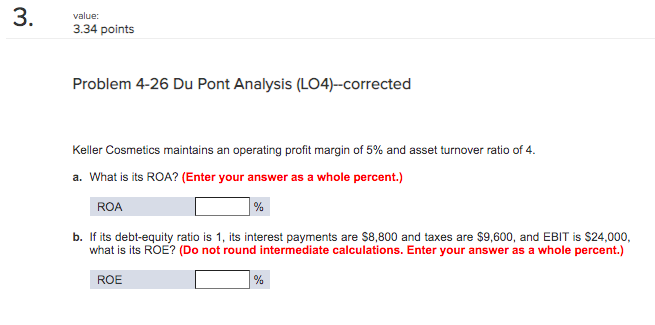

Question: 3. value: 3.34 points Problem 4-26 Du Pont Analysis (LO4)--corrected Keller Cosmetics maintains an operating profit margin of 5% and asset turnover ratio of 4.

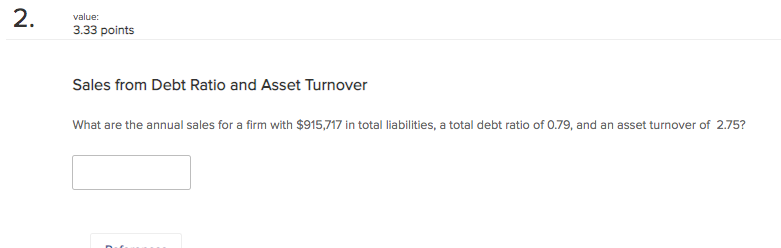

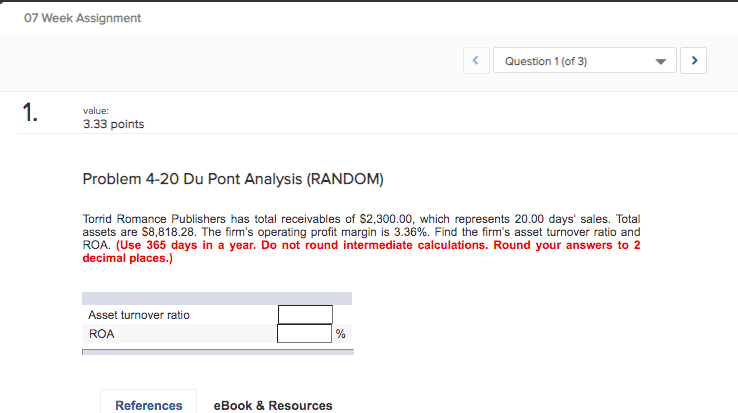

3. value: 3.34 points Problem 4-26 Du Pont Analysis (LO4)--corrected Keller Cosmetics maintains an operating profit margin of 5% and asset turnover ratio of 4. a. What is its ROA? (Enter your answer as a whole percent.) ROA % b. If its debt-equity ratio is 1, its interest payments are $8,800 and taxes are $9,600, and EBIT is $24,000, what is its ROE? (Do not round intermediate calculations. Enter your answer as a whole percent.) ROE % 2. value: 3.33 points Sales from Debt Ratio and Asset Turnover What are the annual sales for a firm with $915,717 in total liabilities, a total debt ratio of 0.79, and an asset turnover of 2.75? 07 Week Assignment Question 1 (of 3) 1. value: 3.33 points Problem 4-20 Du Pont Analysis (RANDOM) Torrid Romance Publishers has total receivables of $2,300.00, which represents 20.00 days' sales. Total assets are $8,818.28. The firm's operating profit margin is 3.36%. Find the firm's asset turnover ratio and ROA. (Use 365 days in a year. Do not round intermediate calculations. Round your answers to 2 decimal places.) Asset turnover ratio ROA % References eBook & Resources

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts