Question: 3. Warrants Warrants are long-term options to buy a stated number of common shares at a specified price that is generally attached to debt issues.

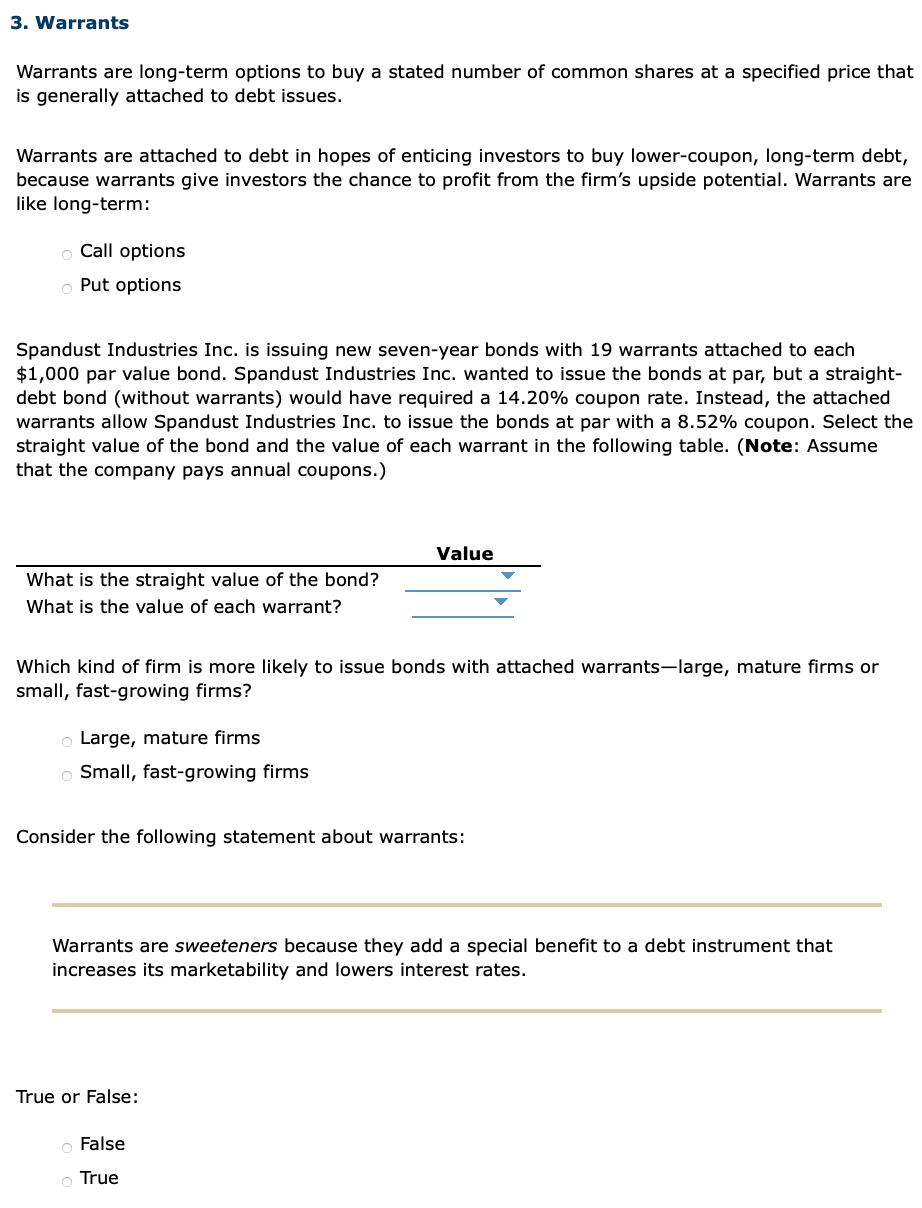

3. Warrants Warrants are long-term options to buy a stated number of common shares at a specified price that is generally attached to debt issues. Warrants are attached to debt in hopes of enticing investors to buy lower-coupon, long-term debt, because warrants give investors the chance to profit from the firm's upside potential. Warrants are like long-term: Call options Put options Spandust Industries Inc. is issuing new seven-year bonds with 19 warrants attached to each $1,000 par value bond. Spandust Industries Inc. wanted to issue the bonds at par, but a straight- debt bond (without warrants) would have required a 14.20% coupon rate. Instead, the attached warrants allow Spandust Industries Inc. to issue the bonds at par with a 8.52% coupon. Select the straight value of the bond and the value of each warrant in the following table. (Note: Assume that the company pays annual coupons.) Value What is the straight value of the bond? What is the value of each warrant? Which kind of firm is more likely to issue bonds with attached warrants-large, mature firms or small, fast-growing firms? Large, mature firms Small, fast-growing firms Consider the following statement about warrants: Warrants are sweeteners because they add a special benefit to a debt instrument that increases its marketability and lowers interest rates. True or False: False o True

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts