Question: 3. Using the average prices computed from the table in task t, compute the following: i. the average returns (arithmetic mean) for each stock (6

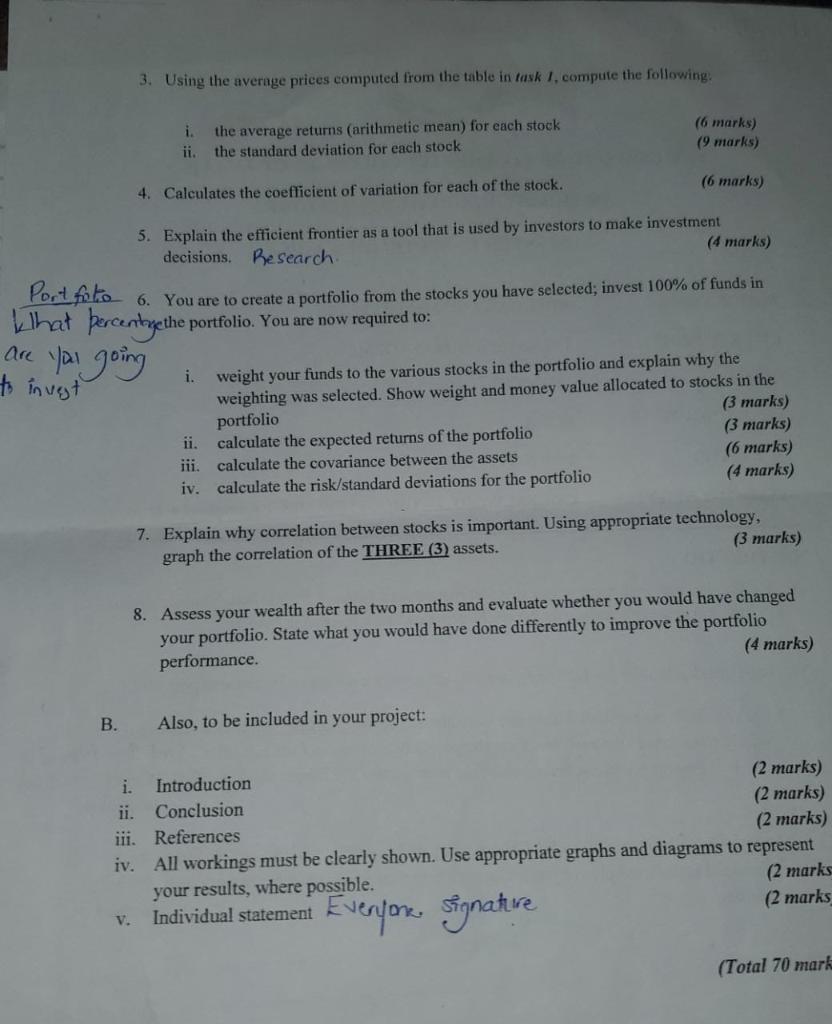

3. Using the average prices computed from the table in task t, compute the following: i. the average returns (arithmetic mean) for each stock (6 marks) ii. the standard deviation for each stock (9 marks) 4. Calculates the coefficient of variation for each of the stock. (6 marks) 5. Explain the efficient frontier as a tool that is used by investors to make investment decisions. Research. (4 marks) Port fotio 6. You are to create a portfolio from the stocks you have selected; invest 100% of funds in What percentyethe portfolio. You are now required to: are pal going i. weight your funds to the various stocks in the portfolio and explain why the weighting was selected. Show weight and money value allocated to stocks in the portfolio ii. calculate the expected returns of the portfolio (3 marks) iii. calculate the covariance between the assets (3 marks) iv. calculate the risk/standard deviations for the portfolio (6 marks) (4 marks) 7. Explain why correlation between stocks is important. Using appropriate technology, graph the correlation of the THREE (3) assets. (3 marks) 8. Assess your wealth after the two months and evaluate whether you would have changed your portfolio. State what you would have done differently to improve the portfolio performance. (4 marks) B. Also, to be included in your project: i. Introduction (2 marks) ii. Conclusion (2 marks) iii. References (2 marks) iv. All workings must be clearly shown. Use appropriate graphs and diagrams to represent your results, where possible. v. Individual statement Everuone signature (2 marks (2 marks 3. Using the average prices computed from the table in task t, compute the following: i. the average returns (arithmetic mean) for each stock (6 marks) ii. the standard deviation for each stock (9 marks) 4. Calculates the coefficient of variation for each of the stock. (6 marks) 5. Explain the efficient frontier as a tool that is used by investors to make investment decisions. Research. (4 marks) Port fotio 6. You are to create a portfolio from the stocks you have selected; invest 100% of funds in What percentyethe portfolio. You are now required to: are pal going i. weight your funds to the various stocks in the portfolio and explain why the weighting was selected. Show weight and money value allocated to stocks in the portfolio ii. calculate the expected returns of the portfolio (3 marks) iii. calculate the covariance between the assets (3 marks) iv. calculate the risk/standard deviations for the portfolio (6 marks) (4 marks) 7. Explain why correlation between stocks is important. Using appropriate technology, graph the correlation of the THREE (3) assets. (3 marks) 8. Assess your wealth after the two months and evaluate whether you would have changed your portfolio. State what you would have done differently to improve the portfolio performance. (4 marks) B. Also, to be included in your project: i. Introduction (2 marks) ii. Conclusion (2 marks) iii. References (2 marks) iv. All workings must be clearly shown. Use appropriate graphs and diagrams to represent your results, where possible. v. Individual statement Everuone signature (2 marks (2 marks

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts