Question: show work You are trying to estimate a beta for Zoom Tech. The regression beta over the last 5 years is 1.55, but the firm

show work

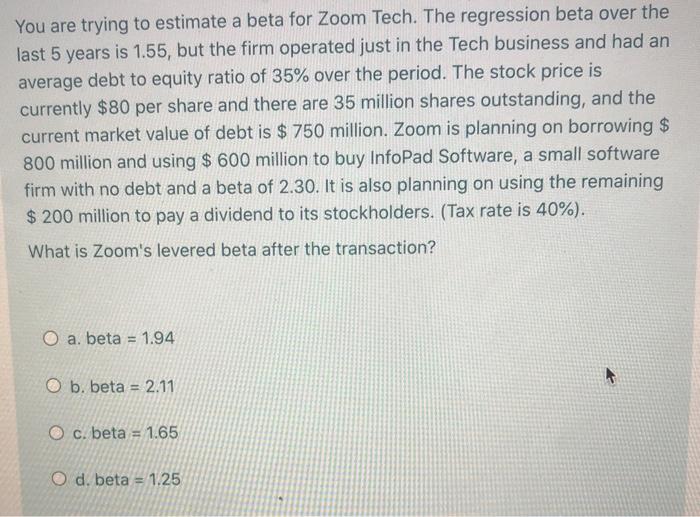

show workYou are trying to estimate a beta for Zoom Tech. The regression beta over the last 5 years is 1.55, but the firm operated just in the Tech business and had an average debt to equity ratio of 35% over the period. The stock price is currently $80 per share and there are 35 million shares outstanding, and the current market value of debt is $ 750 million. Zoom is planning on borrowing $ 800 million and using $ 600 million to buy InfoPad Software, a small software firm with no debt and a beta of 2.30. It is also planning on using the remaining $ 200 million to pay a dividend to its stockholders. (Tax rate is 40%). What is Zoom's levered beta after the transaction? O a. beta = 1.94 O b. beta = 2.11 O c. beta = 1.65 O d. beta = 1.25 You are trying to estimate a beta for Zoom Tech. The regression beta over the last 5 years is 1.55, but the firm operated just in the Tech business and had an average debt to equity ratio of 35% over the period. The stock price is currently $80 per share and there are 35 million shares outstanding, and the current market value of debt is $ 750 million. Zoom is planning on borrowing $ 800 million and using $ 600 million to buy InfoPad Software, a small software firm with no debt and a beta of 2.30. It is also planning on using the remaining $ 200 million to pay a dividend to its stockholders. (Tax rate is 40%). What is Zoom's levered beta after the transaction? O a. beta = 1.94 O b. beta = 2.11 O c. beta = 1.65 O d. beta = 1.25

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts