Question: answer part b please Two risky assets with returns 5%, 10% and standard deviations 10%, 15%, and correlation 0.3. Calculate the weights for a. The

answer part b please

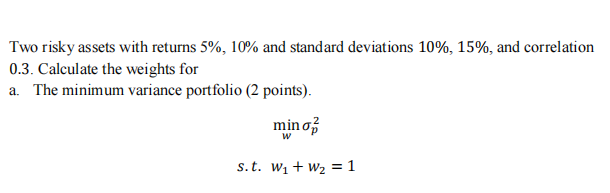

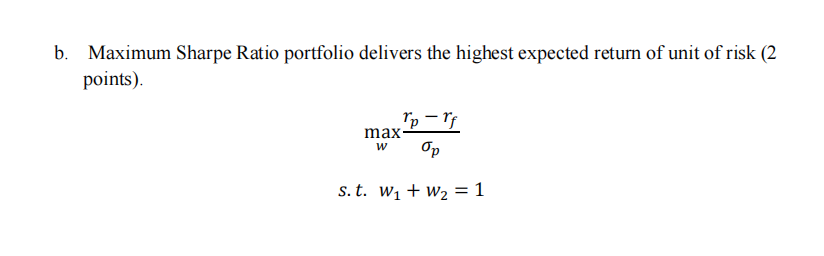

Two risky assets with returns 5%, 10% and standard deviations 10%, 15%, and correlation 0.3. Calculate the weights for a. The minimum variance portfolio (2 points). mino s.t. Wi+w2 = 1 Maximum Sharpe Ratio portfolio delivers the highest expected return of unit of risk (2 points) Yp - rf max Op w s. t. W1 + W2 = 1 Two risky assets with returns 5%, 10% and standard deviations 10%, 15%, and correlation 0.3. Calculate the weights for a. The minimum variance portfolio (2 points). mino s.t. Wi+w2 = 1 Maximum Sharpe Ratio portfolio delivers the highest expected return of unit of risk (2 points) Yp - rf max Op w s. t. W1 + W2 = 1

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts