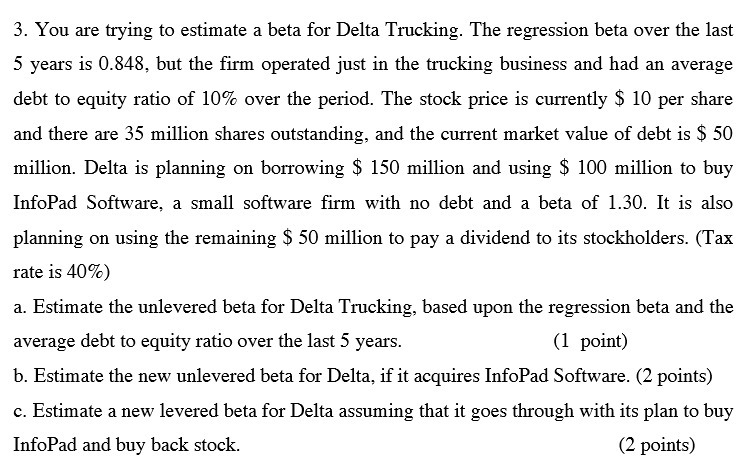

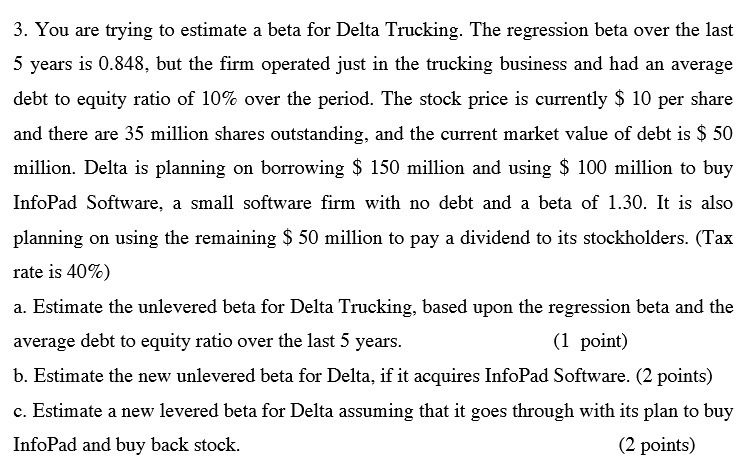

Question: 3. You are trying to estimate a beta for Delta Trucking. The regression beta over the last 5 years is 0.348, but the rm operated

3. You are trying to estimate a beta for Delta Trucking. The regression beta over the last 5 years is 0.348, but the rm operated just in the trucking business and had an average debt to equity ratio of 10% over the period. The stock price is currently $ 10 per share and there are 35 million shares outstanding, and the current market value of debt is $ 50 million. Delta is planning on borrowing $ 15CI million and using 3': 100 million to buy InfoPad Software, a small software rm with no debt and a beta of 1.30. It is also planning on using the remaining $ 50 million to pay a dividend to its stockholders. (Tait rate is 40%) a. Estimate the unlevered beta for Delta Trucking, based upon the regression beta and the average debt to equity ratio over the last 5 years. (1 point) b. Estimate the new unlevered beta for Delta, if it acquires InfoPad Software. (2 points) c. Estimate a new levered beta for Delta assuming that it goes through with its plan to buy InfoPad and buy back stock. (2 points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts