Question: 3. Your assignment t is to prepare a ATCF replacement analysis study. A new machine is under consideration, it will cost $100.000 and have annual

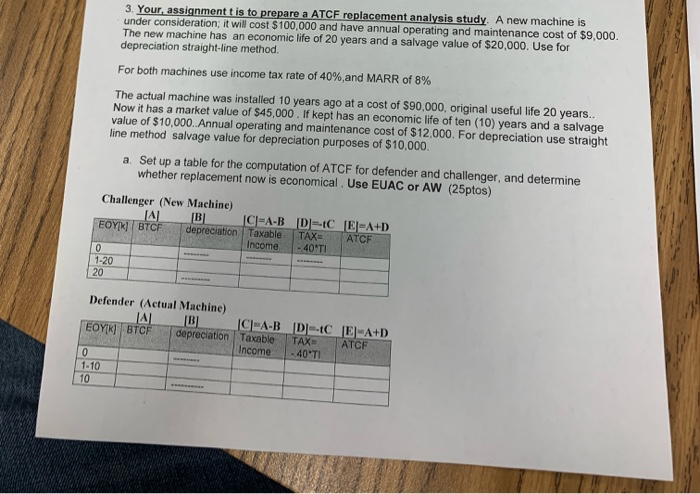

3. Your assignment t is to prepare a ATCF replacement analysis study. A new machine is under consideration, it will cost $100.000 and have annual operating and maintenance cost of $9,000. The new machine has an economic life of 20 years and a salvage value of $20,000. Use for depreciation straight-line method. For both machines use income tax rate of 40% and MARR of 8% The actual machine was installed 10 years ago at a cost of $90.000, original useful life 20 years.. Now it has a market value of $45,000. If kept has an economic life of ten (10) years and a salvage value of $10,000. Annual operating and maintenance cost of $12,000. For depreciation use straight line method salvage value for depreciation purposes of $10.000. a. Set up a table for the computation of ATCF for defender and challenger, and determine whether replacement now is economical. Use EUAC or AW (25ptos) Challenger (New Machine) ABD C-A-B DECE=A+D EOYK) BTCF depreciation Taxable TAX= ATCF Income - 40'TI 10 1-20 20 Defender (Actual Machine) A [B] C-A-B EOYR) BTCF depreciation Taxable Income D-C TAX - 40'TI LE-A+D A TCF O 1-10 10

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts