Question: help out with question 3-4 3) Using Coca Cola's financial statement data. Suppose Coca Cola had purchased additional equipment for S670 million at the end

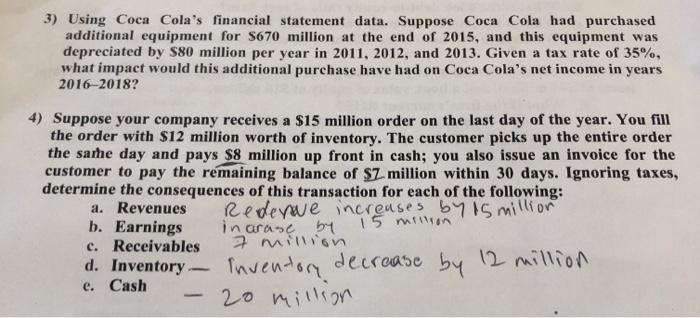

3) Using Coca Cola's financial statement data. Suppose Coca Cola had purchased additional equipment for S670 million at the end of 2015, and this equipment was depreciated by S80 million per year in 2011, 2012, and 2013. Given a tax rate of 35%, what impact would this additional purchase have had on Coca Cola's net income in years 2016-2018? 4) Suppose your company receives a $15 million order on the last day of the year. You fill the order with $12 million worth of inventory. The customer picks up the entire order the same day and pays $8 million up front in cash; you also issue an invoice for the customer to pay the remaining balance of SZ million within 30 days. Ignoring taxes, determine the consequences of this transaction for each of the following: a. Revenues Redenue increases by 5 million b. Earnings in arane 54 c. Receivables 7 million d. Inventory Inventory decrease by 12 million - 20 million

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts