Question: You are valuing a four year project. The initial capital expenditure (capex) is $125 million. You have a risk free agreement to sell the PP&E

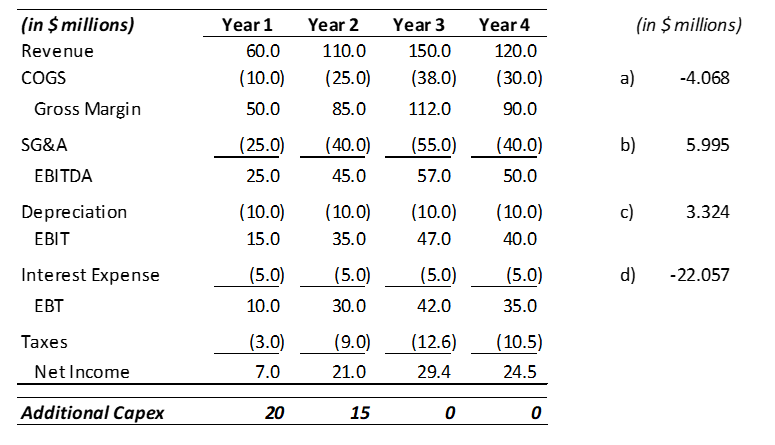

You are valuing a four year project. The initial capital expenditure (capex) is $125 million. You have a risk free agreement to sell the PP&E four years from now for $80 million. The relevant corporate tax rate is 30%, the cost of equity capital is 25%, and the WACC is 17%. Assume that net operating working capital needs are 30% of revenue and that you recoup your NOWC three months after you sell the equipment. Assume that we recognize operating cash flows in the middle of the year. The risk free rate is 4.5%. Based on the projections below, what is value of this project?

(in $ millions) Year 1 Year 2 Year 3 Year 4 (in $ millions) Revenue 60.0 110.0 150.0 120.0 COGS (10.0) (25.0) (38.0) (30.0) a) -4.068 Gross Margin 50.0 85.0 112.0 90.0 SG&A (25.0) (40.0) (55.0) (40.0) b) 5.995 EBITDA 25.0 45.0 57.0 50.0 Depreciation (10.0) (10.0) (10.0) (10.0) c) 3.324 EBIT 15.0 35.0 47.0 40.0 Interest Expense (5.0) (5.0) (5.0) (5.0) d) -22.057 EBT 10.0 30.0 42.0 35.0 Taxes (3.0) (9.0) (12.6) (10.5) Net Income 7.0 21.0 29.4 24.5 Additional Capex 20 15 0 0

Step by Step Solution

There are 3 Steps involved in it

To calculate the value of the project we need to determine the net operating cash flows OCF for each ... View full answer

Get step-by-step solutions from verified subject matter experts