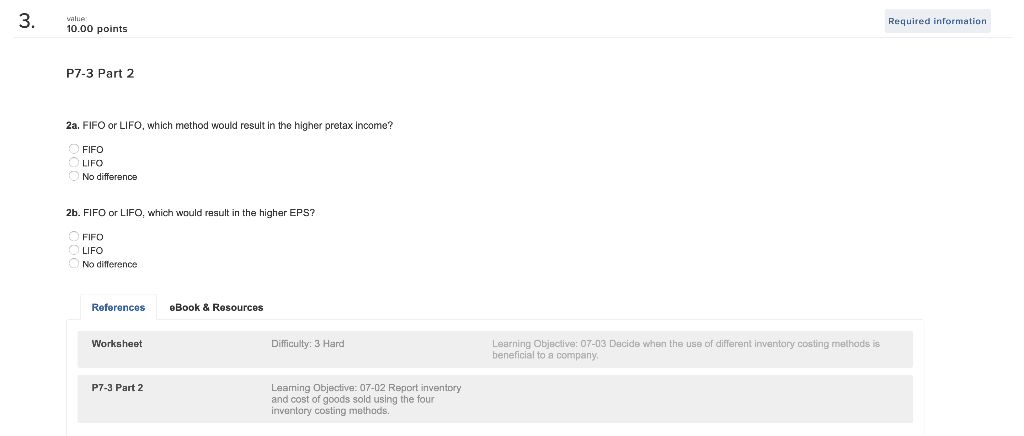

Question: 3. value Required information 10.00 points P7-3 Part 2 2a. FIFO or LIFO, which method would result in the higher pretax income? FIFO OLIFO No

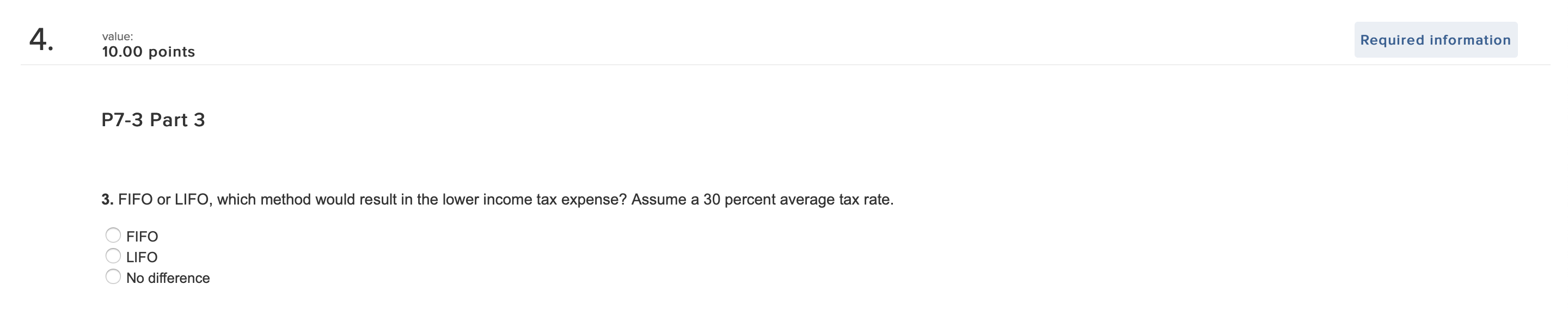

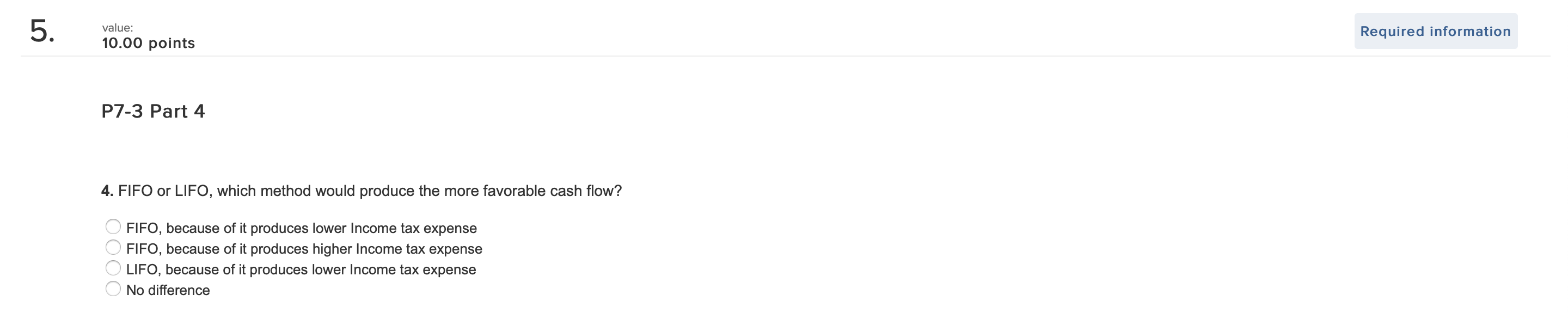

3. value Required information 10.00 points P7-3 Part 2 2a. FIFO or LIFO, which method would result in the higher pretax income? FIFO OLIFO No difference 2b. FIFO or LIFO, which would result in the higher EPS? FIFO LIFO No difference References eBook & Resources Worksheet Difficulty: 3 Hard Learning Objective: 07-03 Decide when the use of different inventory costing methods is beneficial to a company, P7-3 Part 2 Leaming Objective: 07-02 Report inventory and cost of goods sold using the four inventory costing methods. 4. value: 10.00 points Required information P7-3 Part 3 3. FIFO or LIFO, which method would result in the lower income tax expense? Assume a 30 percent average tax rate. FIFO LIFO No difference 5. value: 10.00 points Required information P7-3 Part 4 4. FIFO or LIFO, which method would produce the more favorable cash flow? FIFO, because of it produces lower Income tax expense FIFO, because of it produces higher Income tax expense LIFO, because of it produces lower Income tax expense No difference 3. value Required information 10.00 points P7-3 Part 2 2a. FIFO or LIFO, which method would result in the higher pretax income? FIFO OLIFO No difference 2b. FIFO or LIFO, which would result in the higher EPS? FIFO LIFO No difference References eBook & Resources Worksheet Difficulty: 3 Hard Learning Objective: 07-03 Decide when the use of different inventory costing methods is beneficial to a company, P7-3 Part 2 Leaming Objective: 07-02 Report inventory and cost of goods sold using the four inventory costing methods. 4. value: 10.00 points Required information P7-3 Part 3 3. FIFO or LIFO, which method would result in the lower income tax expense? Assume a 30 percent average tax rate. FIFO LIFO No difference 5. value: 10.00 points Required information P7-3 Part 4 4. FIFO or LIFO, which method would produce the more favorable cash flow? FIFO, because of it produces lower Income tax expense FIFO, because of it produces higher Income tax expense LIFO, because of it produces lower Income tax expense No difference

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts