Question: 3) You bought a 5% coupon, $1000 face value, five-year bond at par three years ago. What annual rate did you expect to make when

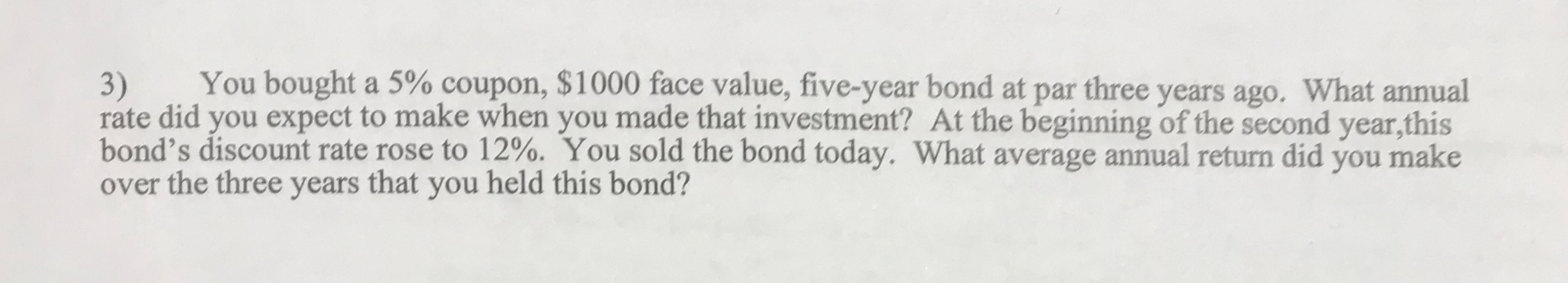

3) You bought a 5% coupon, $1000 face value, five-year bond at par three years ago. What annual rate did you expect to make when you made that investment? At the beginning of the second year, this bond's discount rate rose to 12%. You sold the bond today. What average annual return did you make over the three years that you held this bond

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock