Question: 3. When using the RIM model, assuming the discount rate is given, forecasting future ROCE and future CSE based on current financial statements are

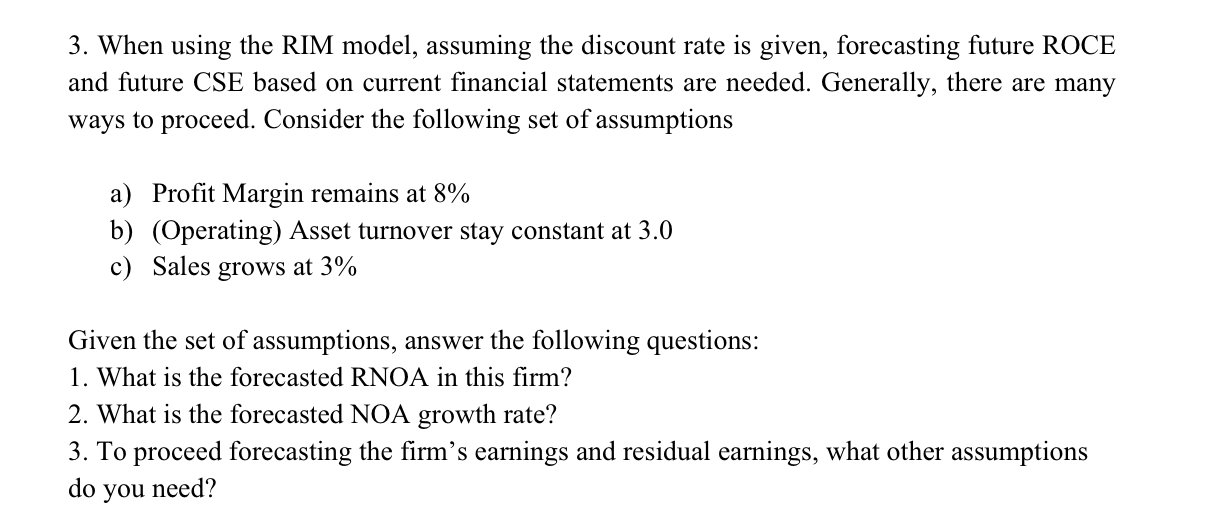

3. When using the RIM model, assuming the discount rate is given, forecasting future ROCE and future CSE based on current financial statements are needed. Generally, there are many ways to proceed. Consider the following set of assumptions a) Profit Margin remains at 8% b) (Operating) Asset turnover stay constant at 3.0 c) Sales grows at 3% Given the set of assumptions, answer the following questions: 1. What is the forecasted RNOA in this firm? 2. What is the forecasted NOA growth rate? 3. To proceed forecasting the firm's earnings and residual earnings, what other assumptions do you need?

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts