Question: 3) Using Coca Cola's financial statement data. Suppose Coca Cola had purchased additional equipment for $670 million at the end of 2015, and this equipment

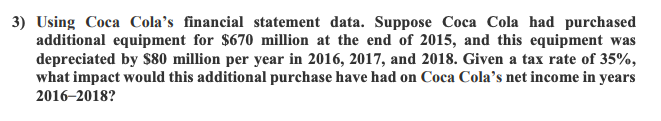

3) Using Coca Cola's financial statement data. Suppose Coca Cola had purchased additional equipment for $670 million at the end of 2015, and this equipment was depreciated by $80 million per year in 2016, 2017, and 2018. Given a tax rate of 35%, what impact would this additional purchase have had on Coca Cola's net income in years 2016-2018

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts