Question: Answer the following question shown the picture down below 6-1 to 6-20 6-7. Tracer Manufacturers issued a 10-year bond six years ago. The bond's maturity

Answer the following question shown the picture down below 6-1 to 6-20

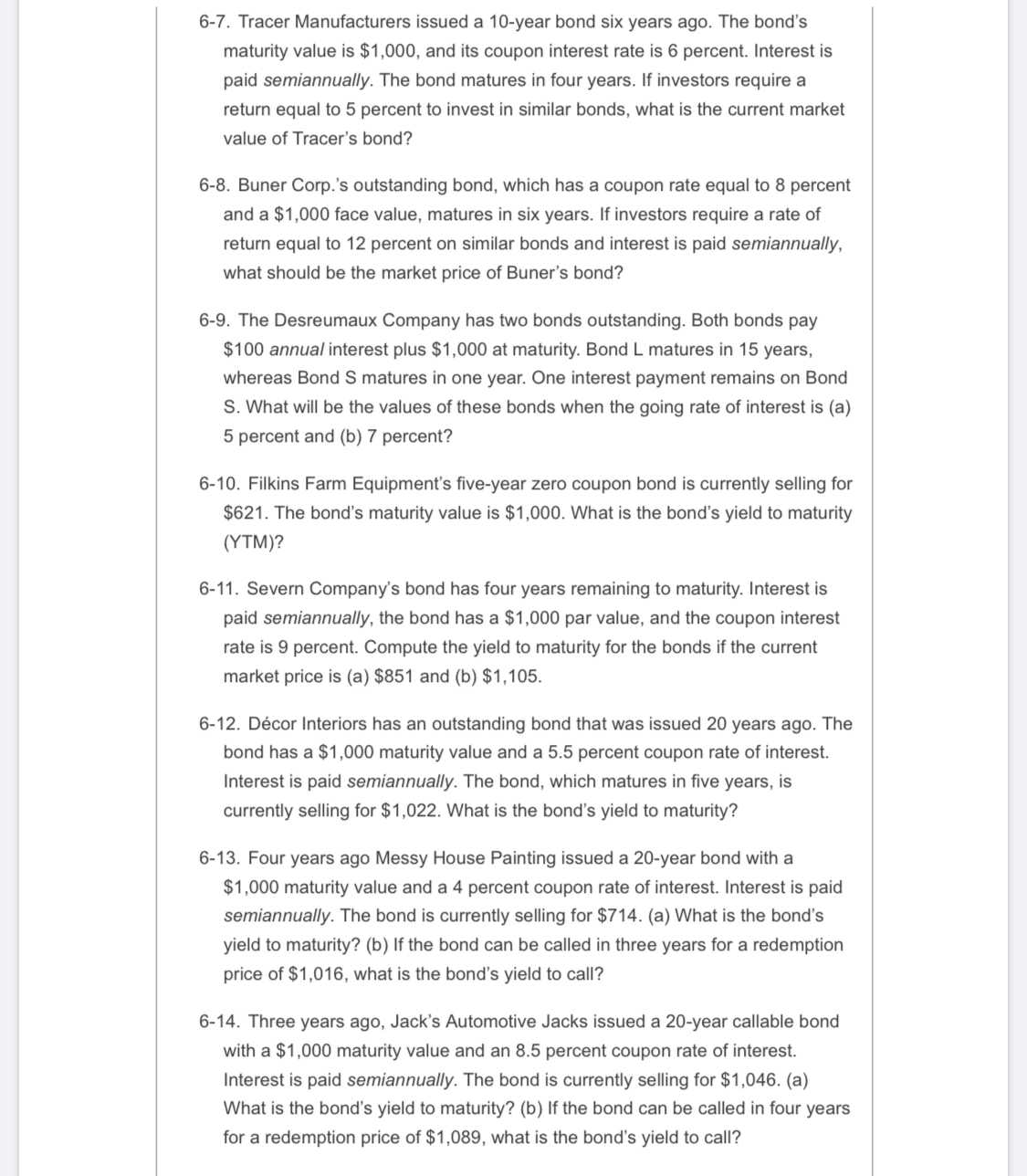

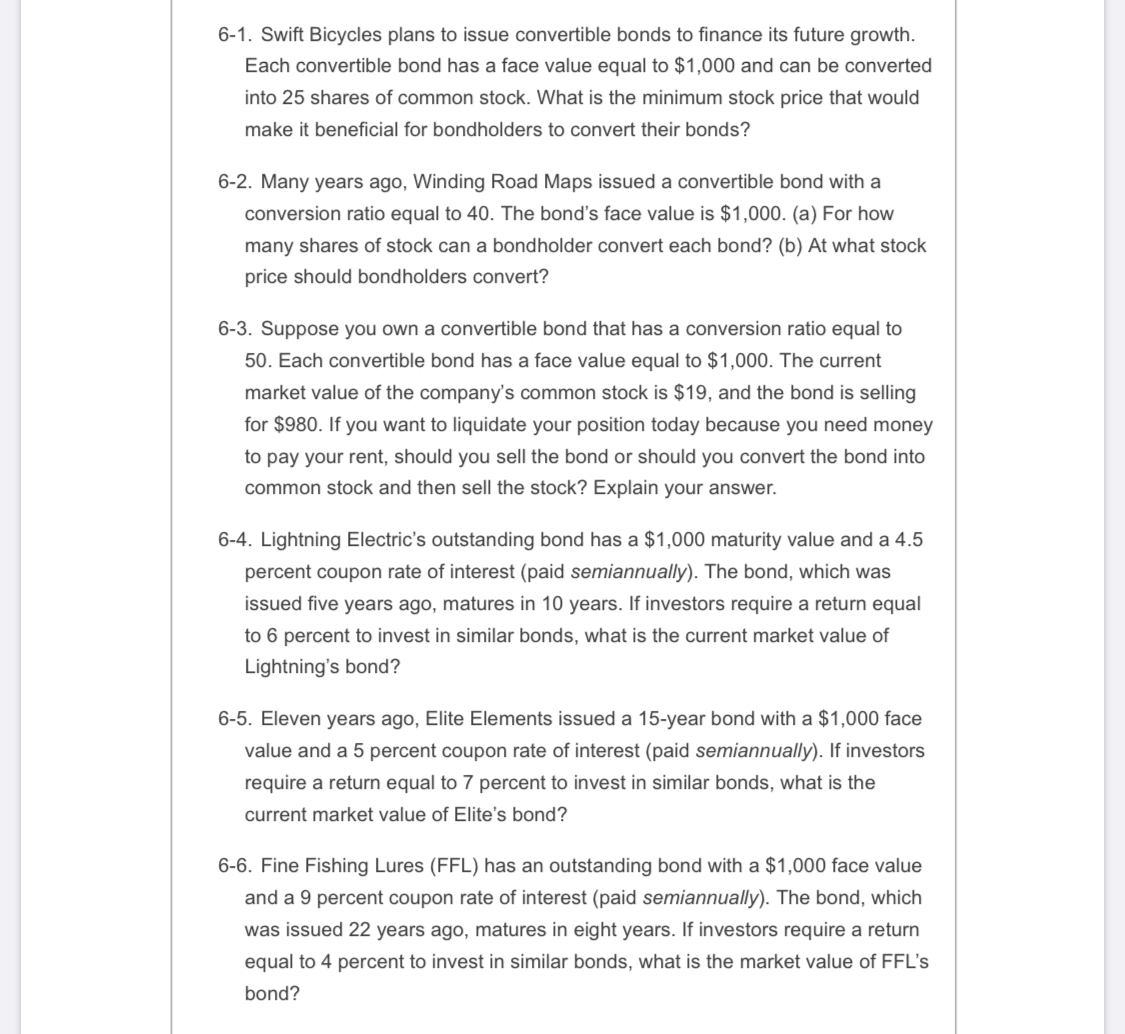

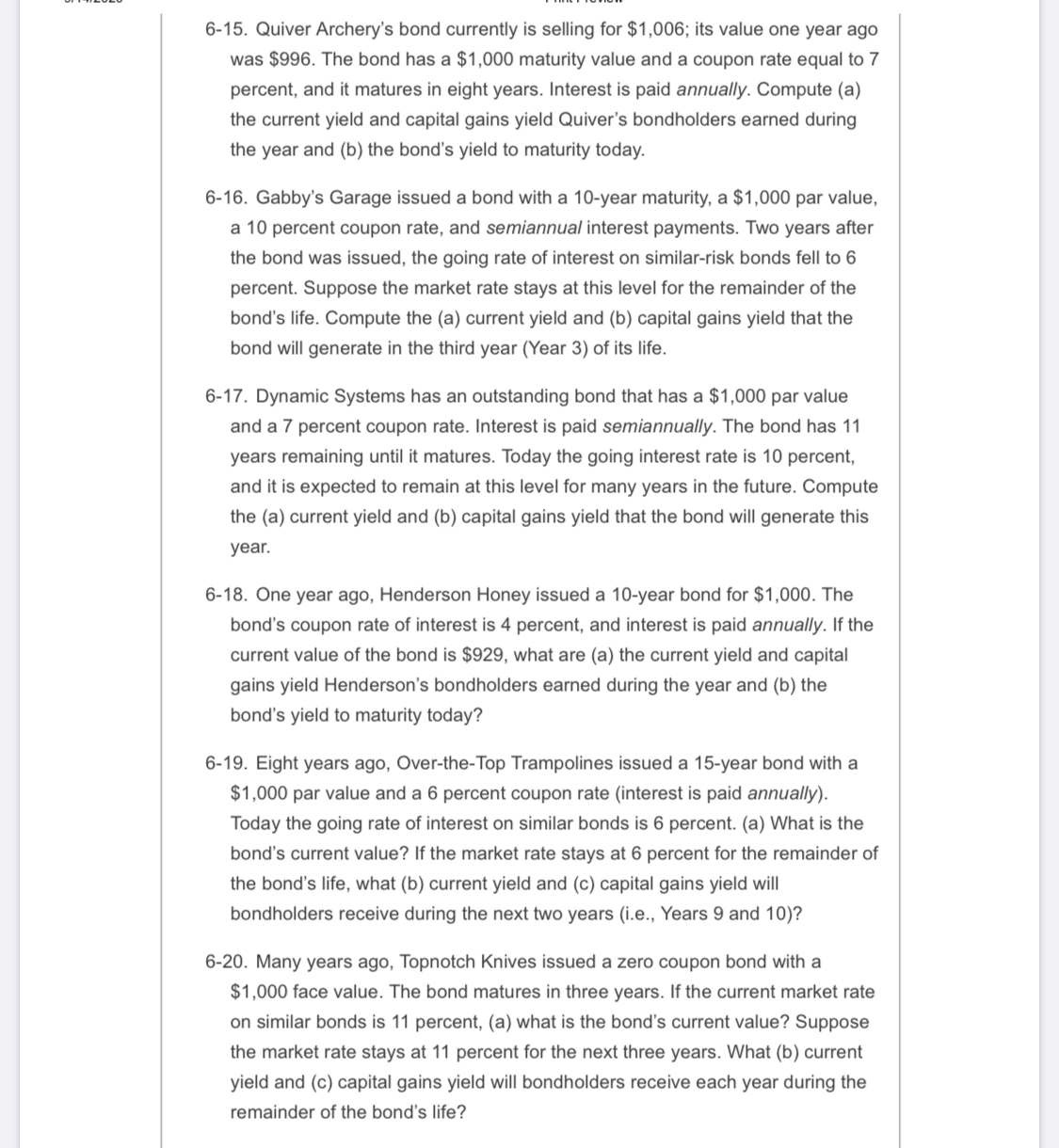

6-7. Tracer Manufacturers issued a 10-year bond six years ago. The bond's maturity value is $1.000. and its coupon interest rate is 6 percent. Interest is paid semiannuaily. The bond matures in four years. If investors require a return equal to 5 percent to invest in similar bonds. what is the current market value of Tracer's bond? 6-8. Buner Corp.'s outstanding bond. which has a coupon rate equal to 8 percent and a $1.000 face value. matures in six years. If investors require a rate of return equal to 12 percent on similar bonds and interest is paid semiannualiy, what should be the market price of Buner's bond? 6-9. The Desreumaux Company has two bonds outstanding. Both bonds pay $100 annual interest plus $1 .000 at maturity. Bond L matures in 15 years. whereas Bond 8 matures in one year. One interest payment remains on Bond 8. What will be the values of these bonds when the going rate of interest is (a) 5 percent and (b) 7 percent? 6-10. Filkins Farm Equipment's ve-year zero coupon bond is currently selling for $621. The bonds maturity value is $1.000. What is the bond's yield to maturity (YTM)? 6-11. Severn Company's bond has four years remaining to maturity. Interest is paid semiannuaily. the bond has a $1 .000 par value, and the coupon interest rate is 9 percent. Compute the yield to maturity for the bonds if the current market price is (a) $851 and (b) $1.105. 6-12. Decor Interiors has an outstanding bond that was issued 20 years ago. The bond has a $1.000 maturity value and a 5.5 percent coupon rate of interest. Interest is paid semiannuaily. The bond. which matures in ve years. is currently selling for $1,022. What is the bond's yield to maturity? 6-13. Four years ago Messy House Painting issued a 20-year bond with a $1.000 maturity value and a 4 percent coupon rate of interest. Interest is paid semiannually. The bond is currently selling for $714. (a) What is the band's yield to maturity? (b) If the bond can be called in three years for a redemption price of $1 .016, what is the bond's yield to call? 6-14. Three years ago, Jack's Automotive Jacks issued a 20-year callable bond with a $1 .000 maturity value and an 8.5 percent coupon rate of interest. Interest is paid semiannuaily. The bond is currently selling for $1.046. (a) What is the bonds yield to maturity? (b) If the bond can be called in four years for a redemption price of $1 .089. what is the bonds yield to call? 6-1. Swift Bicycles plans to issue convertible bonds to nance its future growth. Each convertible bond has a face value equal to $1.000 and can be converted into 25 shares of common stock. What is the minimum stock price that would make it benecial for bondholders to convert their bonds? 6-2. Many years ago. Winding Road Maps issued a convertible bond with a conversion ratio equal to 40. The bonds face value is $1,000. (a) For how many shares of stock can a bondholder convert each bond? (b) At what stock price should bondholders convert? 6-3. Suppose you own a convertible bond that has a conversion ratio equal to 50. Each convertible bond has a face value equal to $1,000. The current market value of the company's common stock is $19. and the bond is selling for $980. If you want to liquidate yOur position today because you need money to pay yOur rent, should you sell the bond or should you convert the bond into common stock and then sell the stock? Explain your answer. 6-4. Lightning Electric's Outstanding bond has a $1,000 maturity value and a 4.5 percent coupon rate of interest (paid semiannually). The bond. which was issued ve years ago, matures in 10 years. If investors require a return equal to 6 percent to invest in similar bonds, what is the current market value of Lightning's bond? 6-5. Eleven years ago. Elite Elements issued a 15-year bond with a $1 .000 face value and a 5 percent coupon rate of interest (paid semiannually). If investors require a return equal to 7 percent to invest in similar bonds. what is the current market value of Elite's bond? 6-6. Fine Fishing Lures (FFL) has an outstanding bond with a $1 .000 face value and a 9 percent coupon rate of interest (paid semiannually). The bond. which was issued 22 years ago, matures in eight years. If investors require a return equal to 4 percent to invest in similar bonds, what is the market value of FFL's bond? 6-15. Quiver Archery's bond currently is selling for $1.006: its value one year ago was $996. The bond has a $1.000 maturity value and a coupon rate equal to 7 percent. and it matures in eight years. Interest is paid annually. Compute (a) the current yield and capital gains yield Quiver's bondholders earned during the year and (b) the bond's yield to maturity today. 6-16. Gabby's Garage issued a bond with a 10-year maturity. a $1 ,000 par value. a 10 percent coupon rate. and semiannual interest payments. Two years after the bond was issued. the going rate of interest on similar-risk bonds fell to 6 percent. Suppose the market rate stays at