Question: When using the RIM model, assuming the discount rate is given, forecasting future ROCE and future CSE based on current financial statements are needed. Generally,

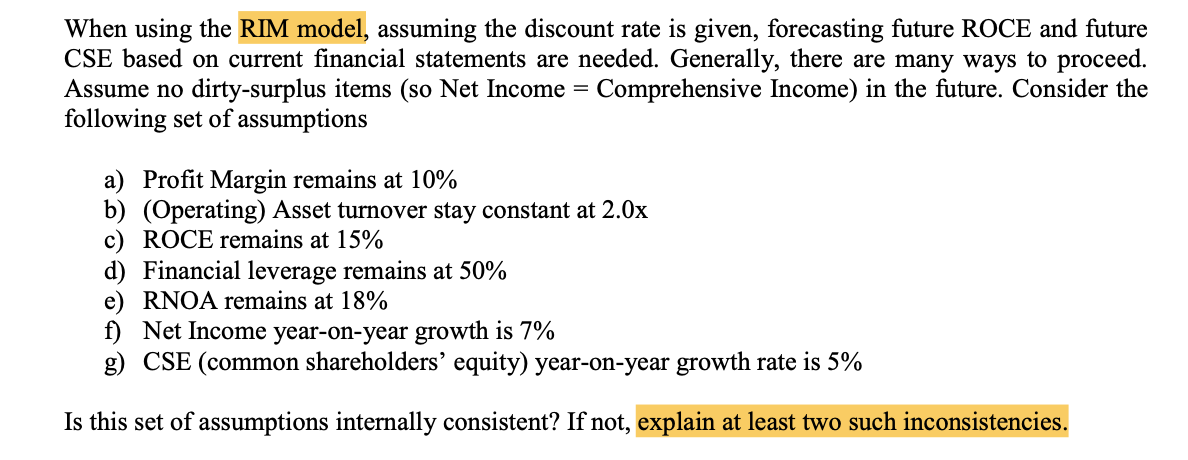

When using the RIM model, assuming the discount rate is given, forecasting future ROCE and future CSE based on current financial statements are needed. Generally, there are many ways to proceed. Assume no dirty-surplus items (so Net Income = Comprehensive Income) in the future. Consider the following set of assumptions a) Profit Margin remains at 10% b) (Operating) Asset turnover stay constant at 2.0x c) ROCE remains at 15% d) Financial leverage remains at 50% e) RNOA remains at 18% f) Net Income year-on-year growth is 7% g) CSE (common shareholders' equity) year-on-year growth rate is 5% Is this set of assumptions internally consistent? If not, explain at least two such inconsistencies

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts