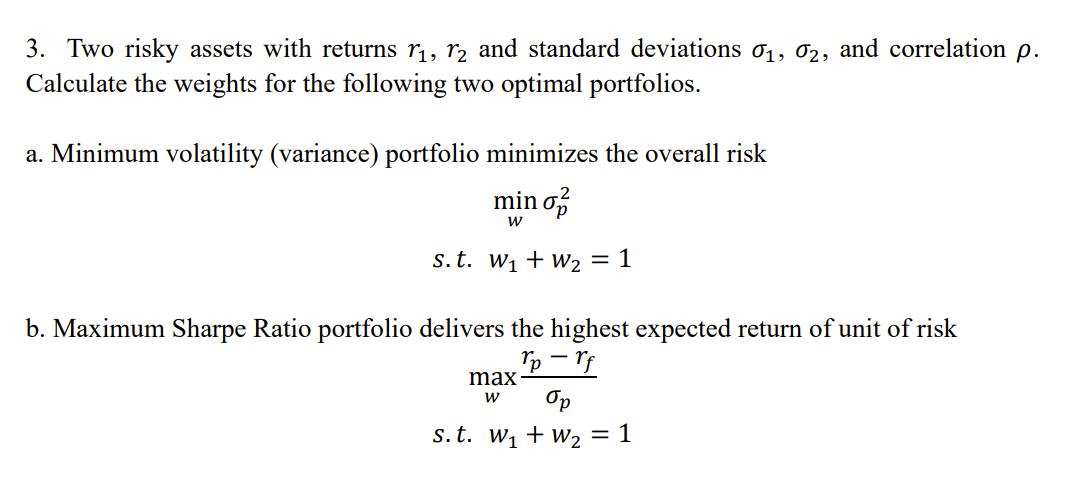

Question: 3. Two risky assets with returns 1, 2 and standard deviations 01, 02, and correlation p. Calculate the weights for the following two optimal

3. Two risky assets with returns 1, 2 and standard deviations 01, 02, and correlation p. Calculate the weights for the following two optimal portfolios. a. Minimum volatility (variance) portfolio minimizes the overall risk min o W s.t. W + W = 1 b. Maximum Sharpe Ratio portfolio delivers the highest expected return of unit of risk max W rp - rf S. t. W1 W2 = 1

Step by Step Solution

There are 3 Steps involved in it

Heres how to calculate the weights for the two optimal portfolios given the information a Minimum Volatility Portfolio This portfolio minimizes the ov... View full answer

Get step-by-step solutions from verified subject matter experts