this level for the remainder of the bond's life. Compute the (a) current yield and (b) capital gains yield that the bond will generate in the third year (Year 3) of its life. 6-17. Dynamic Systems has an outstanding bond that has a $1.000 par value and a 7 percent coupon rate. Interest is paid semiannually. The bond has 11 years remaining until it matures. Today the going interest rate is 10 percent. and it is expected to remain at this level for many years in the future. Compute the (a) current yield and (b) capital gains yield that the bond will generate this yean 6-18. One year ago. Henderson Honey issued a 10-year bond for $1 .000. The bond's coupon rate of interest is 4 percent. and interest is paid annually. lithe current value of the bond is $929, what are (a) the current yield and capital gains yield Henderson's bondholders earned during the year and (b) the bond's yield to maturity today? 6-19. Eight years ago, Over-the-Top Trampolines issued a 15-year bond with a $1.000 par value and a 6 percent coupon rate (interest is paid annually). Today the going rate of interest on similar bonds is 6 percent. (a) What is the bond's current value? If the market rate stays at 6 percent for the remainder of the bond's life. what (b) current yield and (c) capital gains yield will bondholders receive during the next two years (i.e., Years 9 and 10)? 6-20. Many years ago. Topnotch Knives issued a zero coupon bond with a $1 .000 face value. The bond matures in three years. If the current market rate on similar bonds is 11 percent, (a) what is the bonds current value? Suppose the market rate stays at 11 percent for the next three years. What (b) current yield and (c) capital gains yield will bondholders receive each year during the remainder of the bonds life