Question: 3. What is the EAR corresponding to a nominal rate of 4% compounded semiannually? Compounded quarterly? Compounded daily? 4. What is the future value of

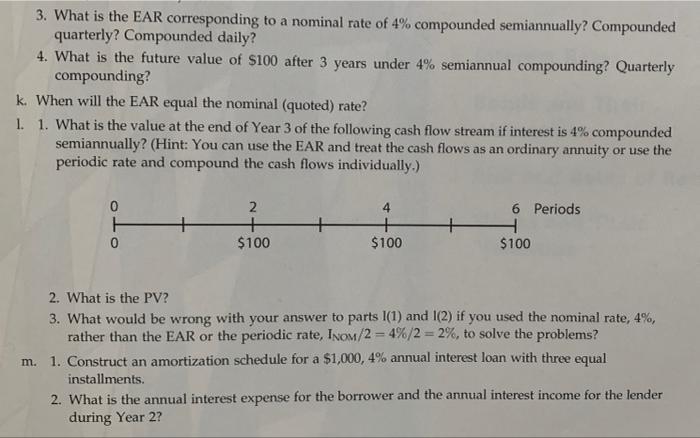

3. What is the EAR corresponding to a nominal rate of 4% compounded semiannually? Compounded quarterly? Compounded daily? 4. What is the future value of $100 after 3 years under 4% semiannual compounding? Quarterly compounding? k. When will the EAR equal the nominal (quoted) rate? 1. 1. What is the value at the end of Year 3 of the following cash flow stream if interest is 4% compounded semiannually? (Hint: You can use the EAR and treat the cash flows as an ordinary annuity or use the periodic rate and compound the cash flows individually.) 0 H 2 + $100 + $100 6 Periods H $100 2. What is the PV? 3. What would be wrong with your answer to parts (1) and (2) if you used the nominal rate, 4%, rather than the EAR or the periodic rate, Inom/2 = 4%/2 = 2%, to solve the problems? m. 1. Construct an amortization schedule for a $1,000,4% annual interest loan with three equal installments. 2. What is the annual interest expense for the borrower and the annual interest income for the lender during Year 2

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts