Question: Warrants are long-term options to buy a stated number of common shares at a specified price that is generally attached to debt issues. Warrants are

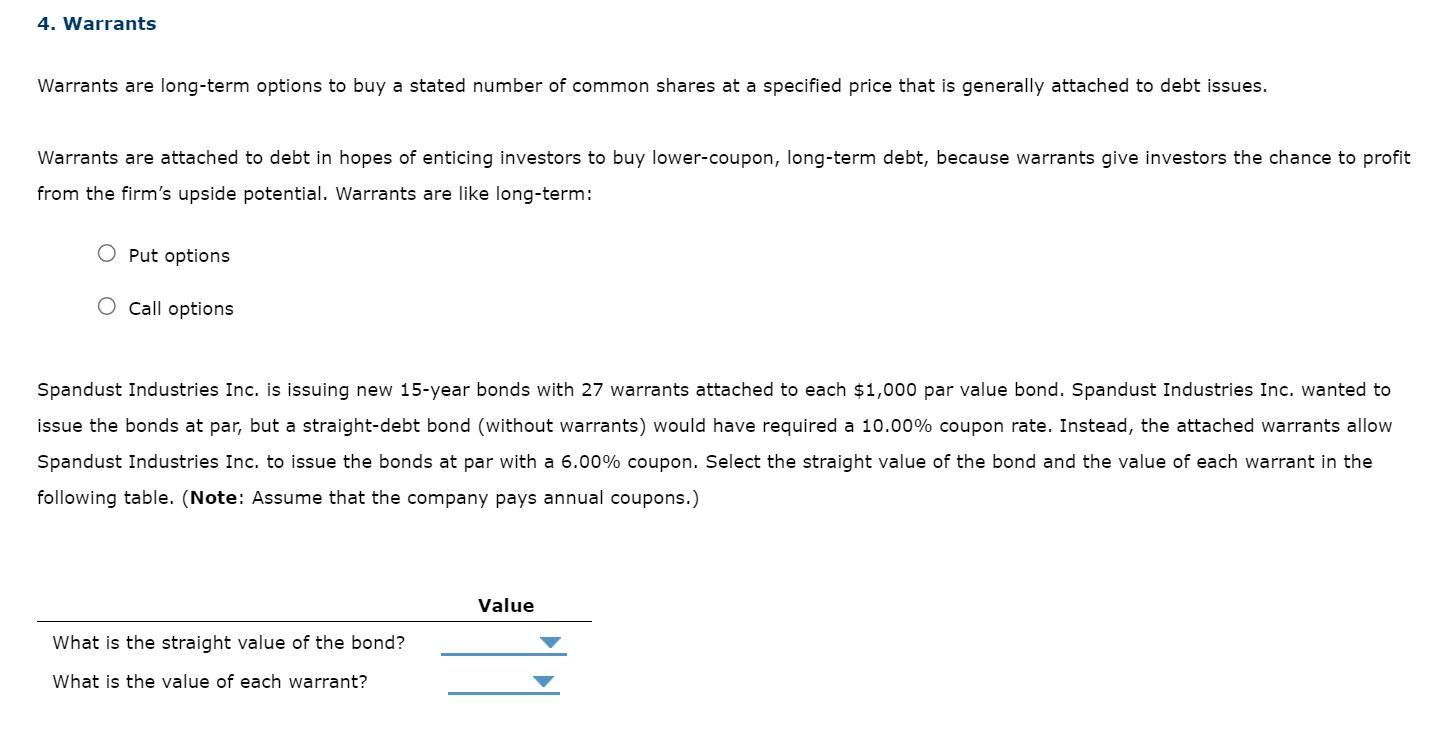

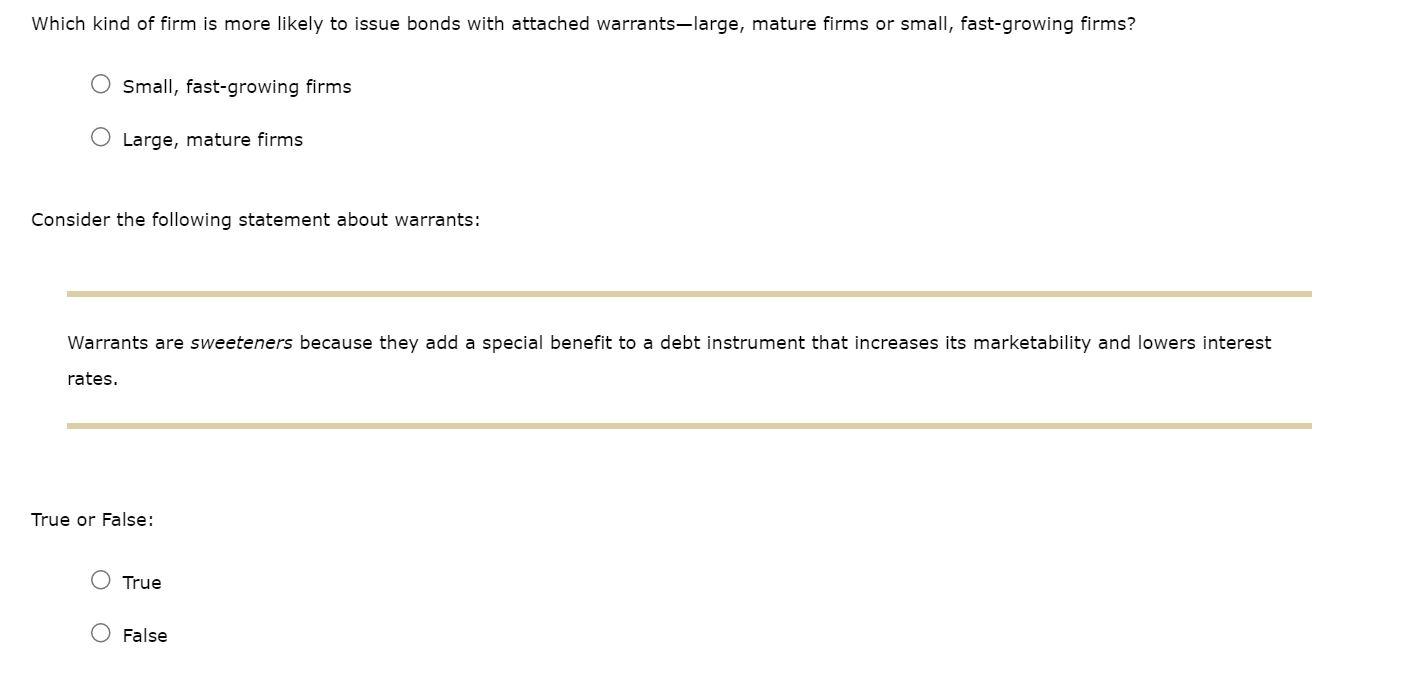

Warrants are long-term options to buy a stated number of common shares at a specified price that is generally attached to debt issues. Warrants are attached to debt in hopes of enticing investors to buy lower-coupon, long-term debt, because warrants give investors the chance to profit from the firm's upside potential. Warrants are like long-term: Put options Call options Spandust Industries Inc. is issuing new 15 -year bonds with 27 warrants attached to each $1,000 par value bond. Spandust Industries Inc. wanted to issue the bonds at par, but a straight-debt bond (without warrants) would have required a 10.00% coupon rate. Instead, the attached warrants allow Spandust Industries Inc. to issue the bonds at par with a 6.00% coupon. Select the straight value of the bond and the value of each warrant in the following table. (Note: Assume that the company pays annual coupons.) Which kind of firm is more likely to issue bonds with attached warrants-large, mature firms or small, fast-growing firms? Small, fast-growing firms Large, mature firms Consider the following statement about warrants: Warrants are sweeteners because they add a special benefit to a debt instrument that increases its marketability and lowers interest rates. True or False: True False Warrants are long-term options to buy a stated number of common shares at a specified price that is generally attached to debt issues. Warrants are attached to debt in hopes of enticing investors to buy lower-coupon, long-term debt, because warrants give investors the chance to profit from the firm's upside potential. Warrants are like long-term: Put options Call options Spandust Industries Inc. is issuing new 15 -year bonds with 27 warrants attached to each $1,000 par value bond. Spandust Industries Inc. wanted to issue the bonds at par, but a straight-debt bond (without warrants) would have required a 10.00% coupon rate. Instead, the attached warrants allow Spandust Industries Inc. to issue the bonds at par with a 6.00% coupon. Select the straight value of the bond and the value of each warrant in the following table. (Note: Assume that the company pays annual coupons.) Which kind of firm is more likely to issue bonds with attached warrants-large, mature firms or small, fast-growing firms? Small, fast-growing firms Large, mature firms Consider the following statement about warrants: Warrants are sweeteners because they add a special benefit to a debt instrument that increases its marketability and lowers interest rates. True or False: True False

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts