Question: 3) You are valuing a four year project. The initial capital expenditure (capex) is $140 million. You have a risk free agreement to sell the

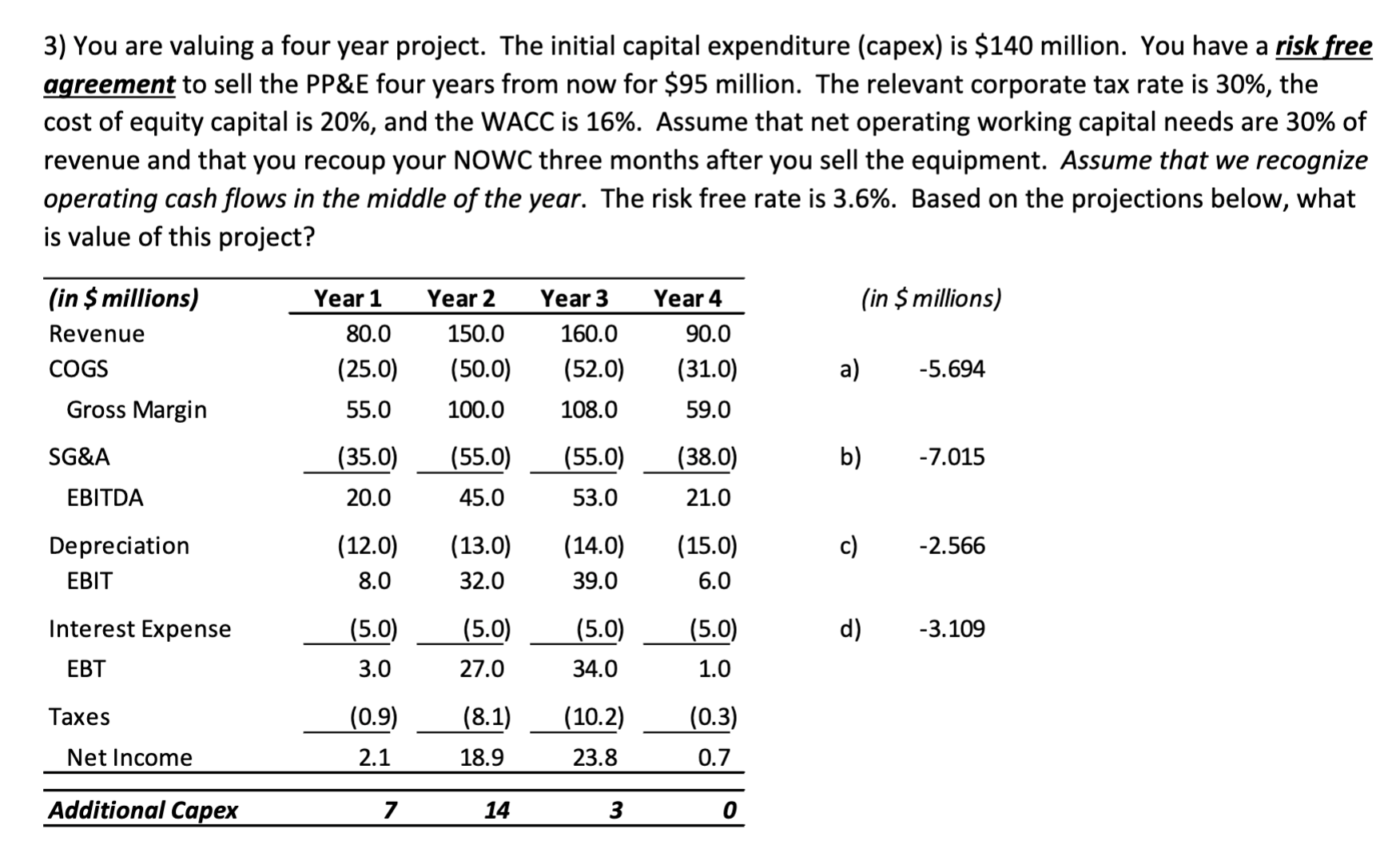

3) You are valuing a four year project. The initial capital expenditure (capex) is $140 million. You have a risk free agreement to sell the PP\&E four years from now for $95 million. The relevant corporate tax rate is 30%, the cost of equity capital is 20%, and the WACC is 16%. Assume that net operating working capital needs are 30% of revenue and that you recoup your NOWC three months after you sell the equipment. Assume that we recognize operating cash flows in the middle of the year. The risk free rate is 3.6%. Based on the projections below, what is value of this project

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts