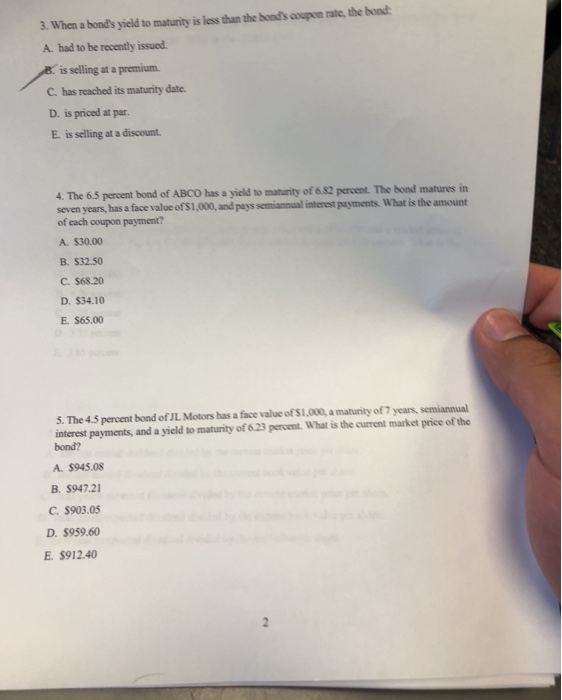

Question: 3. When a bond's yield to maturity is less than the bond's coupon rate, the bond A. had to be recently issued. is selling at

3. When a bond's yield to maturity is less than the bond's coupon rate, the bond A. had to be recently issued. is selling at a premium C. has reached its maturity date. D. is priced at par. E. is selling at a discount 4. The 6.5 percent bond of ABCO has a yield to maturity of &.82 percent. The bond matures in seven years, has a face value of$1,000, and pays semiannual interest payments What is the amount of each coupon payment? A. $30.00 B. $32.50 C. $68.20 D. $34.10 E. $65.00 5. The 4.5 percent bond of JL Motors has a face value of S1,000 a maturity of 7 years, semiannual interest payments, and a yield to maturity of 6.23 percent. What is the current market price of the bond? A. $945.08 B. $947.21 C. S903.05 D. $959.60 E. $912.40

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts